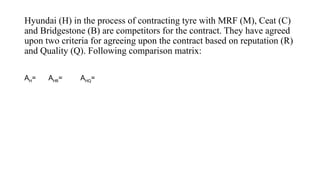

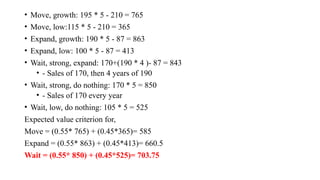

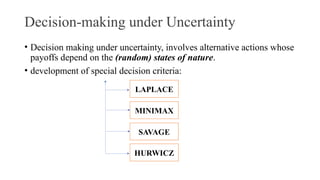

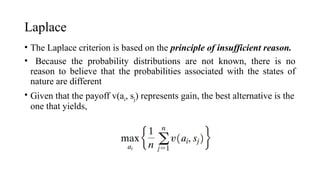

The document discusses quantitative methods in management decision-making theory, highlighting the three branches: normative, perspective, and descriptive decision theory. It covers decision-making under certainty, risk, and uncertainty, explaining various criteria and models such as the expected value criterion, Laplace, maximax/minimax, Savage, and Hurwicz. Examples showcase decisions made in uncertain environments and provide a framework for evaluating alternatives based on their potential outcomes and associated risks.