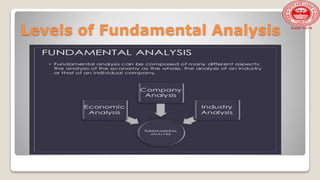

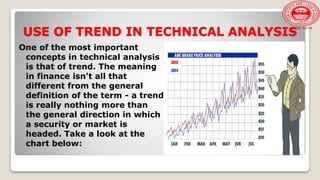

This document provides an overview of fundamental analysis and technical analysis for evaluating securities. Fundamental analysis examines underlying company and economic factors that may influence a security's price, such as revenues, profits, growth rates, risks. It analyzes these factors at an economy, industry and company level. Technical analysis focuses on historical price movements and trading volume through chart patterns and indicators to predict future price movements and identify trading opportunities. Charts like line charts, bar charts and candlestick charts are used to visualize price trends and trading patterns over time.