1) Japanese candlestick patterns provide a visual way to analyze financial markets and identify reversals and changes in market sentiment.

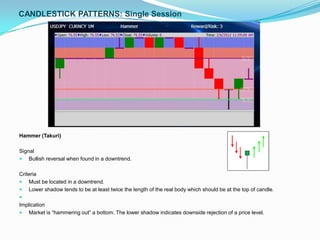

2) Key single candlestick patterns include Doji (indecision), Hammer and Hanging Man (bullish and bearish reversals), and Shooting Star (bearish reversal).

3) Two candlestick patterns like Engulfing, Harami, Piercing Line, and Dark Cloud Cover also signal potential trend reversals.