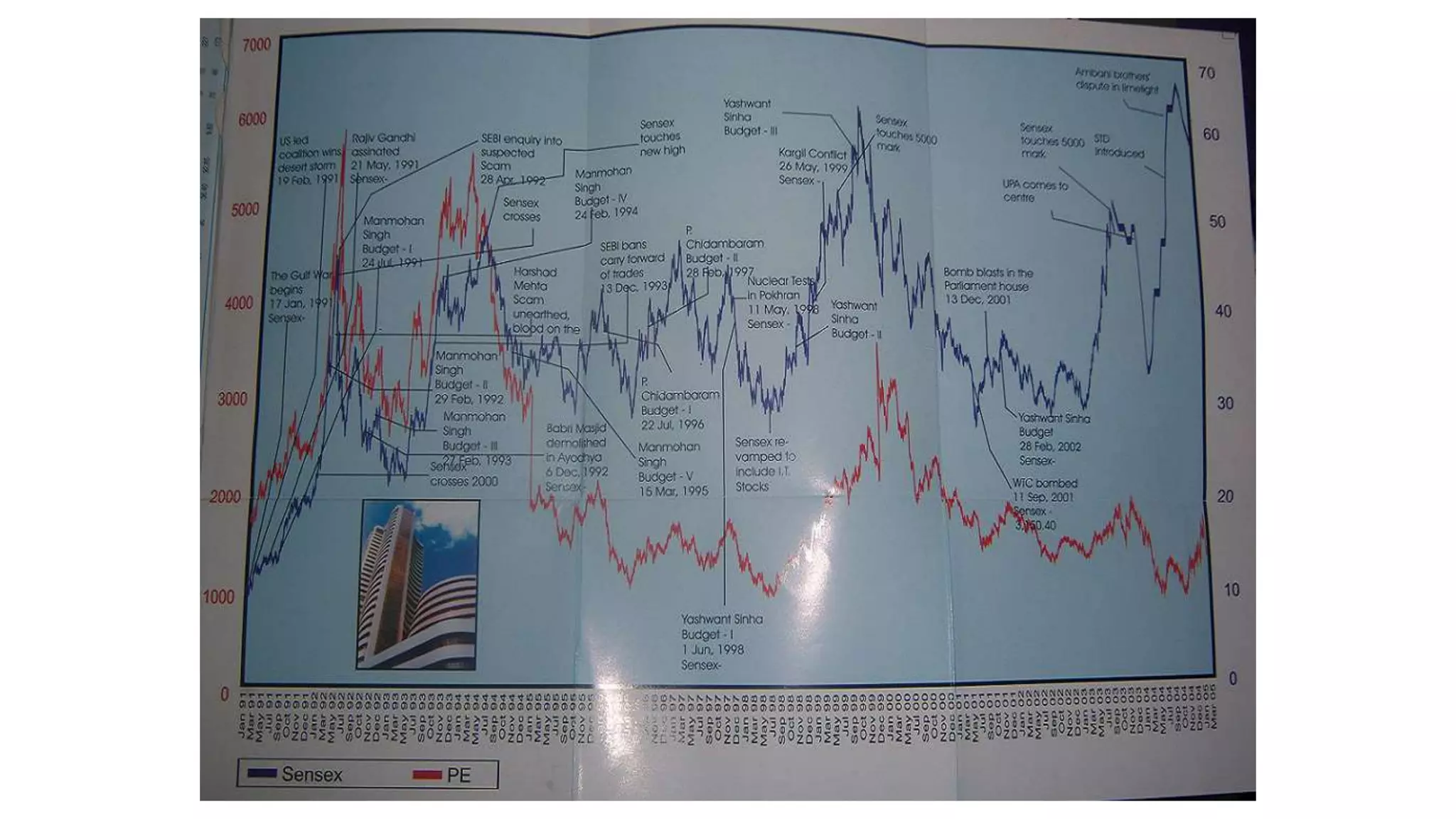

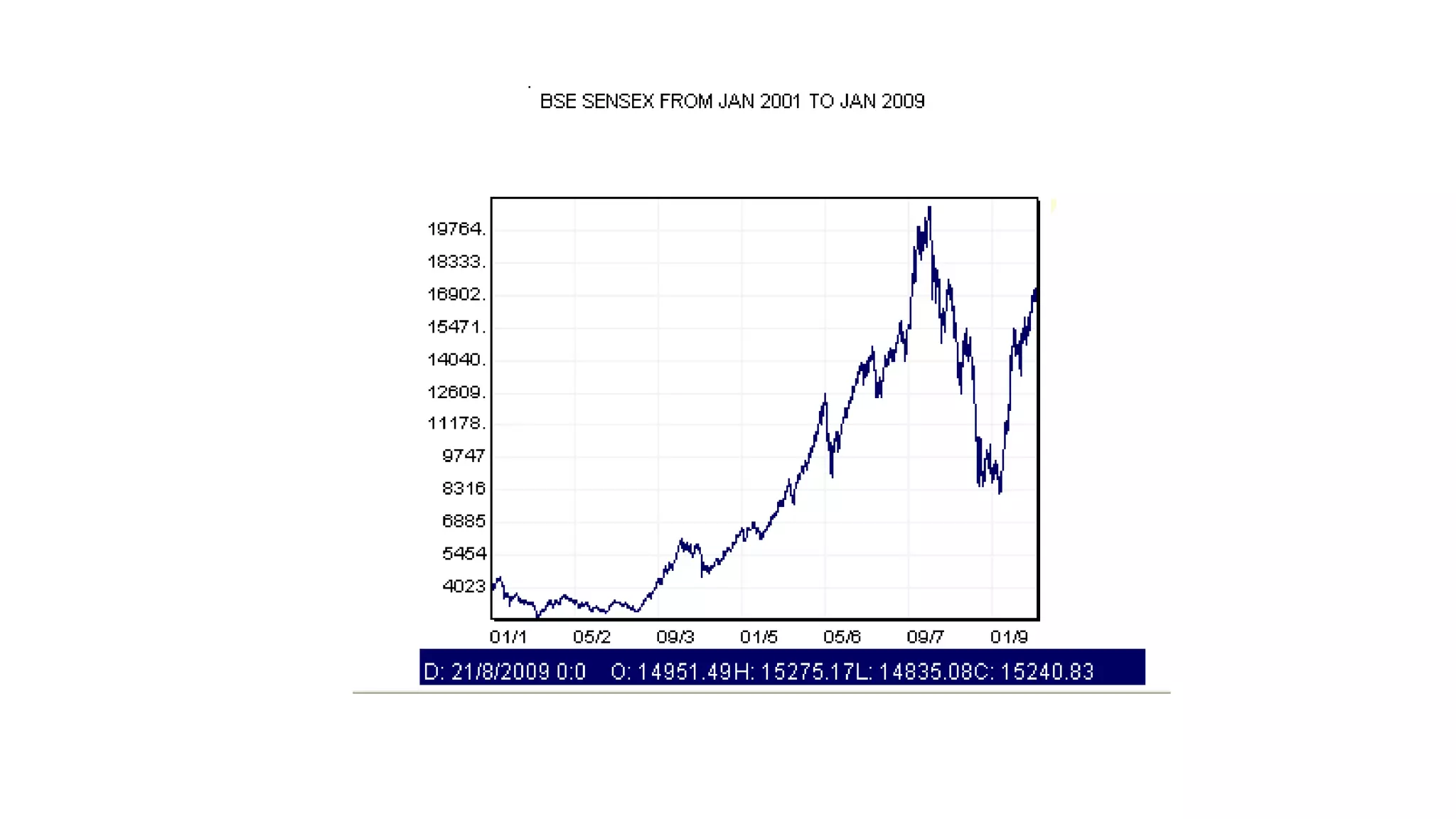

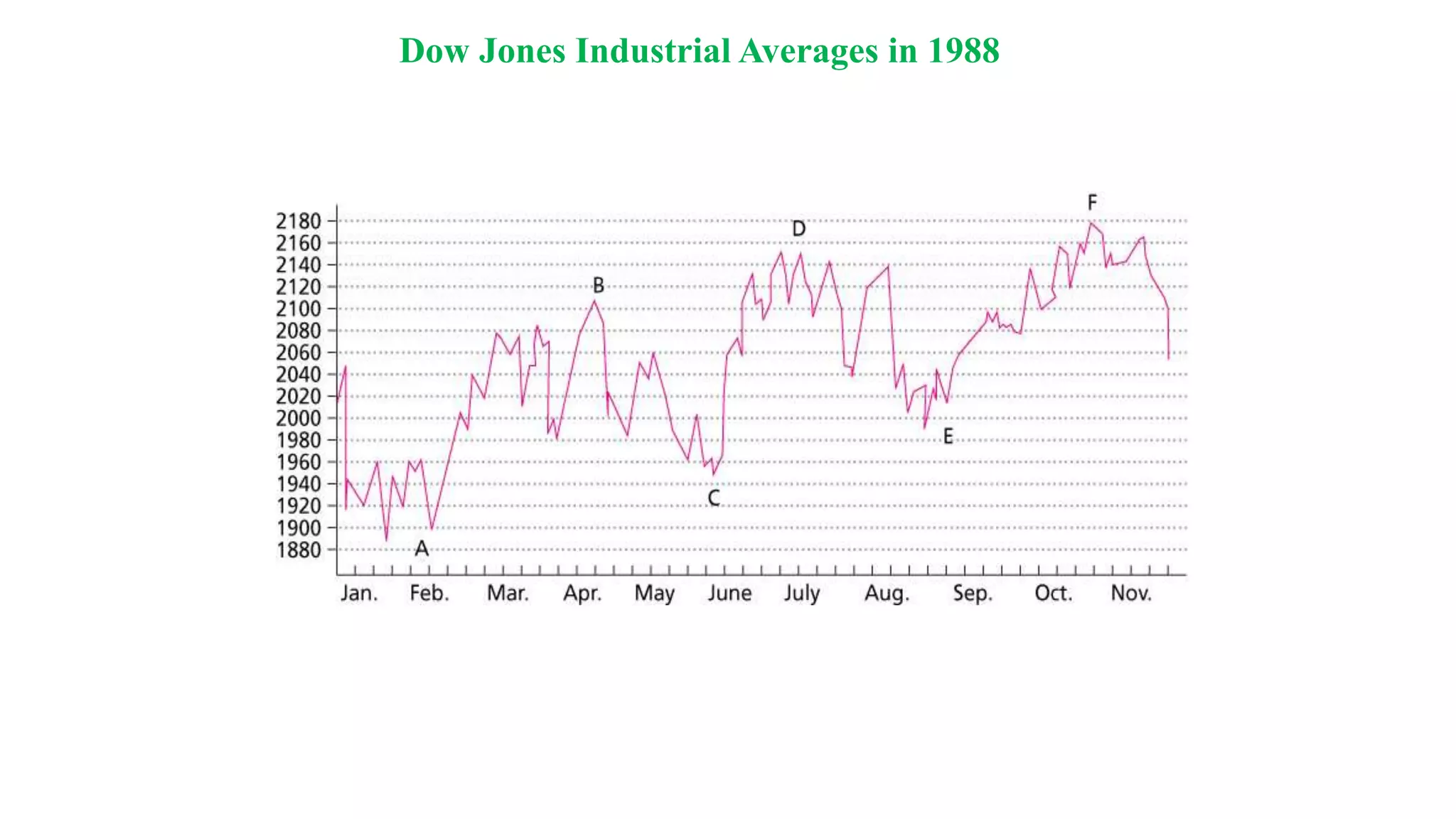

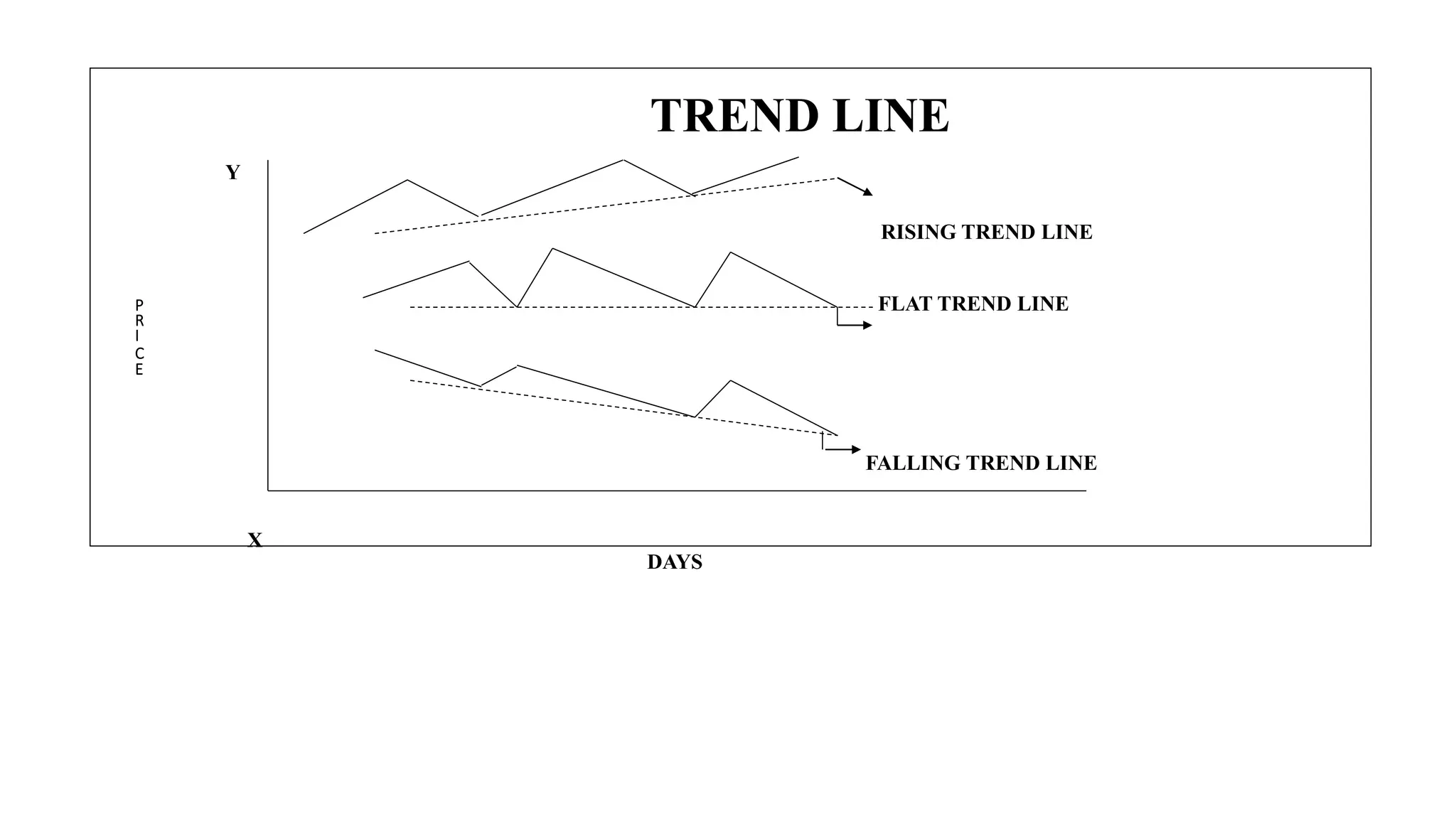

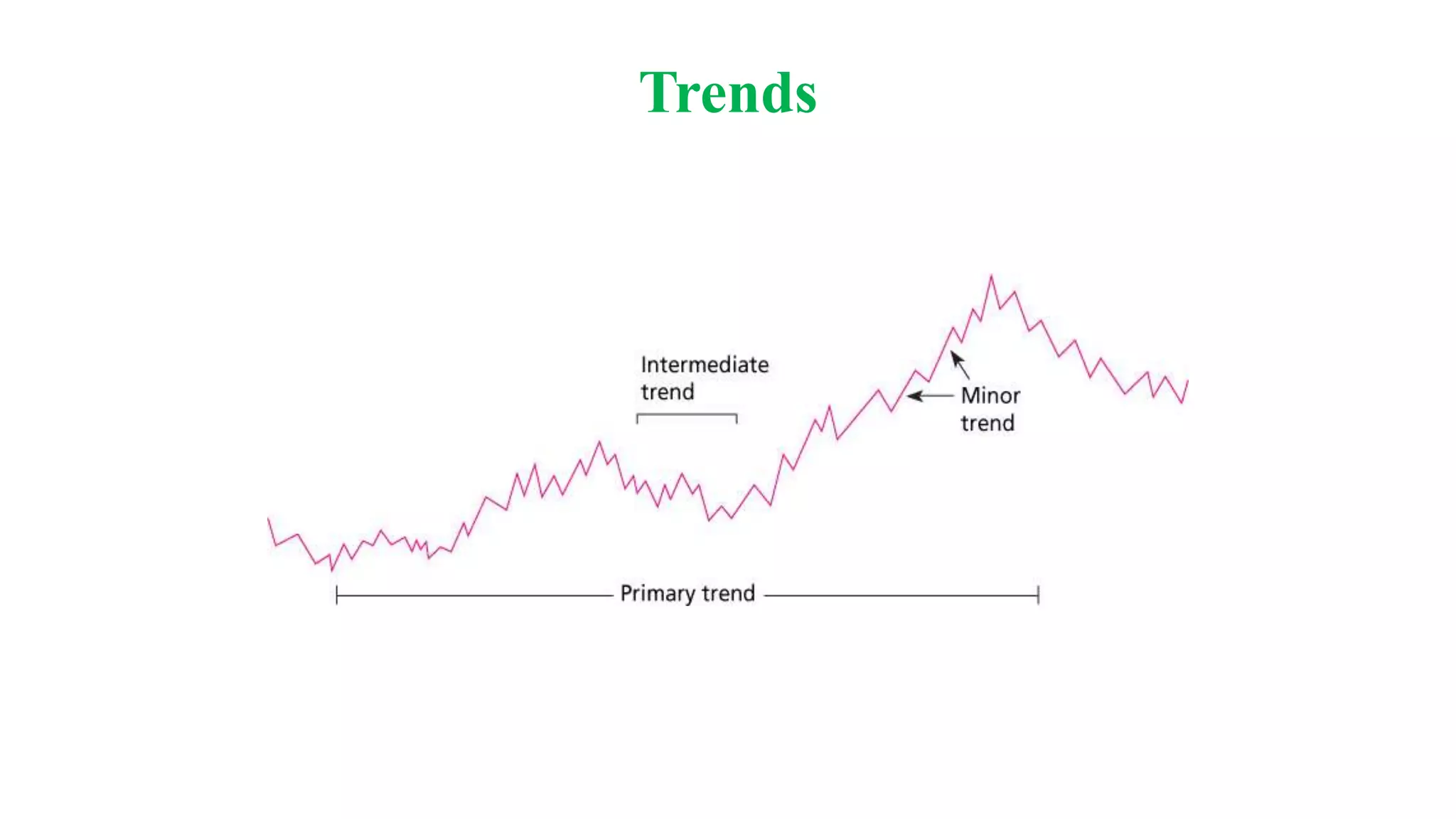

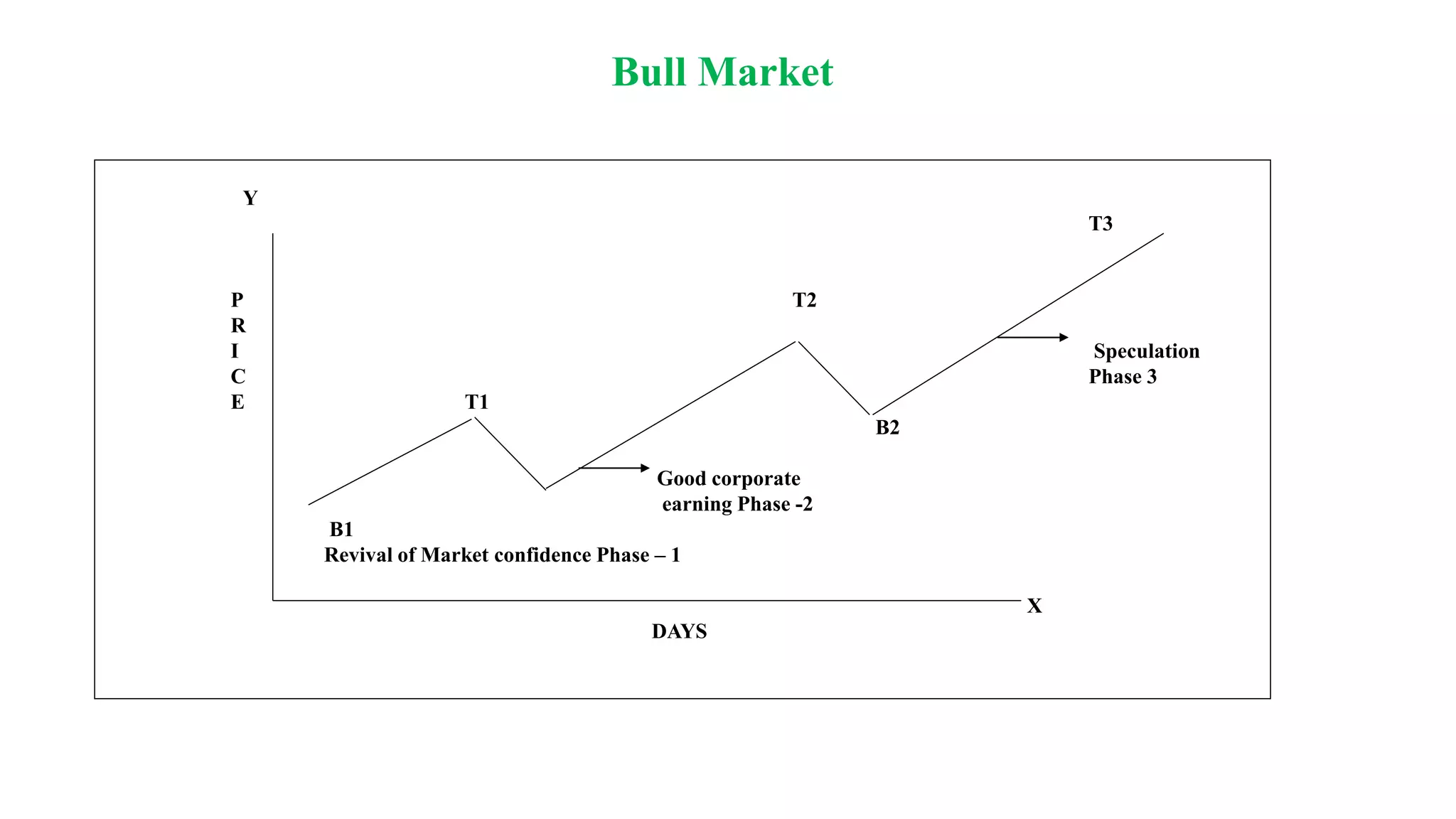

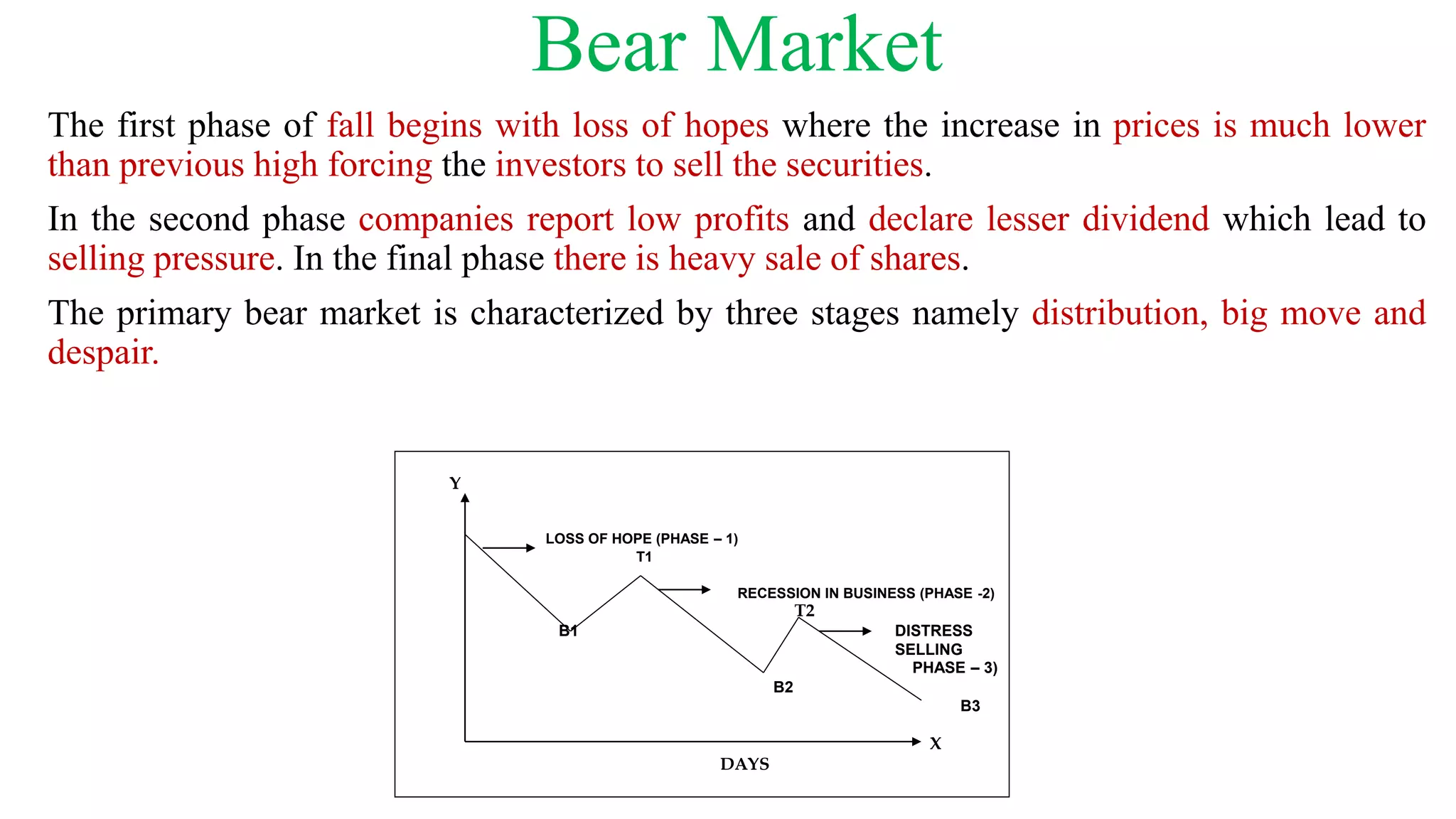

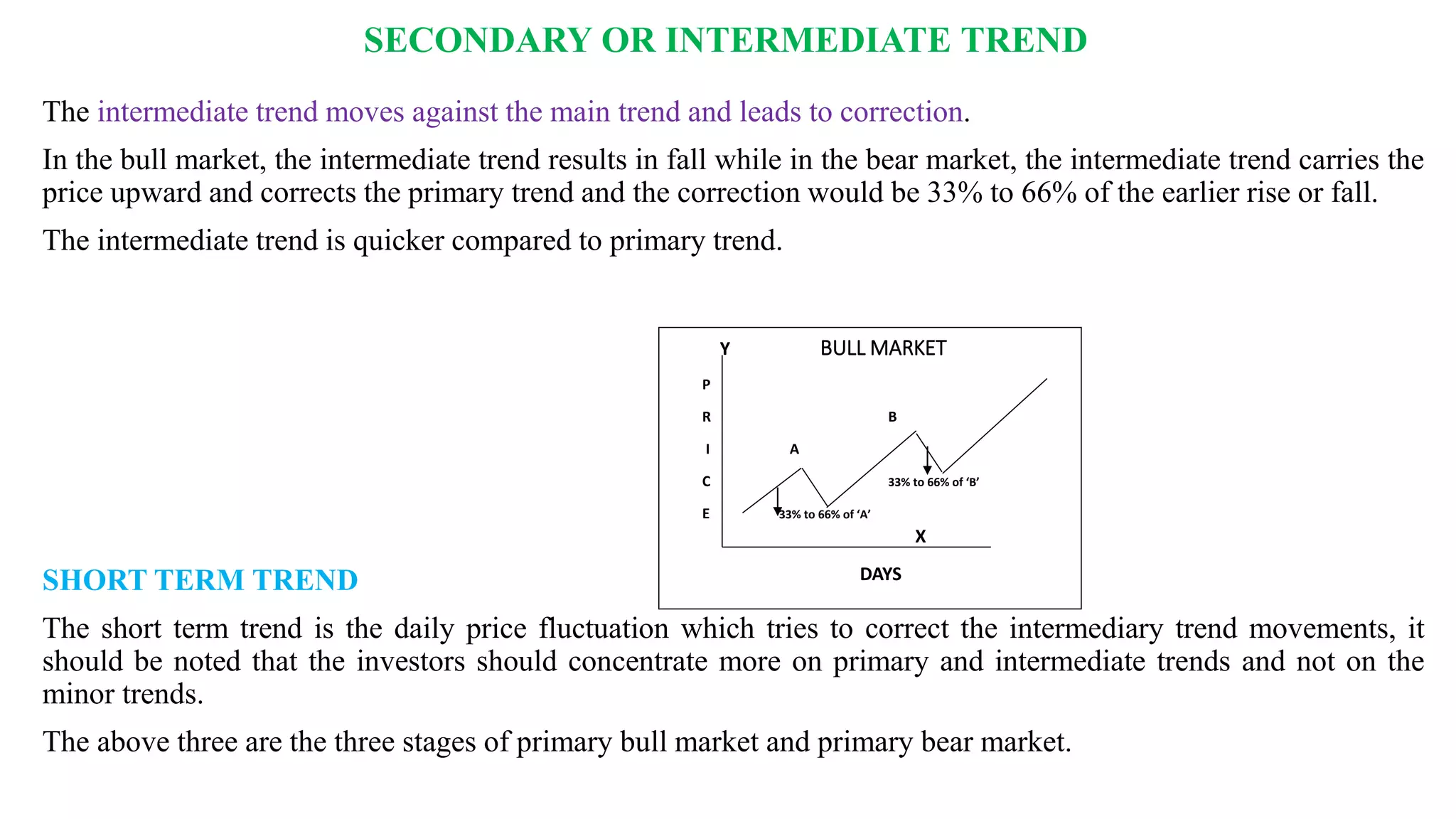

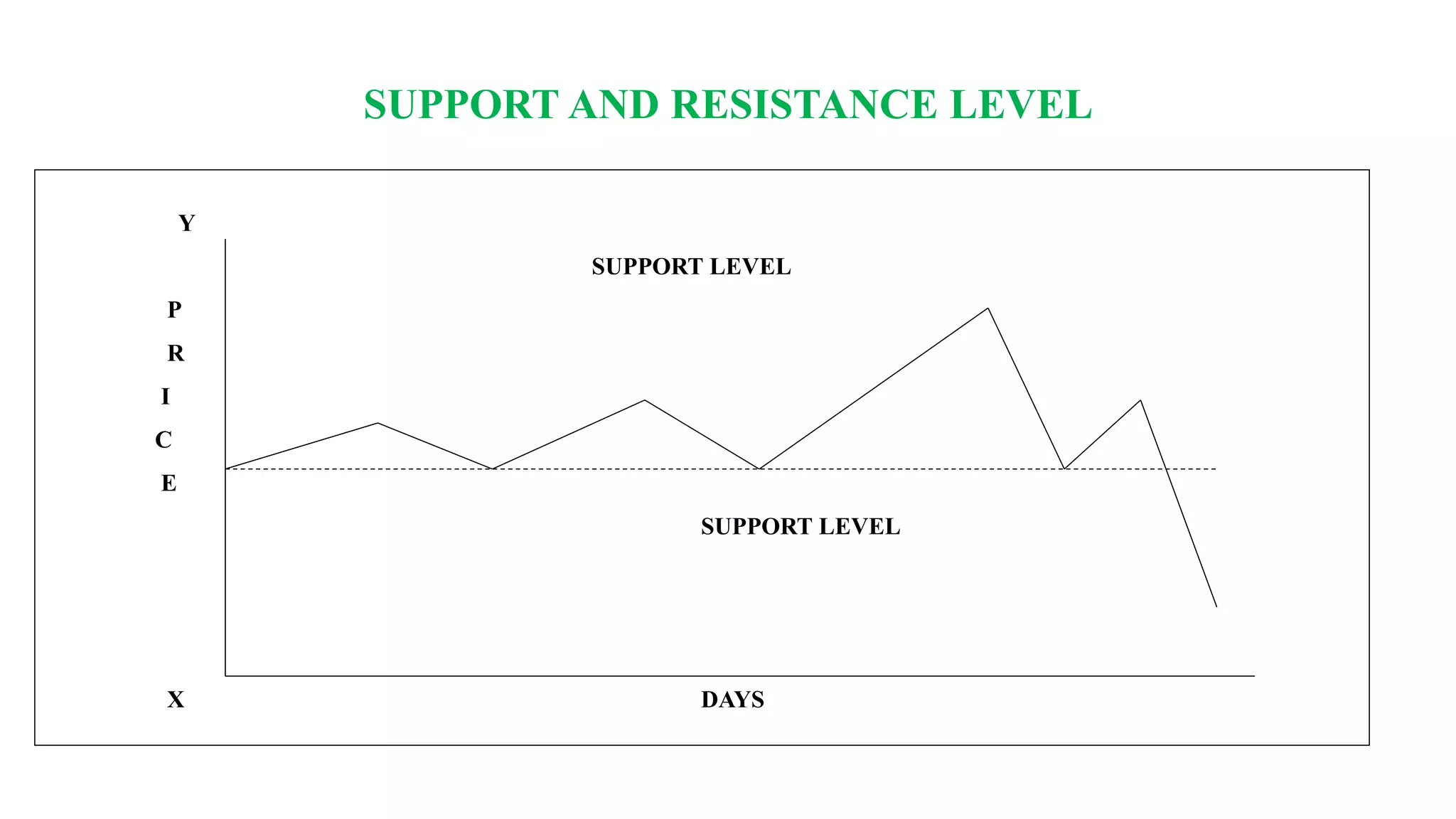

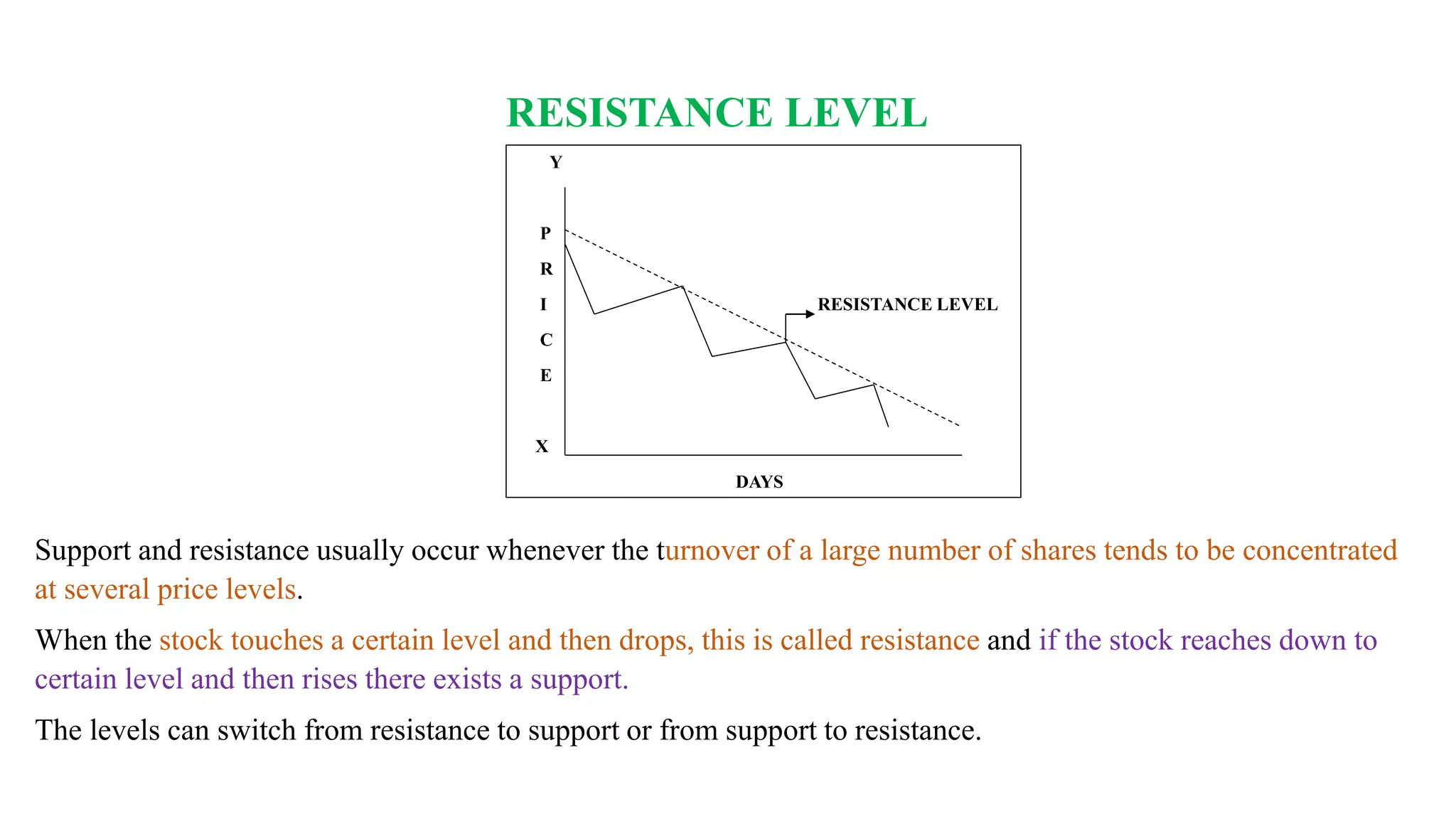

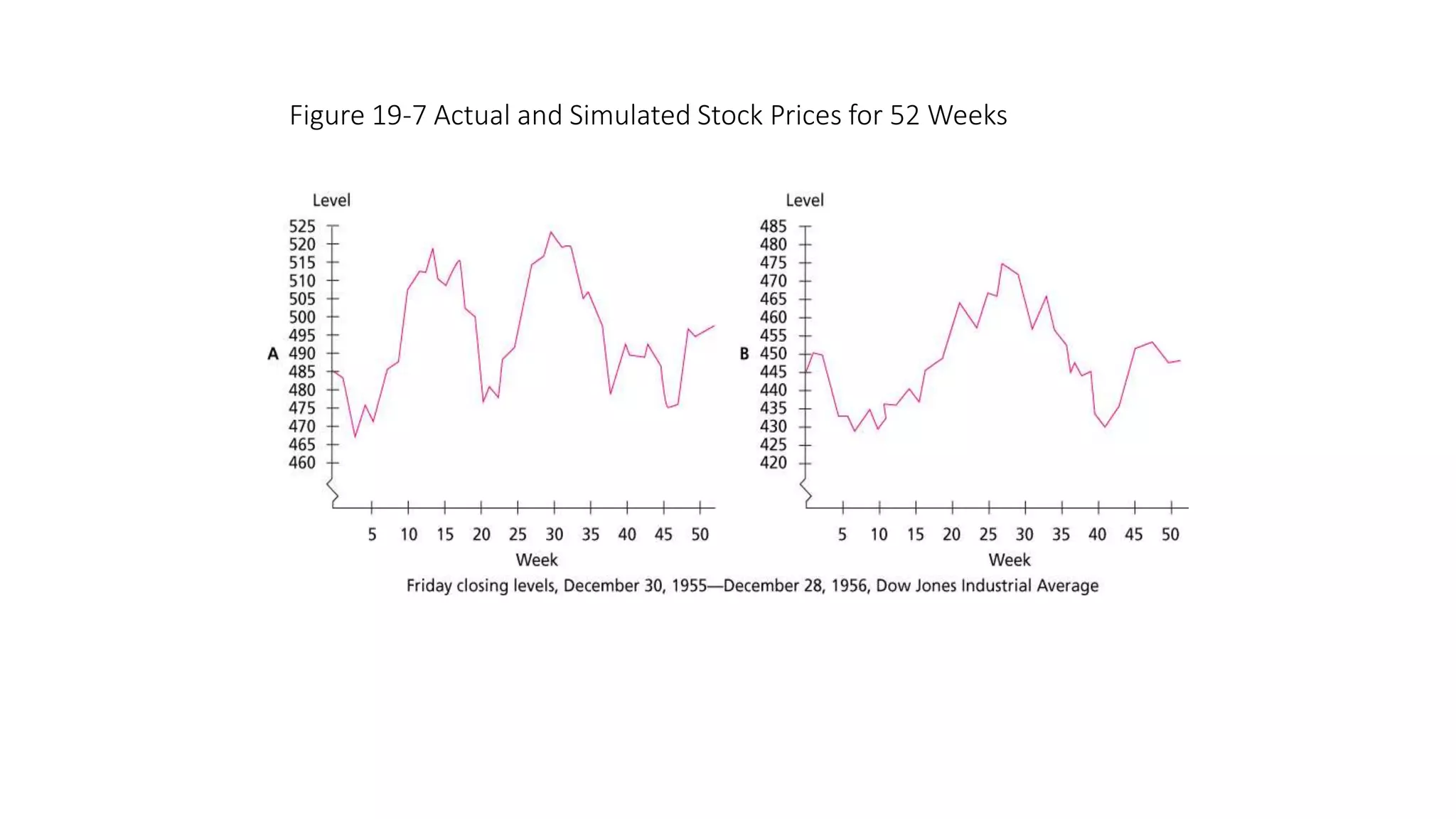

The document discusses technical analysis and its key concepts. It defines technical analysis as identifying trend reversals using indicators to analyze relationships between price, volume, and demand/supply. The assumptions of technical analysis are that the market discounts all information and moves in trends. Charting techniques discussed include Dow theory, identifying primary/secondary trends, and support/resistance levels. Technical indicators examined include moving averages, where crossing the average provides buy/sell signals. Sentiment indicators like volume and odd-lot trading are also summarized.