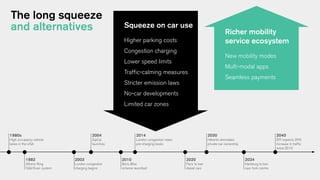

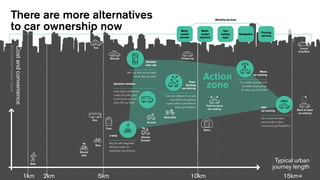

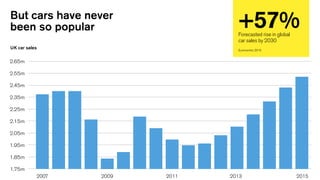

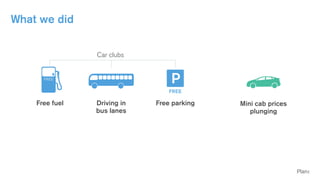

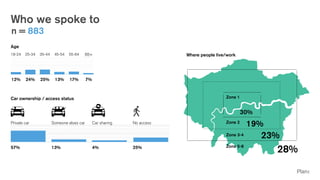

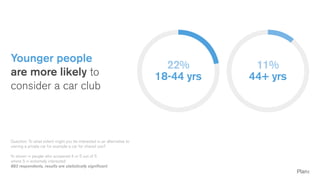

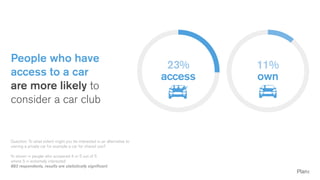

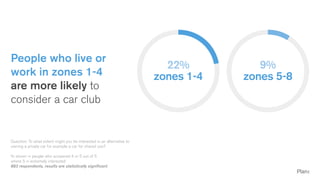

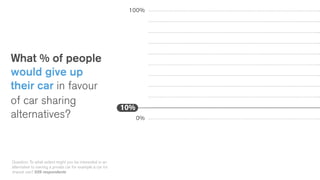

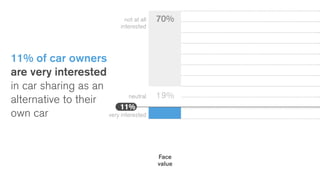

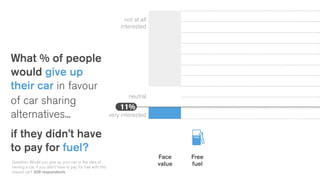

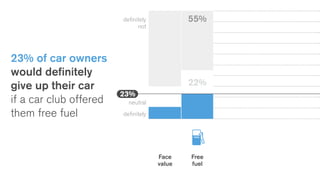

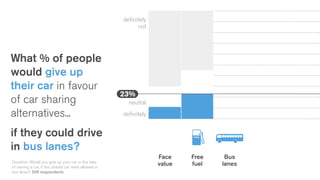

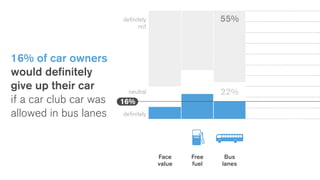

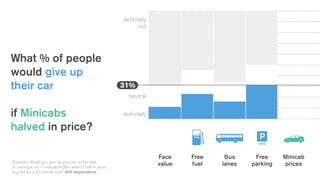

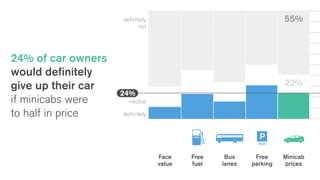

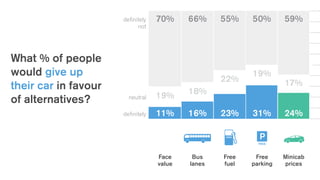

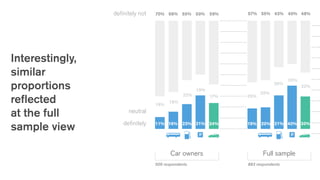

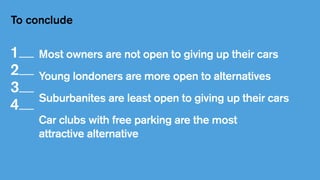

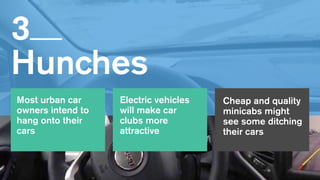

The document discusses trends in urban mobility and the potential decline of car ownership due to the rise of alternatives like car clubs and shared transportation. It highlights a survey indicating that most urban car owners are not keen to give up their cars, although younger individuals show more interest in car-sharing options. Additionally, factors such as electric vehicles and affordable ride-sharing services could influence the future of urban transport and car ownership dynamics.