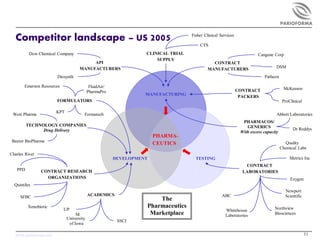

This document provides an overview of the pharmaceutical formulation landscape as of April 2005. It discusses key aspects of pharmaceutics including the diverse scientific disciplines involved. It outlines market segments and trends driving increased outsourcing and emphasis on formulation. These include industry downsizing, emergence of biologics, and need for specialized expertise. The document also provides estimates for the size of the US formulation and manufacturing services market and maps some of the major competitors.