Embed presentation

Downloaded 750 times

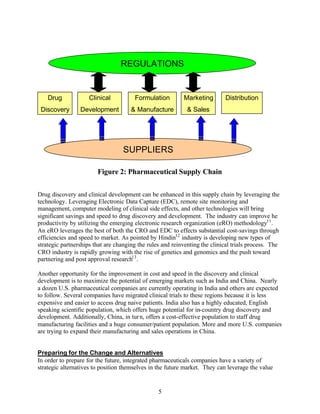

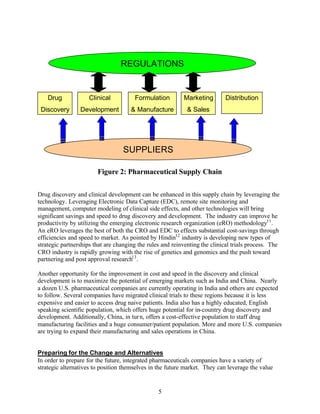

The document discusses emerging business and operational models in the pharmaceutical industry. It notes that the traditional vertically integrated model is shifting to a more fragmented model. It also discusses factors driving changes like rising costs and competition. The document analyzes current blockbuster and niche models and potential future models involving more specialization. It proposes a "progressive drug development model" to reduce risks and costs through targeted development.