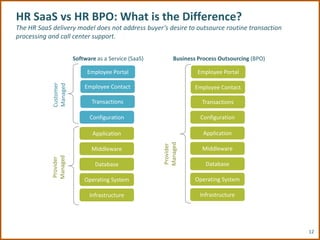

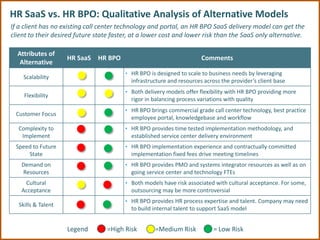

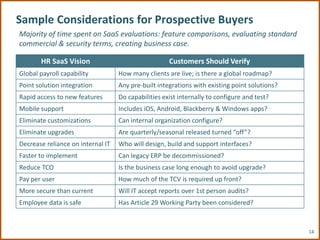

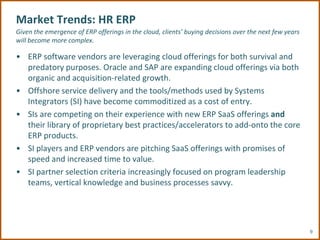

HR in the cloud is a growing trend, with market forces pushing HR systems and processes to software-as-a-service (SaaS) models. However, SaaS alone does not address the need to outsource routine transaction processing and call center support. While SaaS solutions continue gaining traction, acquisitions by large vendors are also consolidating the market. Considerations for buyers include verifying capabilities for global payroll, integration, mobile access, and reducing customizations versus outsourcing transaction processing and help desk support through an HR business process outsourcing provider.

![Market Trends: HR SaaS

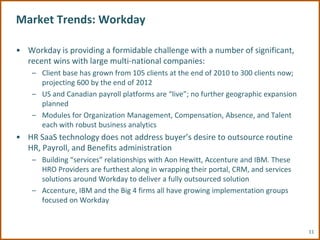

We expect HR’s movement to Software-as-a-Service to continue.

• SaaS solutions continue to gain traction:

– Workday’s native SaaS platform is rapidly evolving from a US-centric

mid-market core HR technology player into a strong competitor to Oracle and

SAP for large, complex global companies

– SaaS solutions delivered by Ultimate Ultipro, ADP Vantage , Ceridian Latitude

and Sapien address the needs of mid-market U.S. firms

• Acquisition activity:

– December 2011, SAP announces their intent to acquire SuccessFactors [March

2012 close]. Speculation is that SAP went down this path because of a serious

lag in their internal product development of Cloud and SaaS products

– February 2012, Oracle announces their intent to acquire Taleo [mid 2012 close].

Speculation is that this acquisition was driven by the goal to provide a complete

cloud offering via the integration of Oracle Fusion and Taleo

– August 2012, IBM announces their intent to acquire Kenexa

10](https://image.slidesharecdn.com/hrinthecloudv4final-121214174033-phpapp01/85/Perfect-Storm-HR-in-the-Cloud-10-320.jpg)