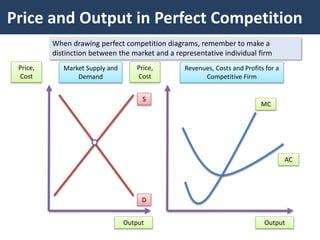

The document discusses the concept of perfect competition, detailing its assumptions such as homogeneous products, numerous buyers and sellers, and price-taking behavior of firms. It explains how market dynamics, like firm entry and exit, impact long-run equilibrium prices and profits. Additionally, it contrasts perfect competition with real-world market imperfections, highlighting factors like differentiated products and varying price-setting power.