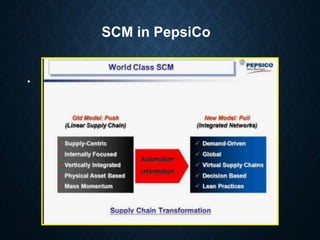

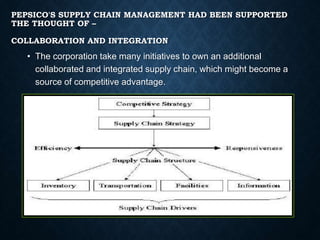

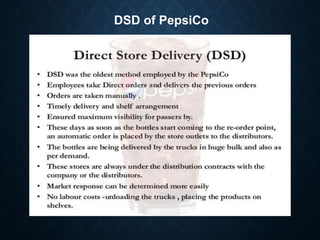

PepsiCo has a collaborative supply chain management approach that focuses on integration and partnerships. It uses a direct-to-store delivery model where bottlers and distributors deliver products directly to retail stores. This ensures freshness and responsiveness. PepsiCo also partners with suppliers and retailers to better meet demands. It aims to have a diverse and globally accessible supplier network that follows its social and environmental standards. These collaborative efforts along with its brands and innovations allow PepsiCo to gain competitive advantages in the market.