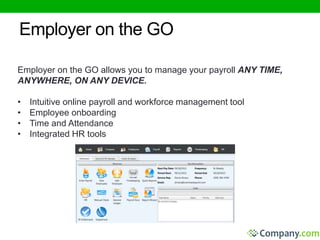

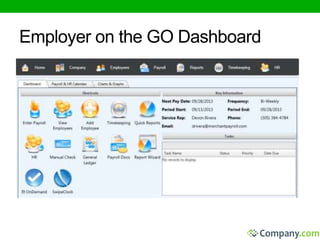

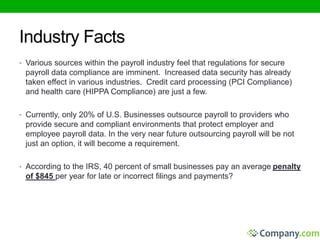

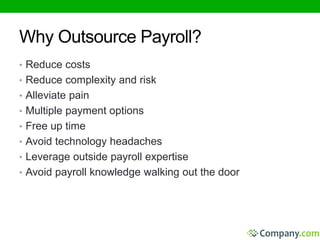

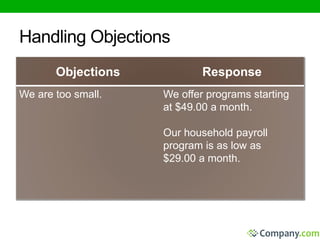

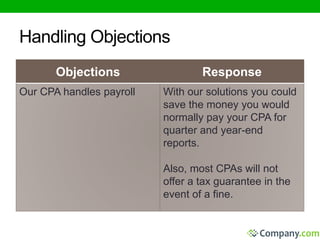

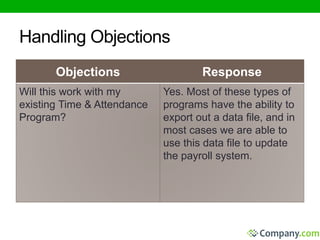

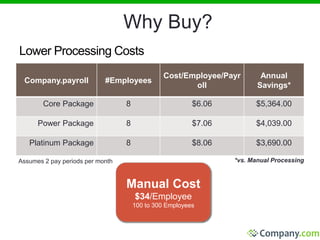

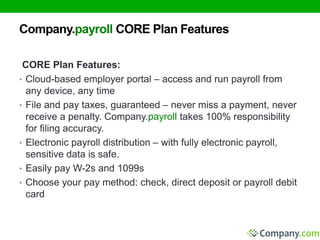

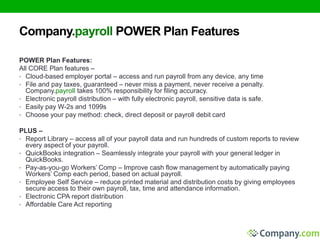

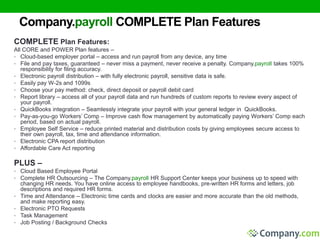

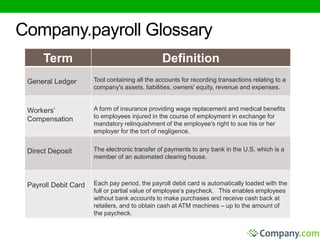

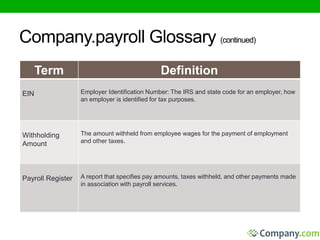

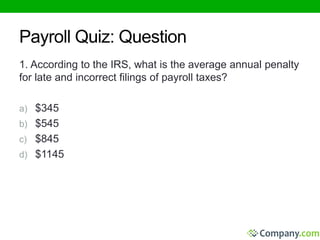

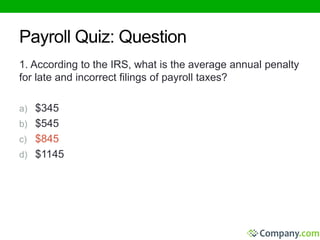

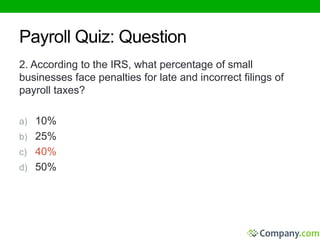

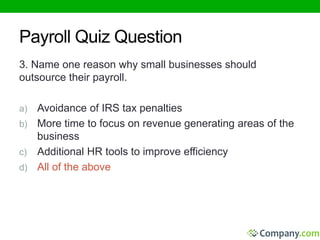

The document discusses payroll processing services provided by Company.payroll. It highlights how the company's cloud-based payroll system is more secure, paperless, integrated and affordable than traditional payroll methods. The system allows access to payroll from any device and includes features like tax filing guarantees and HR tools. The document also provides information on pricing plans and describes the benefits small businesses can realize by outsourcing payroll to Company.payroll like reduced costs and penalties.