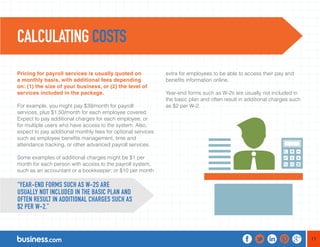

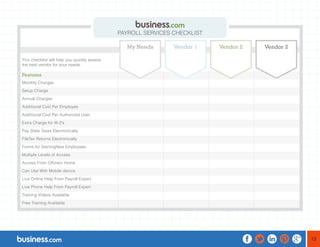

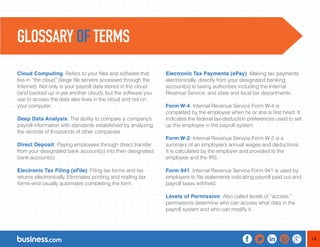

The document provides a comprehensive guide to online payroll services, highlighting their advantages over traditional payroll software and management firms, such as convenience, data security, and cost savings. It outlines key features, optional enhancements, and pricing structures while offering tips for selecting and setting up a payroll service. Additionally, it includes a glossary of relevant terms and a checklist for evaluating payroll vendors.