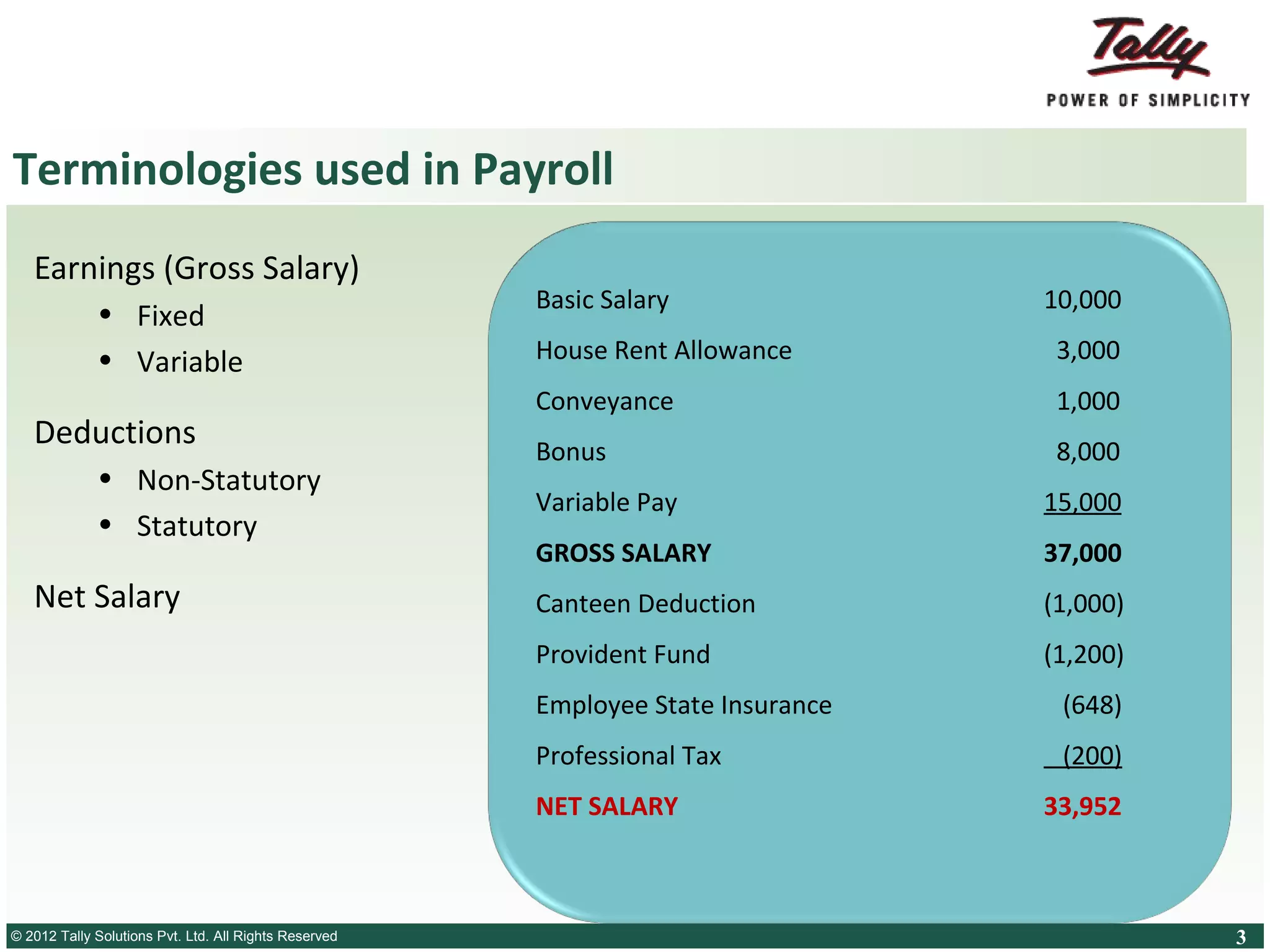

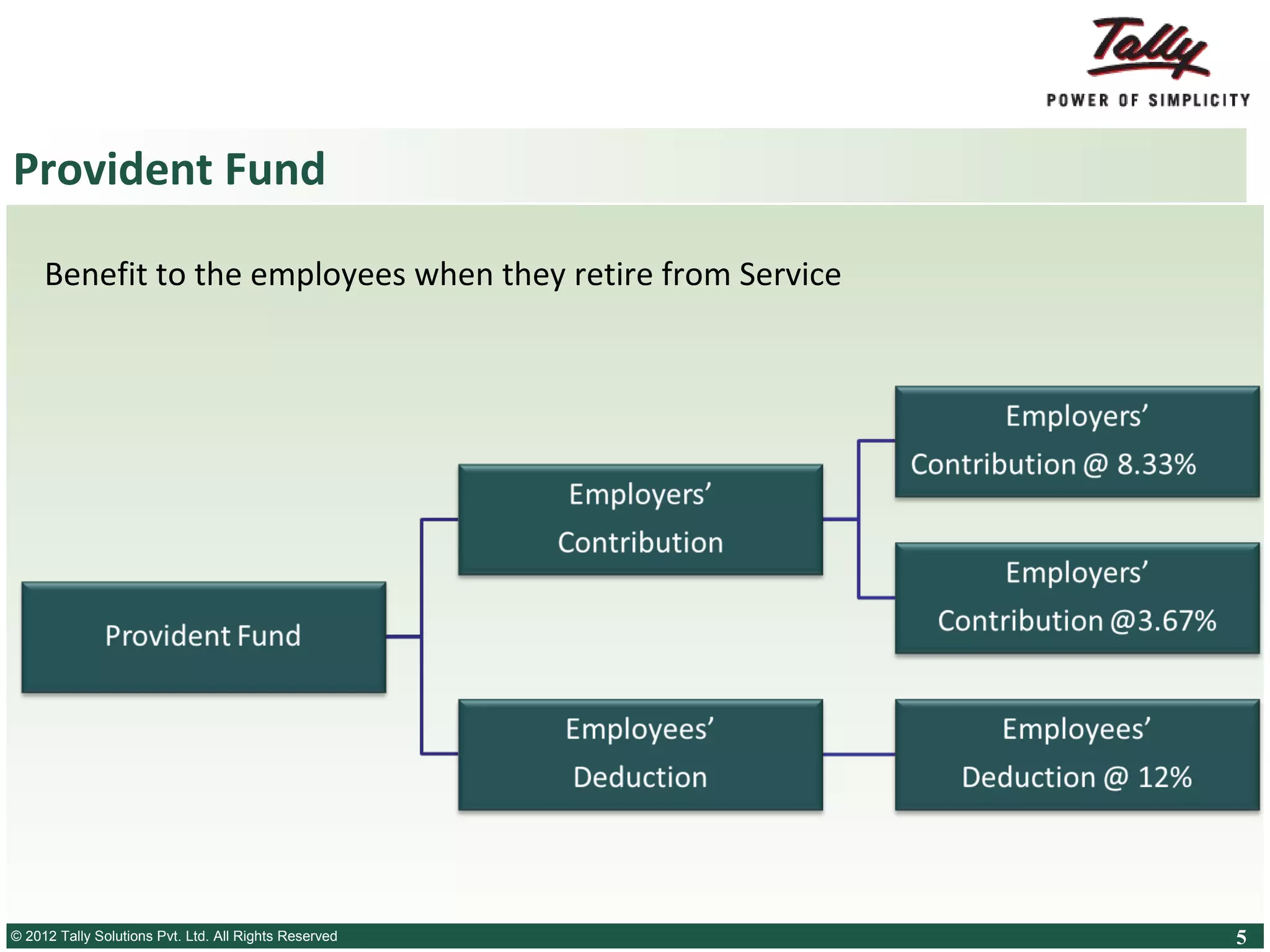

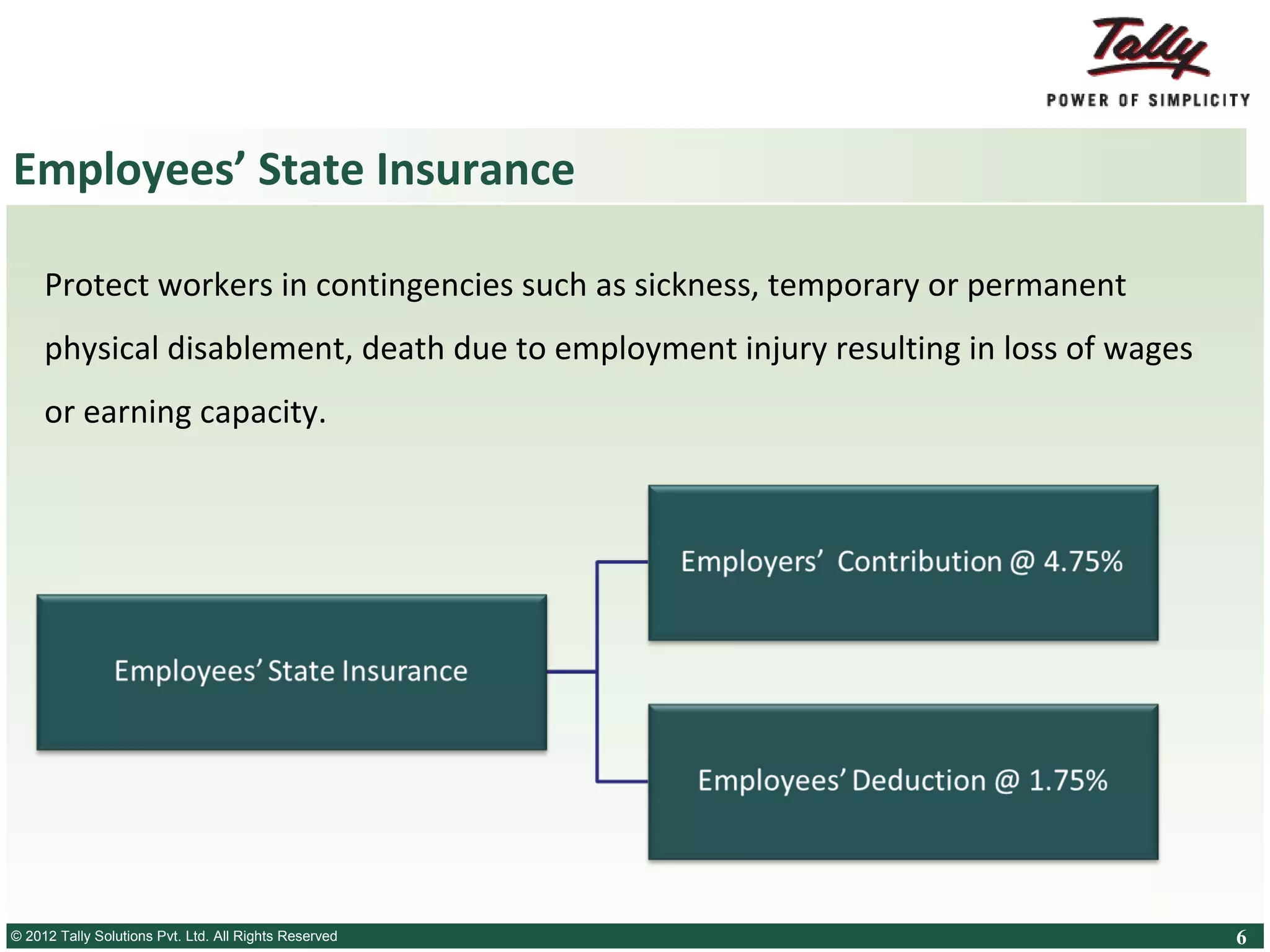

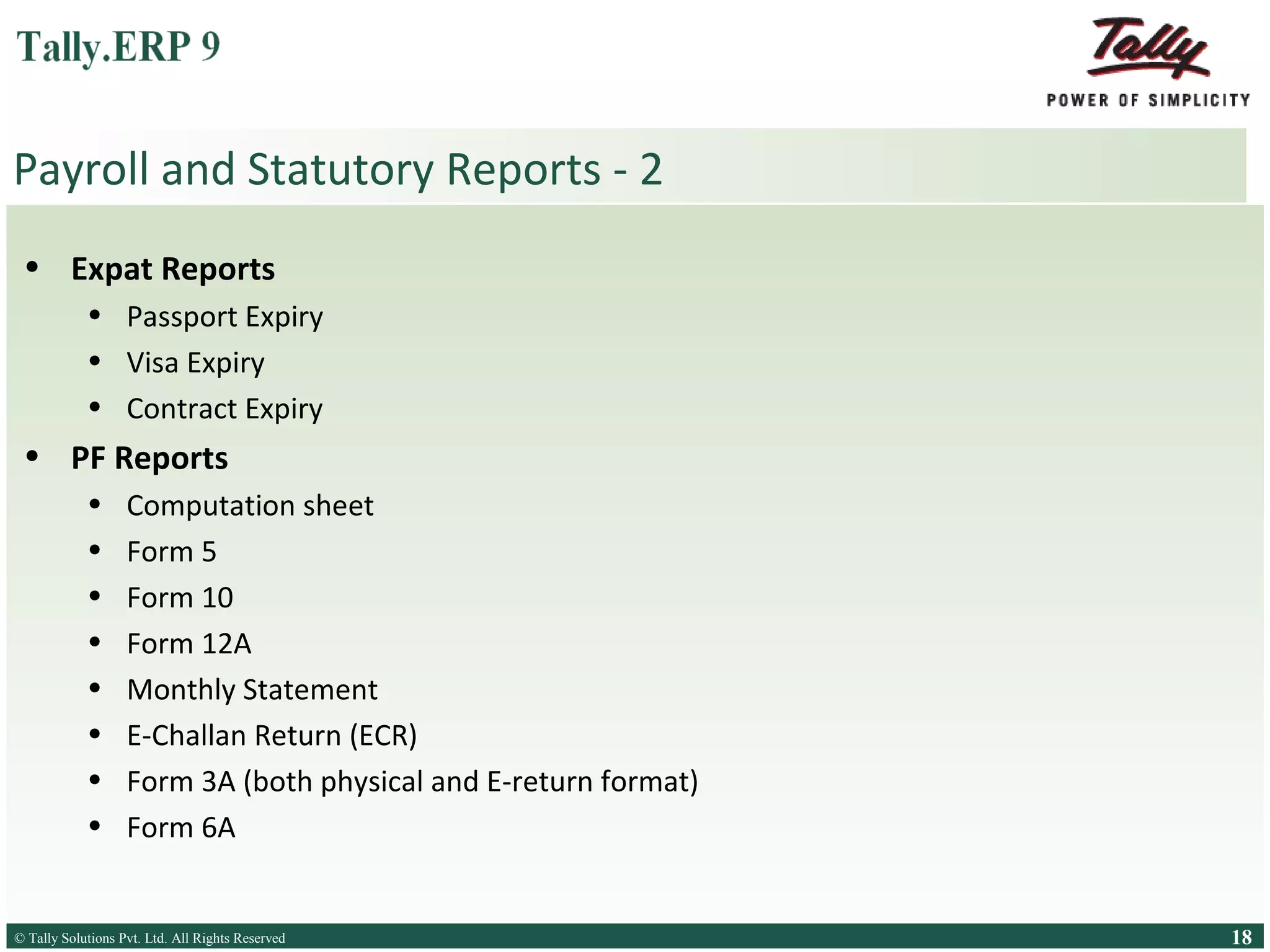

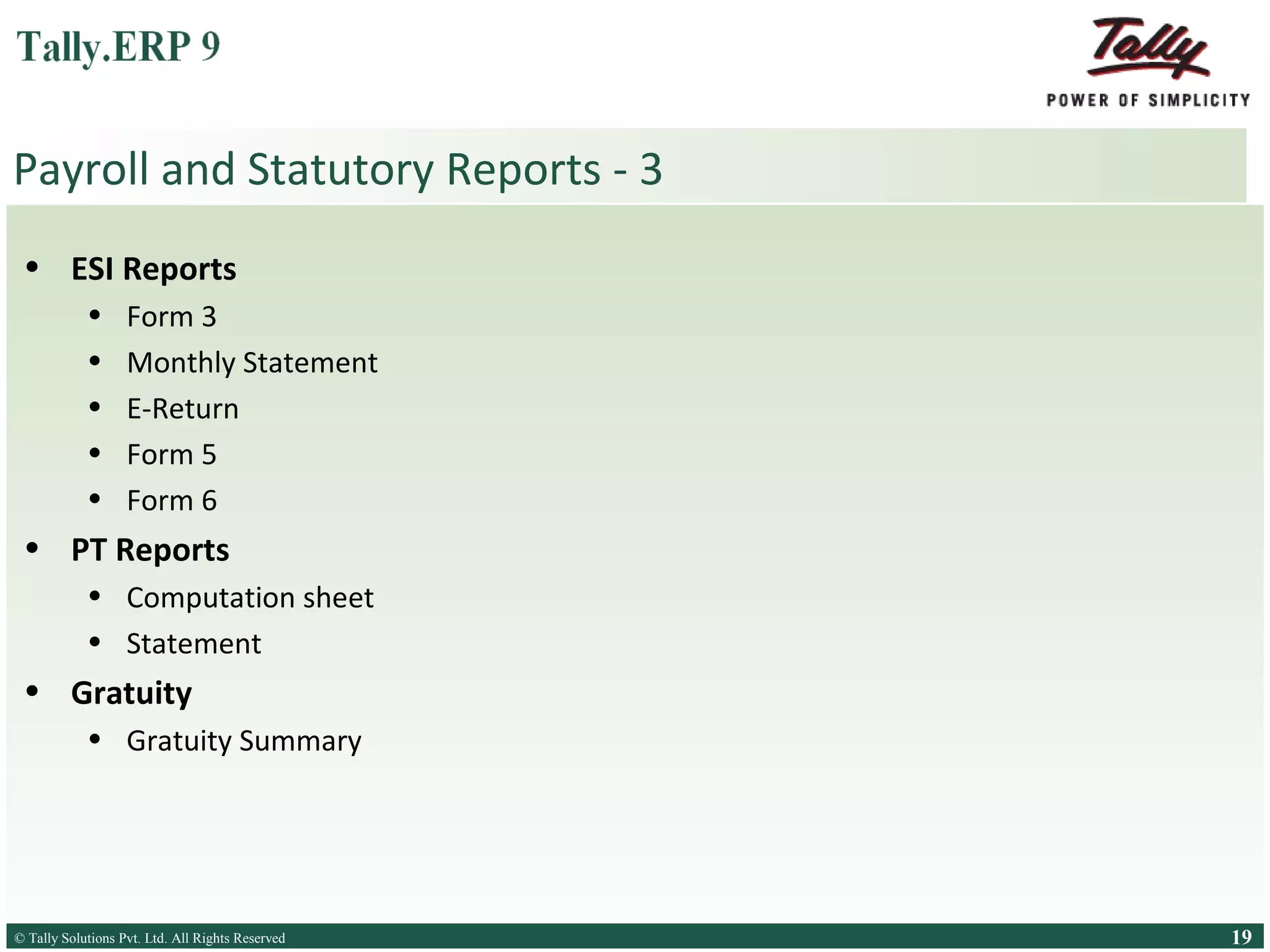

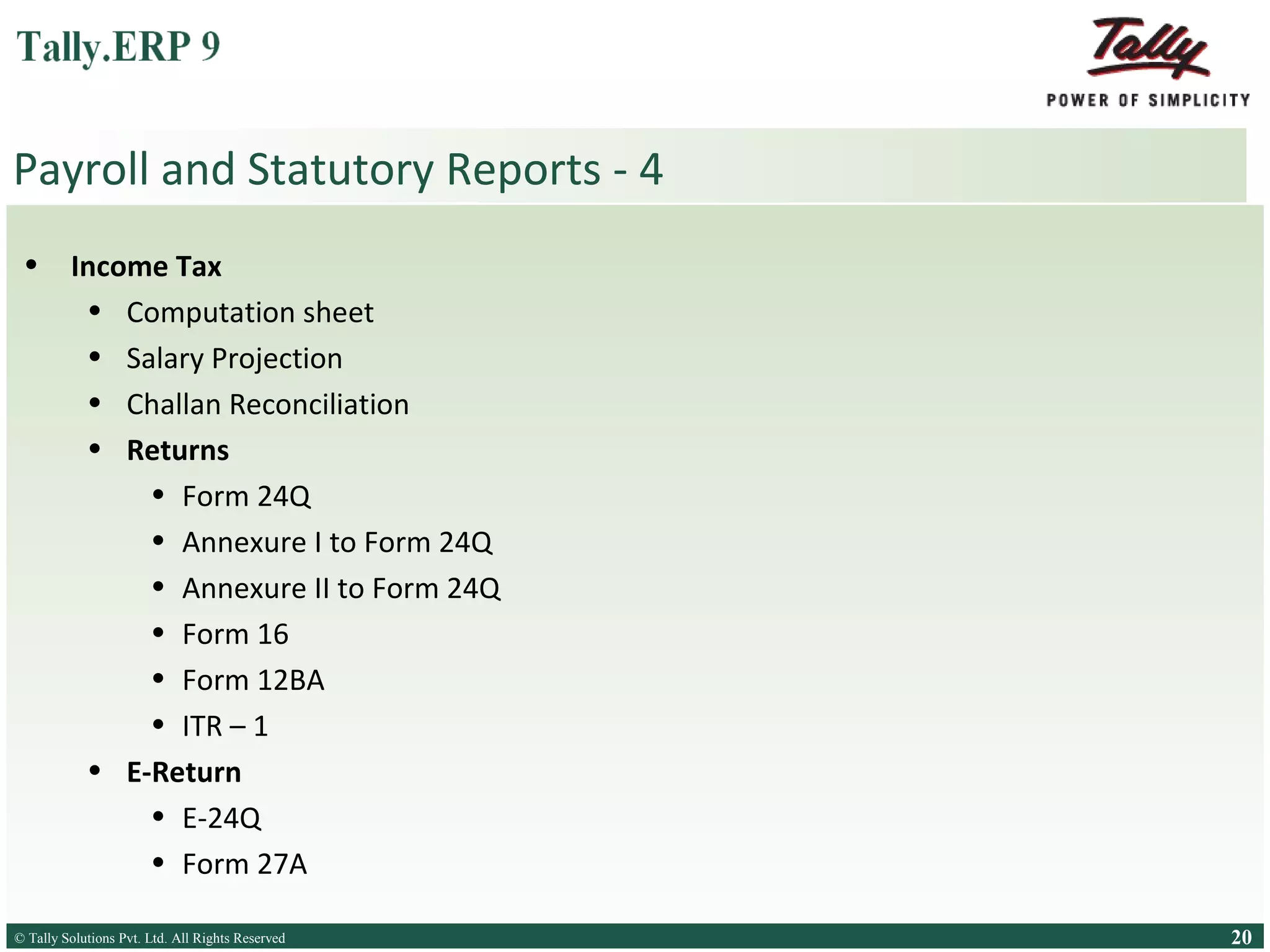

The document outlines payroll management, detailing remuneration paid to employees and various components such as earnings, deductions, and statutory compliance including provident fund and income tax. It emphasizes the importance of payroll for tracking employee payments and maintaining regulatory standards while highlighting features of the Tally ERP 9 payroll system for efficient management. The document also includes various payroll reports and compliance forms required for effective payroll administration.