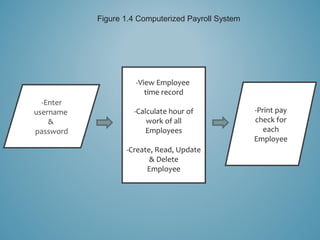

This document is a thesis proposal for a computerized payroll system for St. John Technological College of the Philippines. It introduces the topic and outlines the need to upgrade from a manual to automated payroll system. The proposal discusses the benefits of a computerized system in reducing errors and streamlining payroll processes. It proposes developing a system that allows employees to clock in and out digitally, calculates payroll taxes and deductions accurately, and generates pay slips. The proposal provides conceptual models of the proposed system and its features.