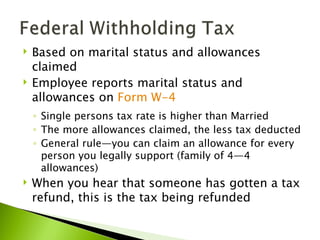

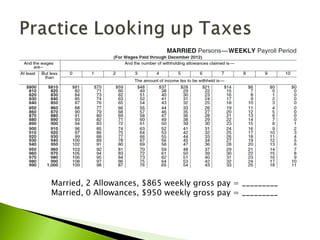

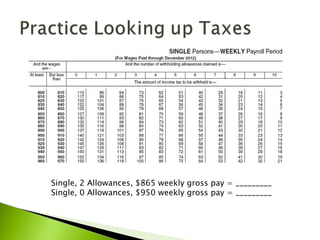

Gross pay is the total amount an employee earns before taxes are deducted. Employers are required to deduct federal withholding tax, social security tax, and Medicare tax from employees' paychecks. Social security tax pays for retirement benefits and Medicare tax pays for health insurance. The amount of federal withholding tax deducted is determined using tax tables that consider the employee's marital status, number of exemptions claimed, and pay frequency.