This document outlines the steps to configure payroll processing for India in SAP, including:

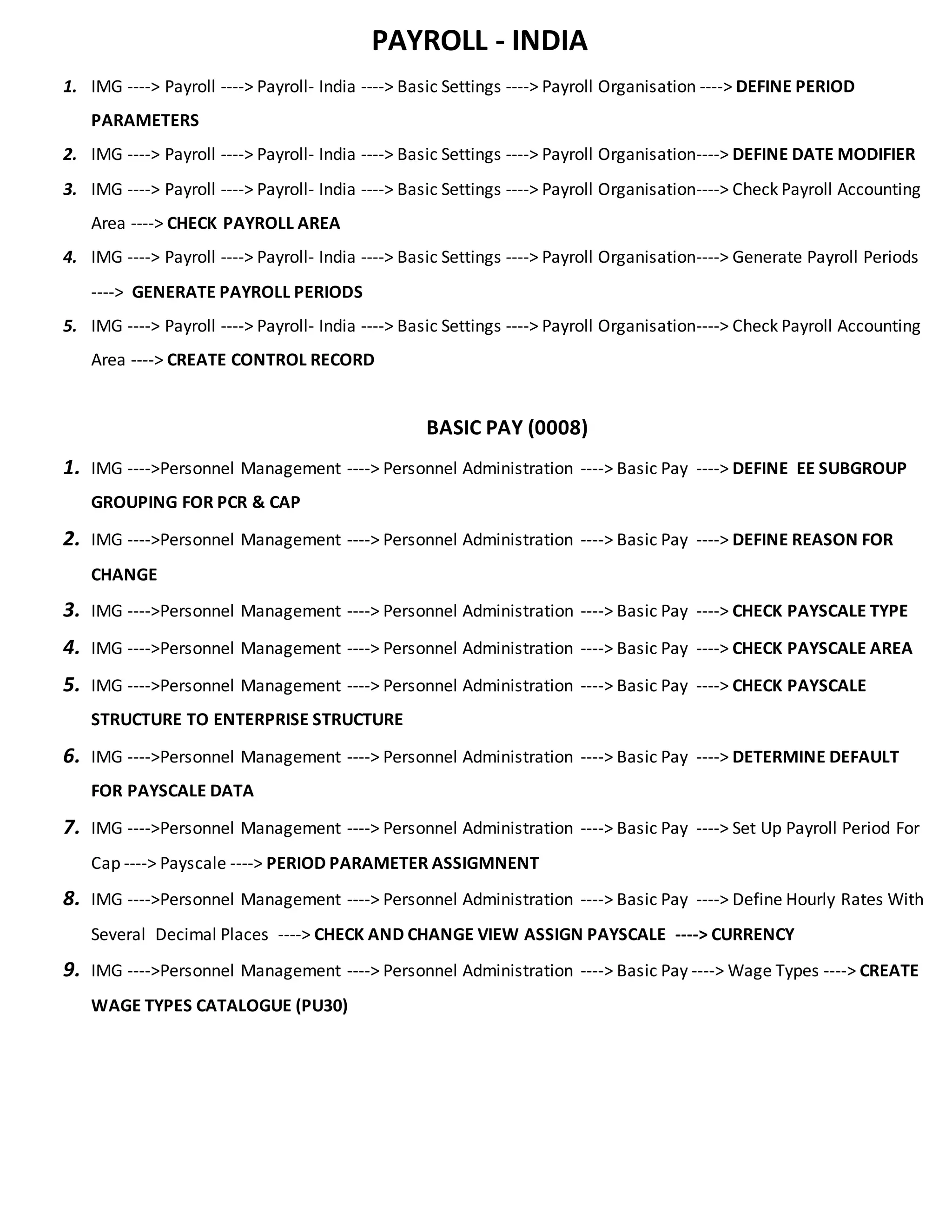

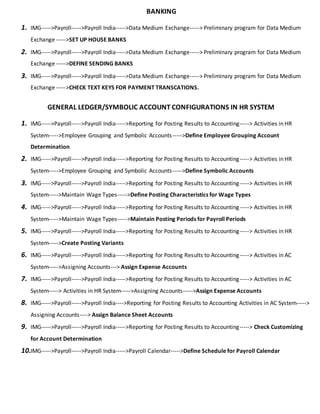

1. Defining payroll organization parameters, periods, and accounts

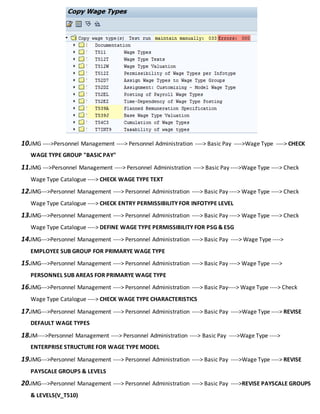

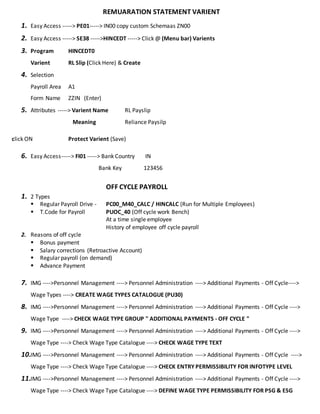

2. Configuring employee basic pay, recurring payments and deductions, additional payments, and wage types

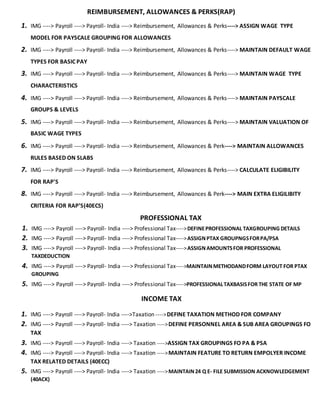

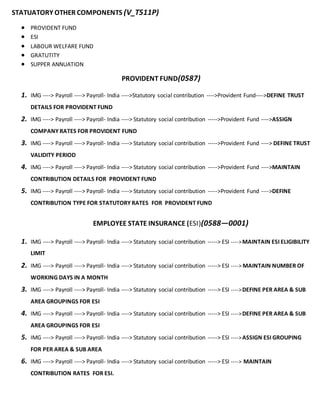

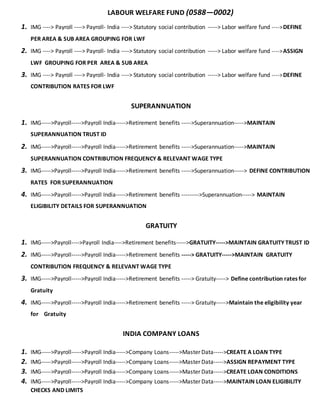

3. Setting up allowances, reimbursements, taxes, and statutory contributions for provident fund, ESI, and other benefits

4. Maintaining gratuity, loans, banks, and general ledger accounts

5. Running pre-programs for the data medium exchange process for bank transfers