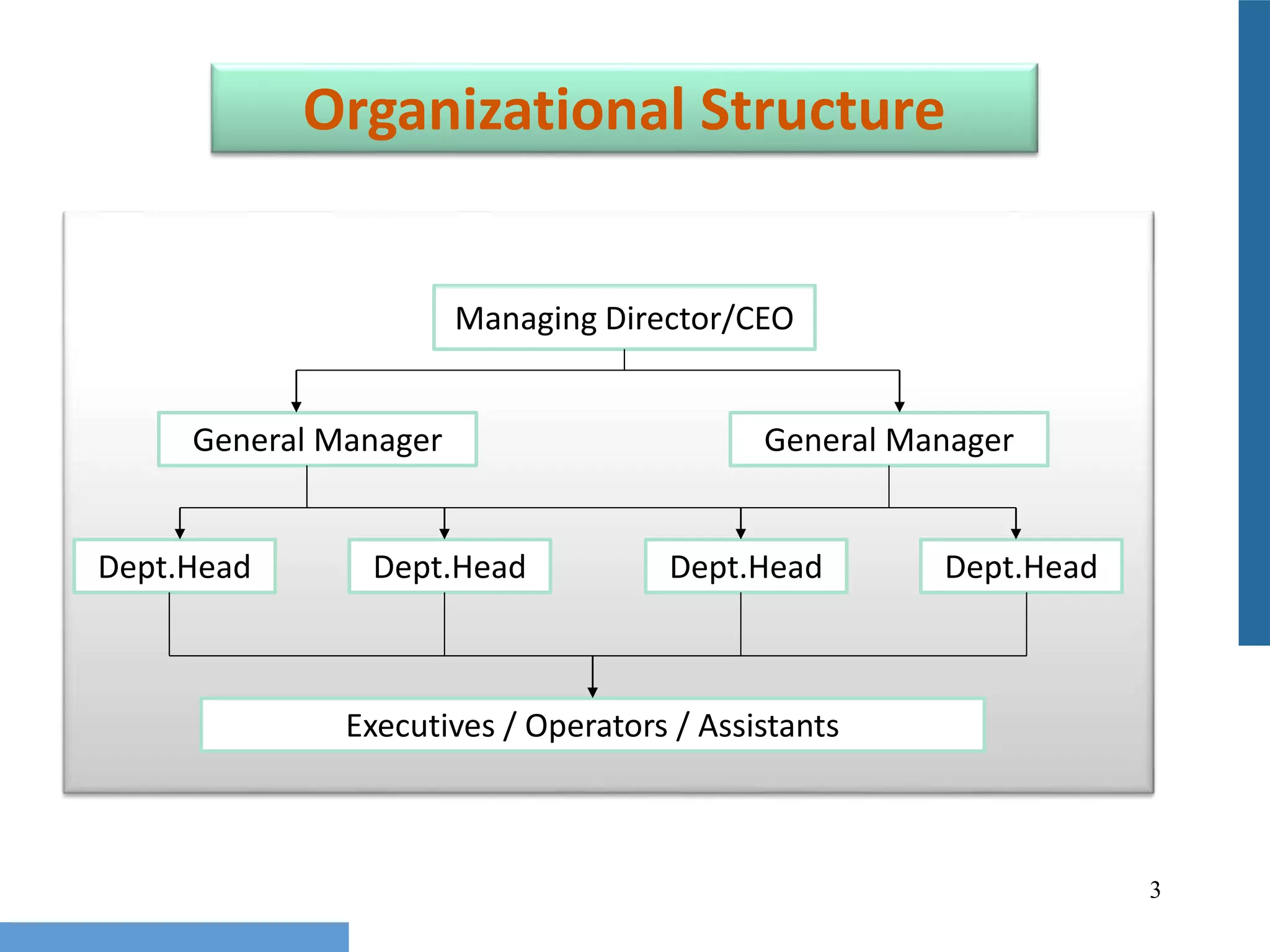

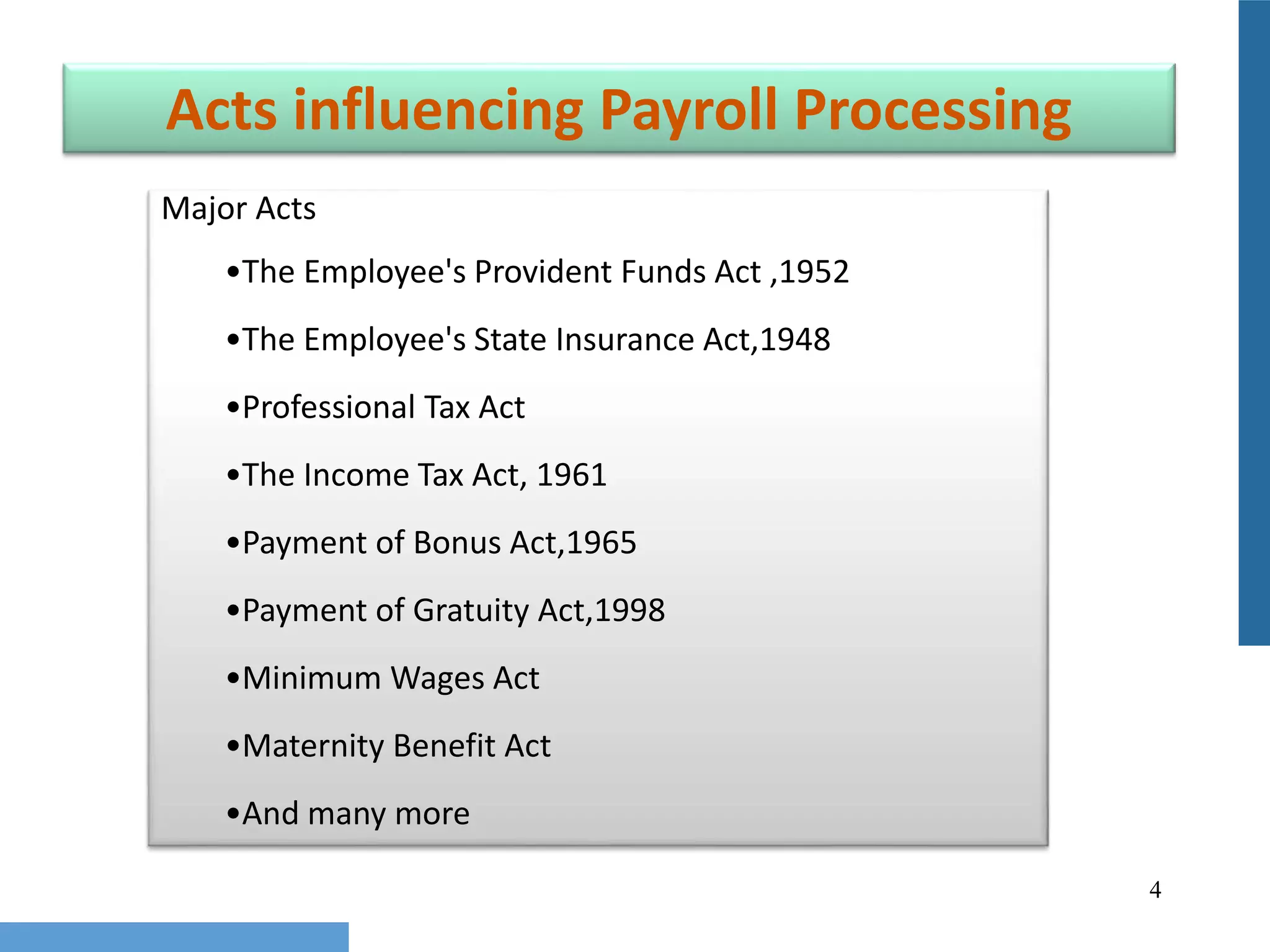

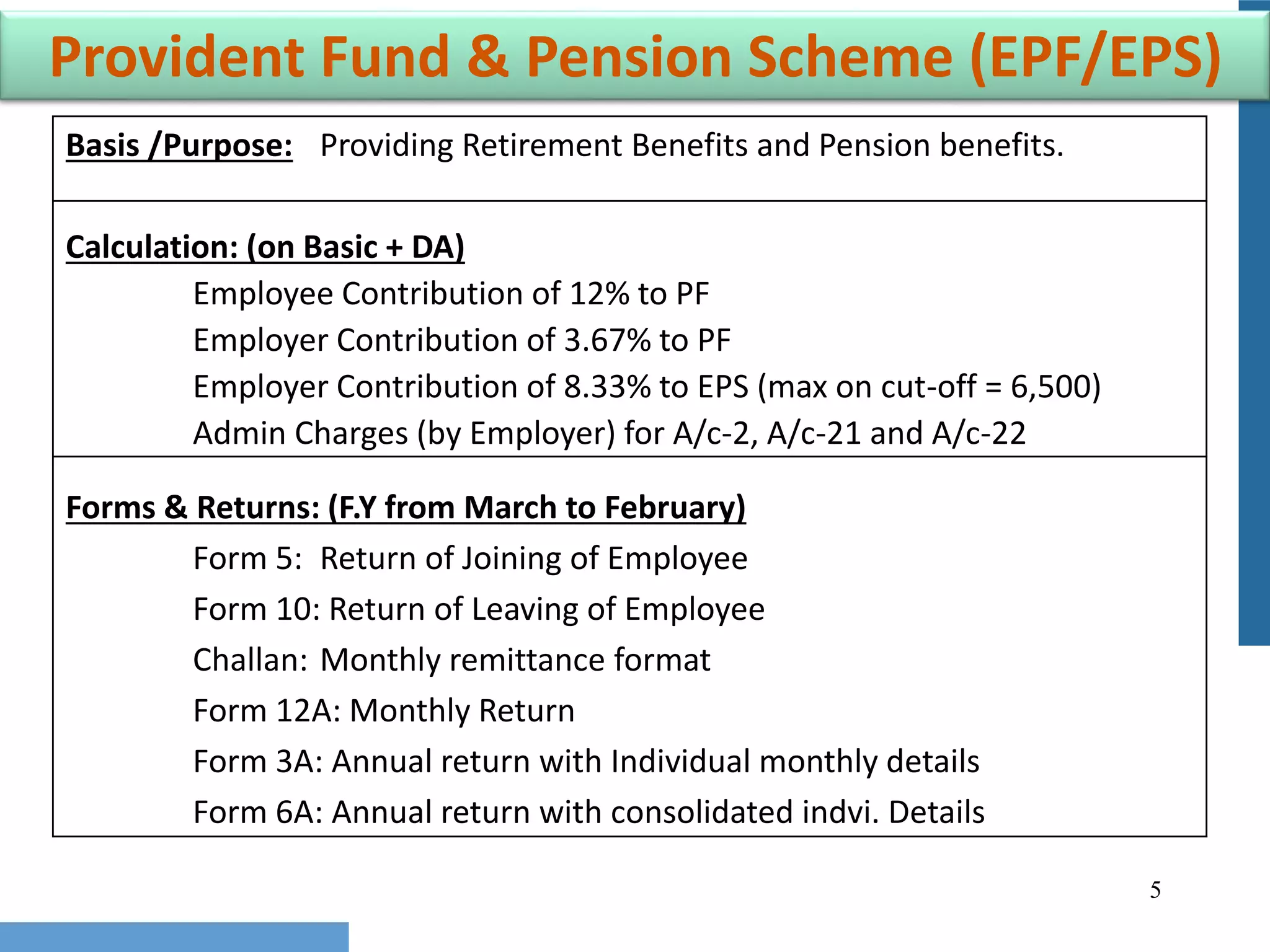

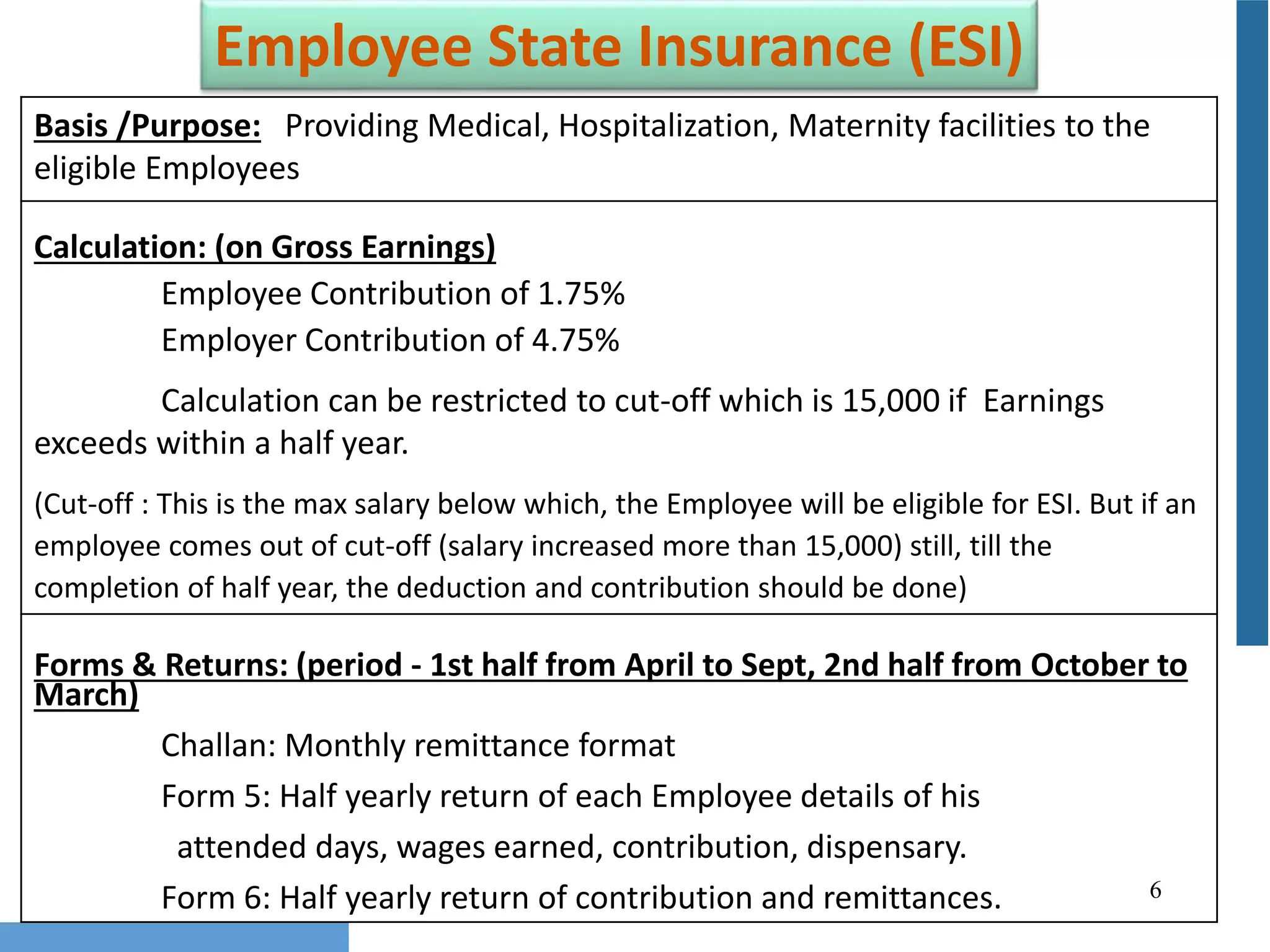

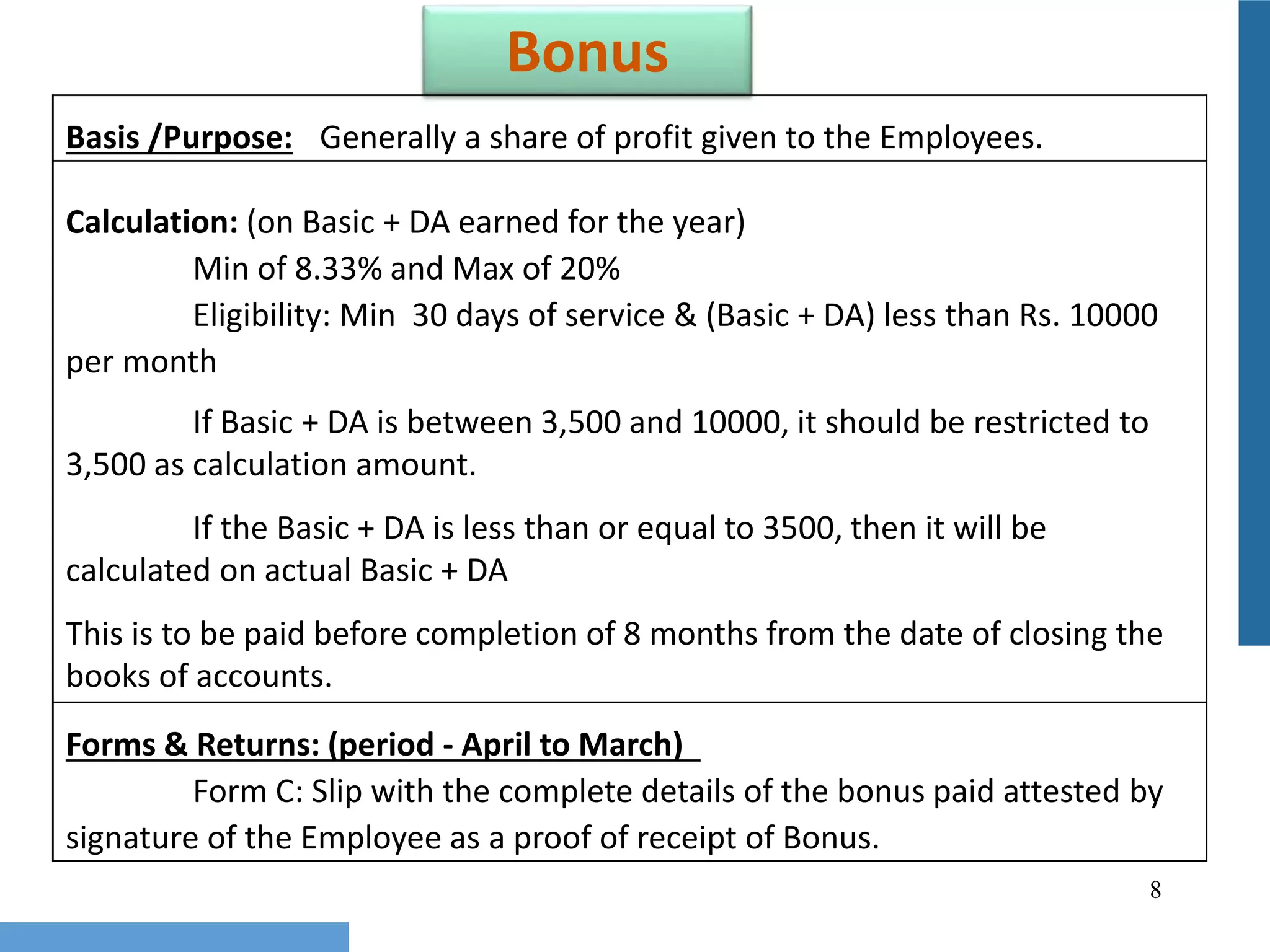

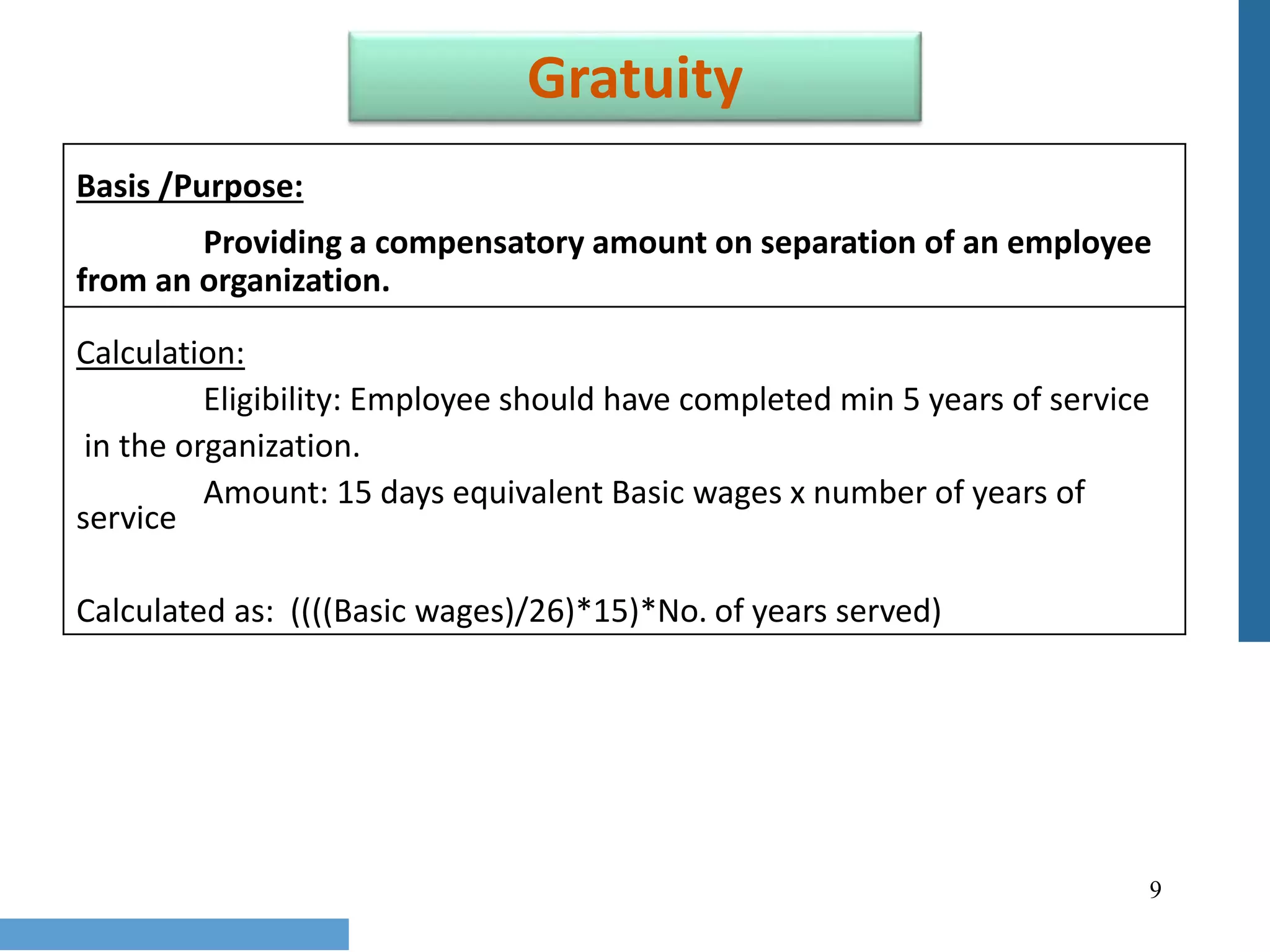

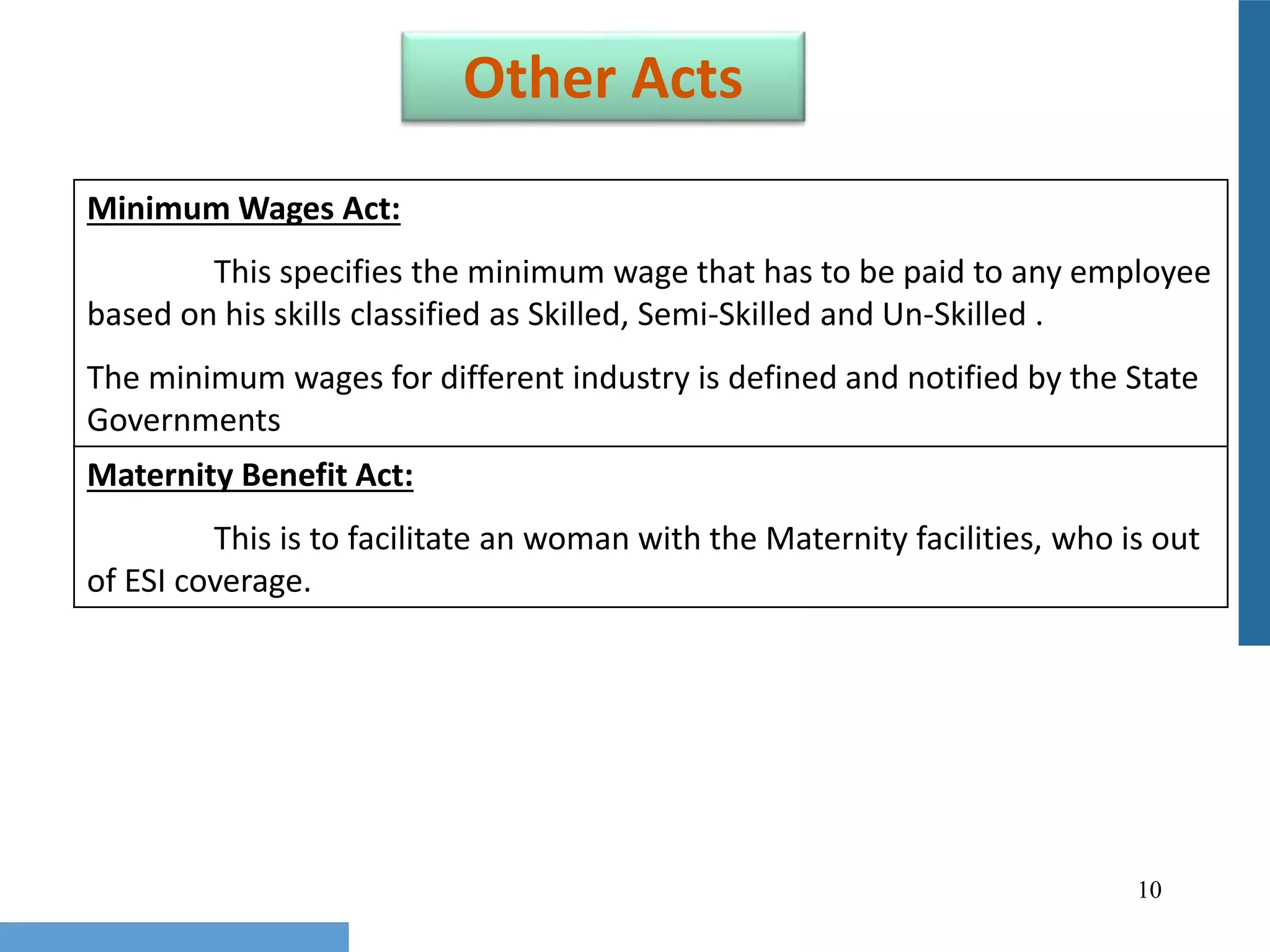

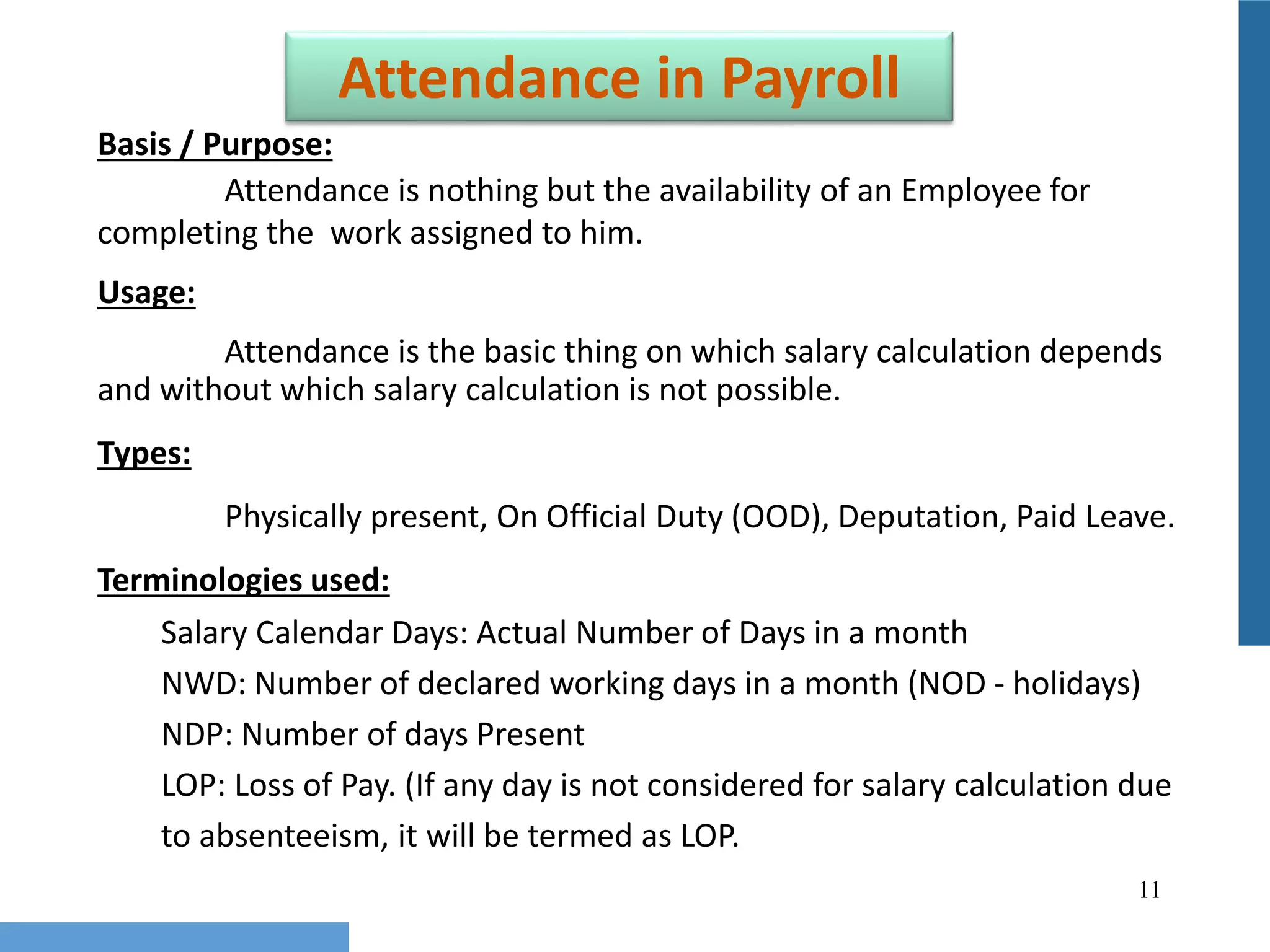

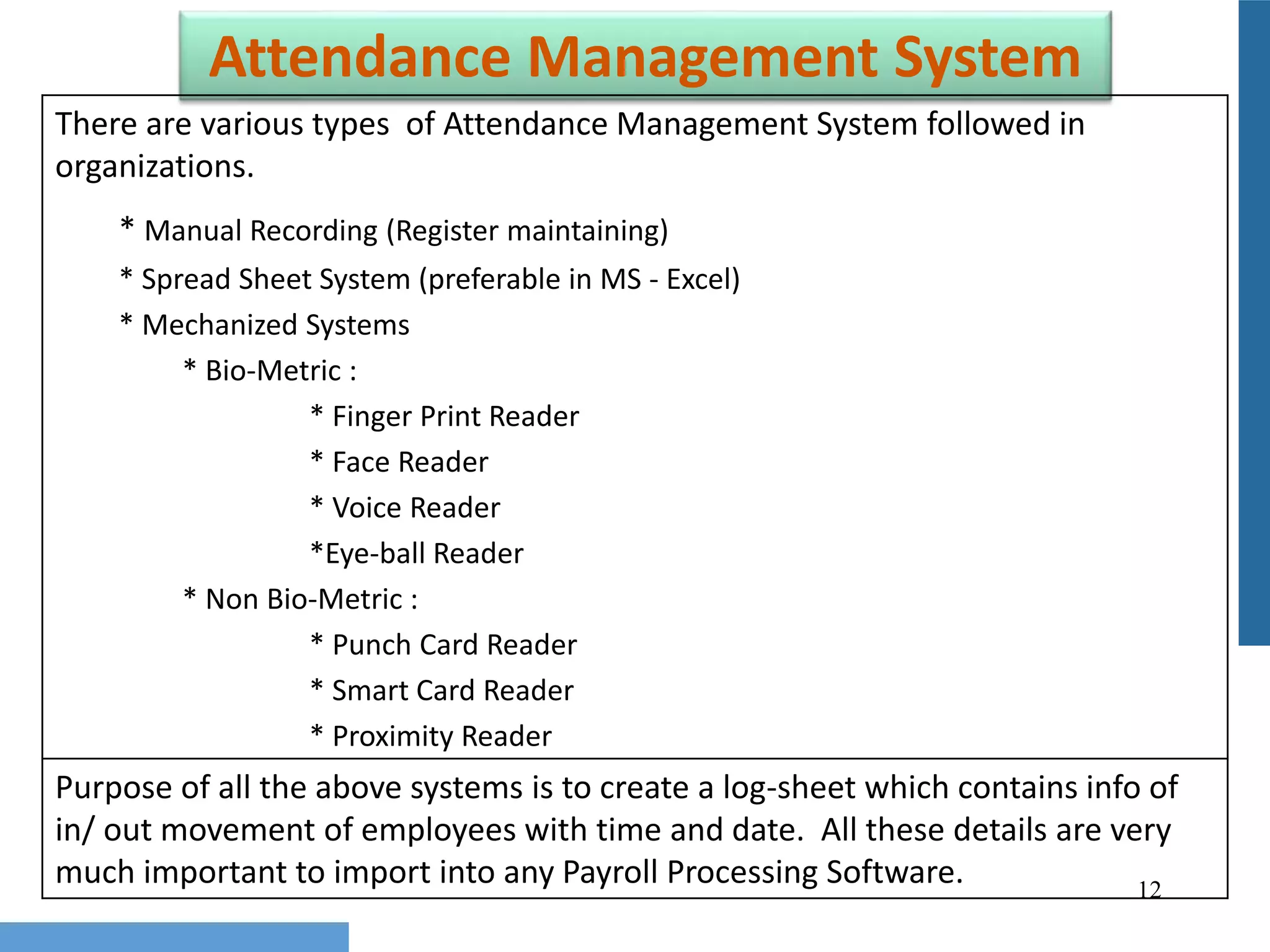

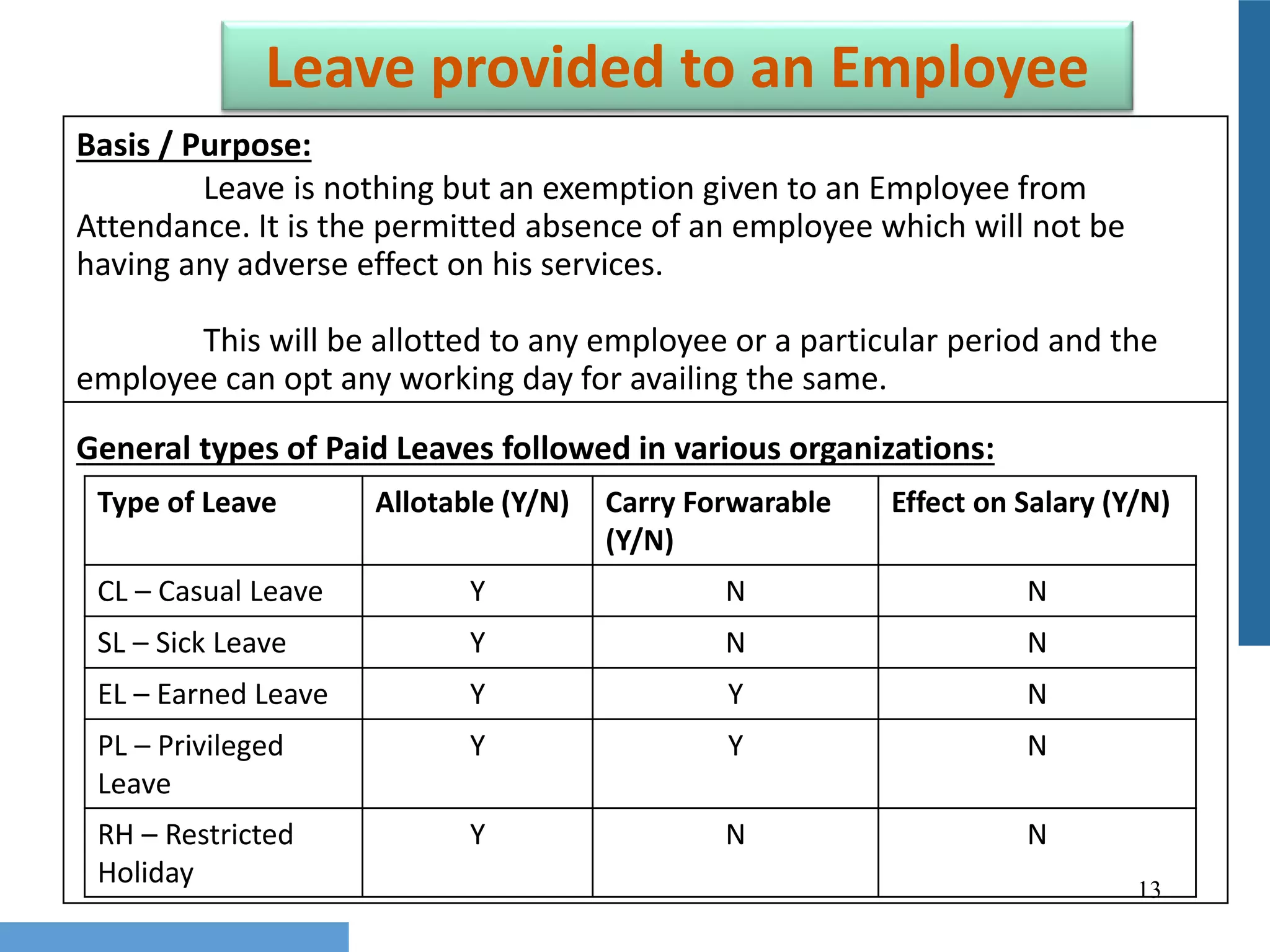

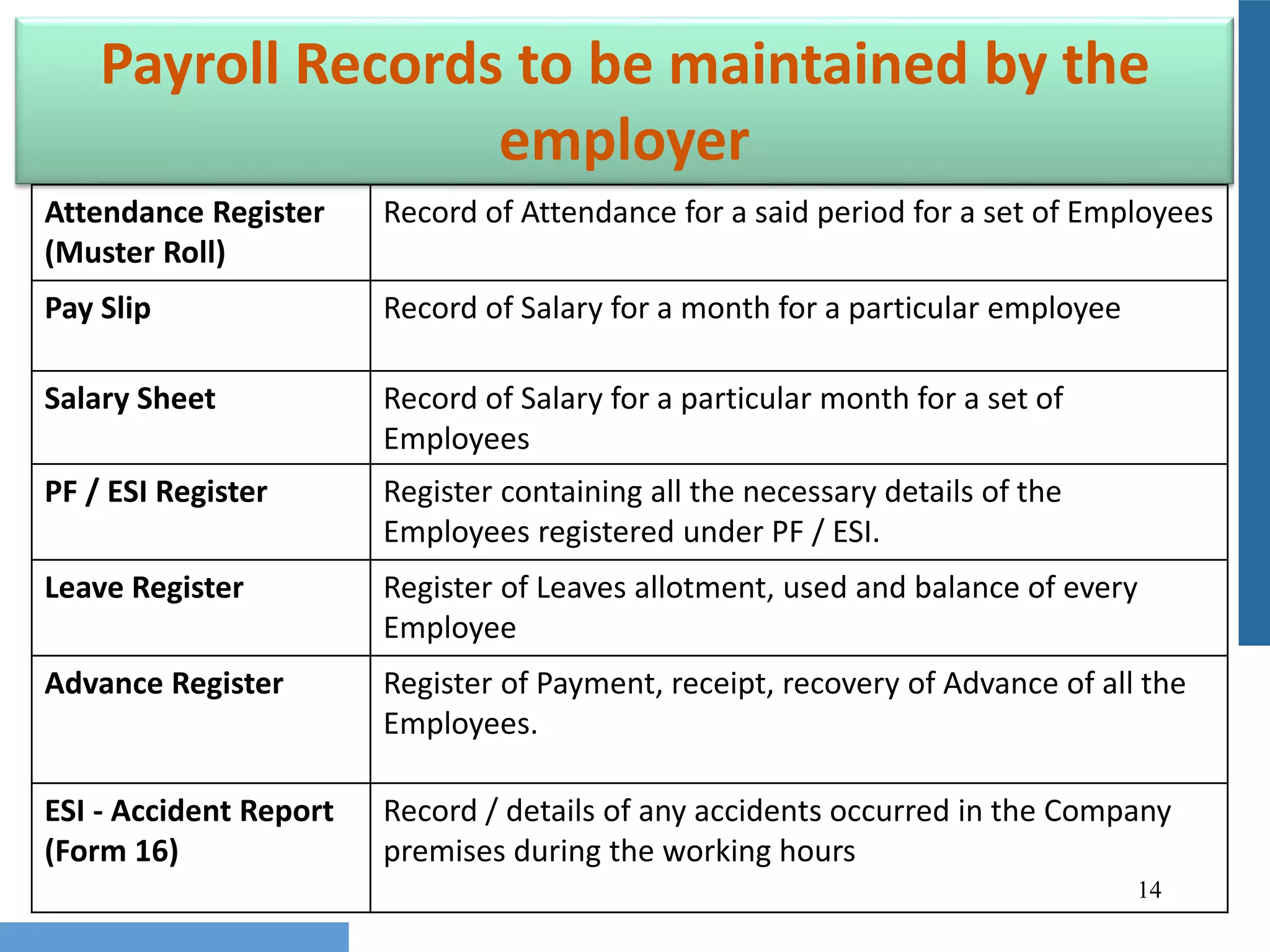

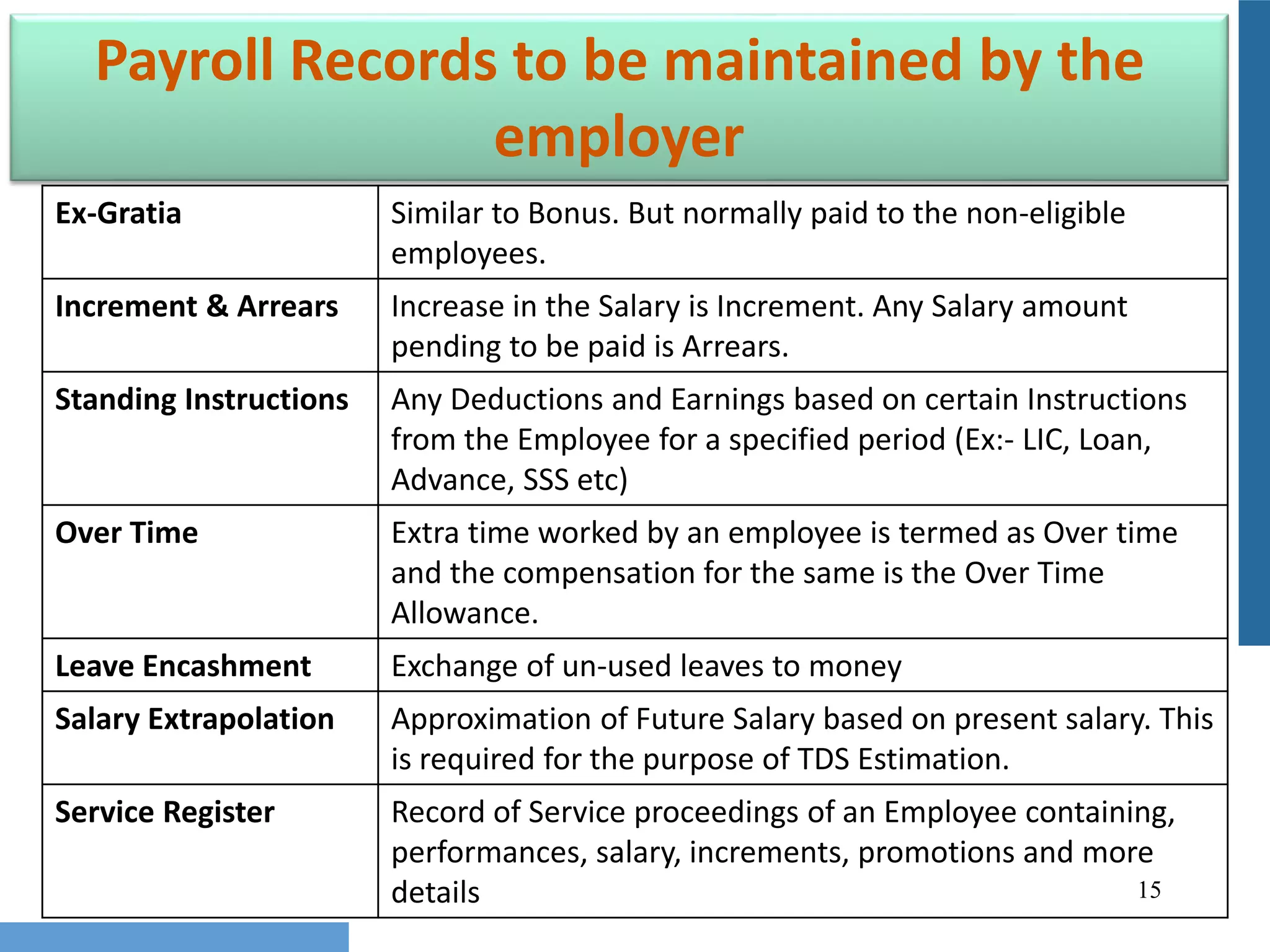

This document provides an overview of key payroll concepts including salary components, organizational structures, acts influencing payroll processing, provident fund and pension schemes, employee state insurance, income tax, bonus, gratuity, attendance tracking, types of leave, and important payroll records that must be maintained by employers. It discusses elements like basic salary, deductions, allowances, statutory contributions, forms and returns, eligibility criteria. The last section provides contact information for a payroll software demonstration.