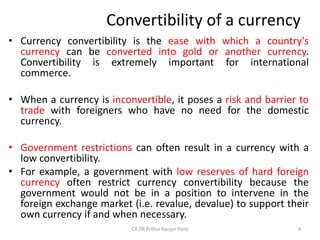

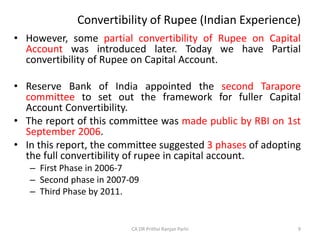

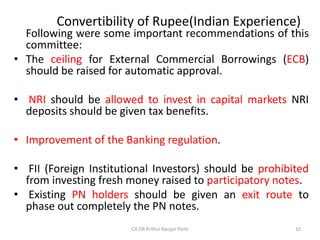

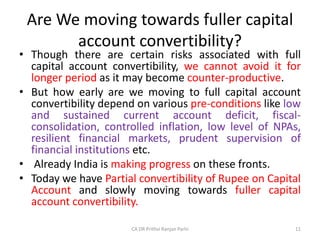

The document discusses the convertibility of the Indian rupee. It begins by stating that the Indian rupee is a partially convertible currency, meaning exchange of higher amounts is restricted and requires approval. It then defines currency convertibility and explains that India has moved towards greater convertibility over time. Currently, the rupee has partial convertibility on the capital account. While full convertibility poses some risks, India is slowly working to meet preconditions like fiscal consolidation and resilient markets. The document outlines India's path towards convertibility since the 1990s crisis and liberalization, including the recommendations of committees to further open the capital account.