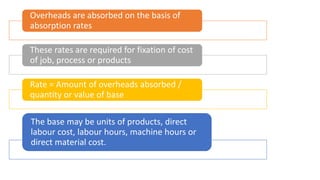

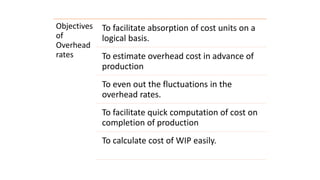

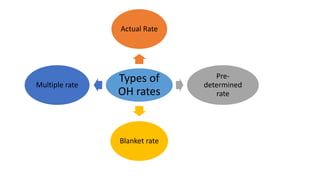

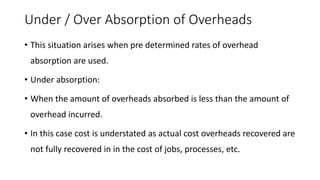

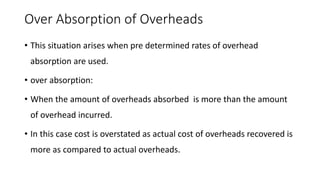

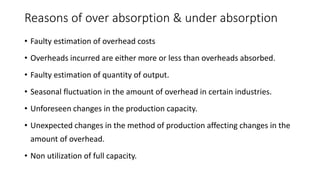

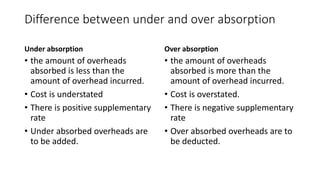

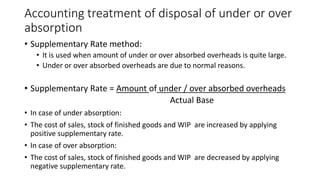

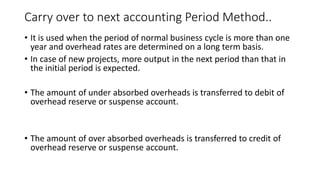

Overhead rates are used to absorb overhead costs based on a quantity or value base like direct labor hours. There are different types of overhead rates like actual, predetermined, blanket, and multiple rates. Predetermined rates are set in advance based on budgets to facilitate cost estimation. Under or over absorption of overheads can occur if actual overhead costs differ from budgeted amounts due to estimation errors. The under or over absorbed amounts are disposed of through supplementary rates, writing off to a costing profit and loss account, or carrying amounts to the next period.