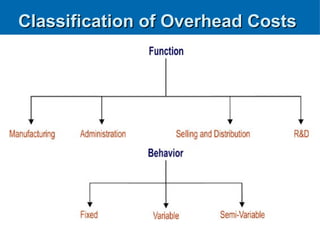

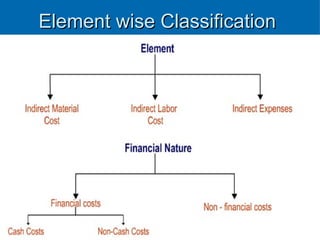

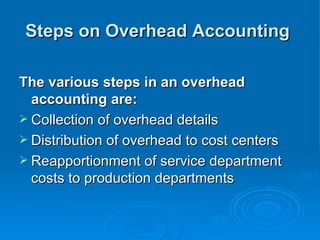

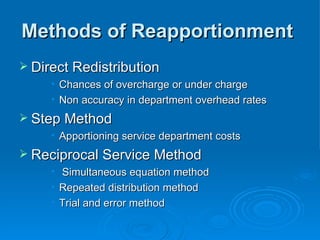

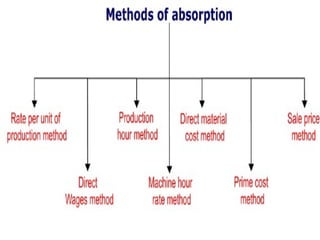

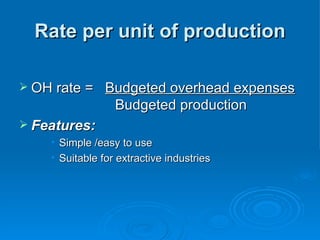

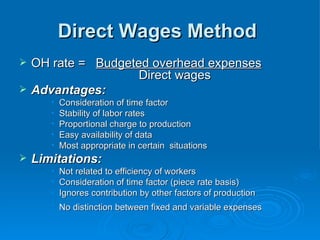

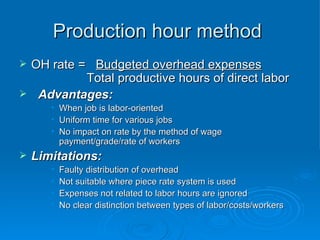

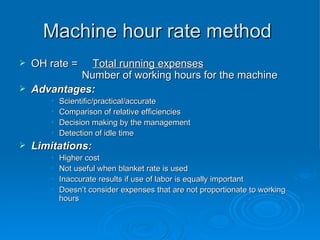

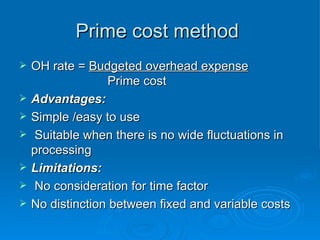

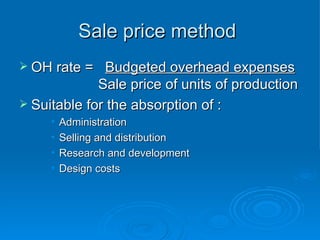

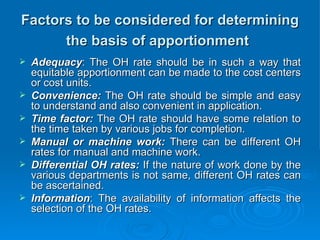

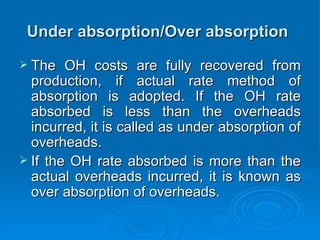

The document discusses cost allocation and overhead accounting. It defines overhead as indirect costs that cannot be traced to a specific product or service. It covers classifying and types of overheads, the steps in overhead accounting including collection, distribution, and reapportionment. The bases and principles of apportioning overheads are explained along with common reapportionment methods. Absorption of overheads refers to allocating overhead expenses to cost units or centers. Various absorption methods and the concepts of under and over absorption are defined.