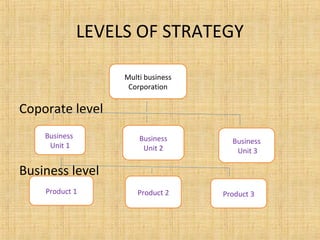

1) The document discusses different levels of strategy for organizations including corporate level strategy, which determines what businesses an organization will be in, and business level strategy, which determines how an organization will compete within each business.

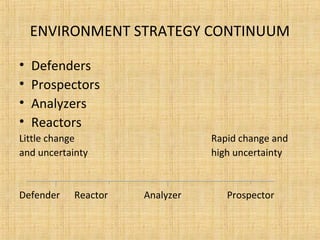

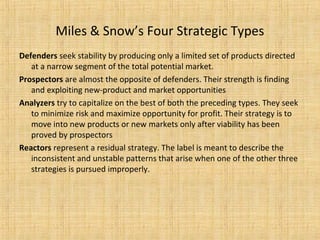

2) It also summarizes various frameworks for classifying strategies such as Miles and Snow's four strategic types of defenders, prospectors, analyzers, and reactors.

3) Porter's three generic competitive strategies are also outlined as cost leadership, differentiation, and focus.