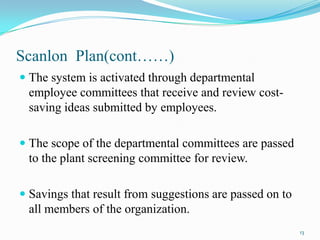

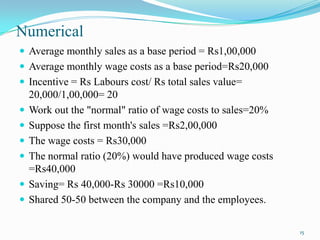

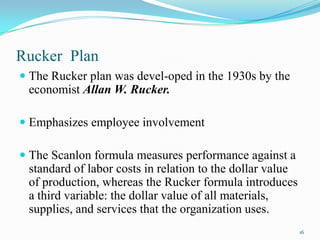

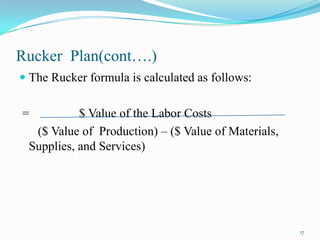

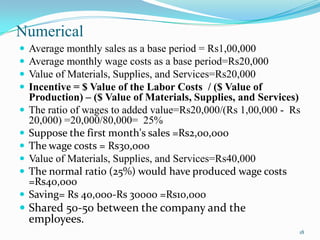

This document discusses various organization-wide incentive plans including profit sharing, gain sharing, and employee stock ownership plans. Profit sharing rewards employees based on organizational success over time to promote ownership culture. Gain sharing specifically shares unexpected productivity or cost savings gains between employees and the company. Employee stock ownership plans give employees the right to purchase company stock in the future. The document provides details on common gain sharing plans like Scanlon, Rucker, and ImproShare and discusses their advantages in motivating employees and aligning them with organizational goals.