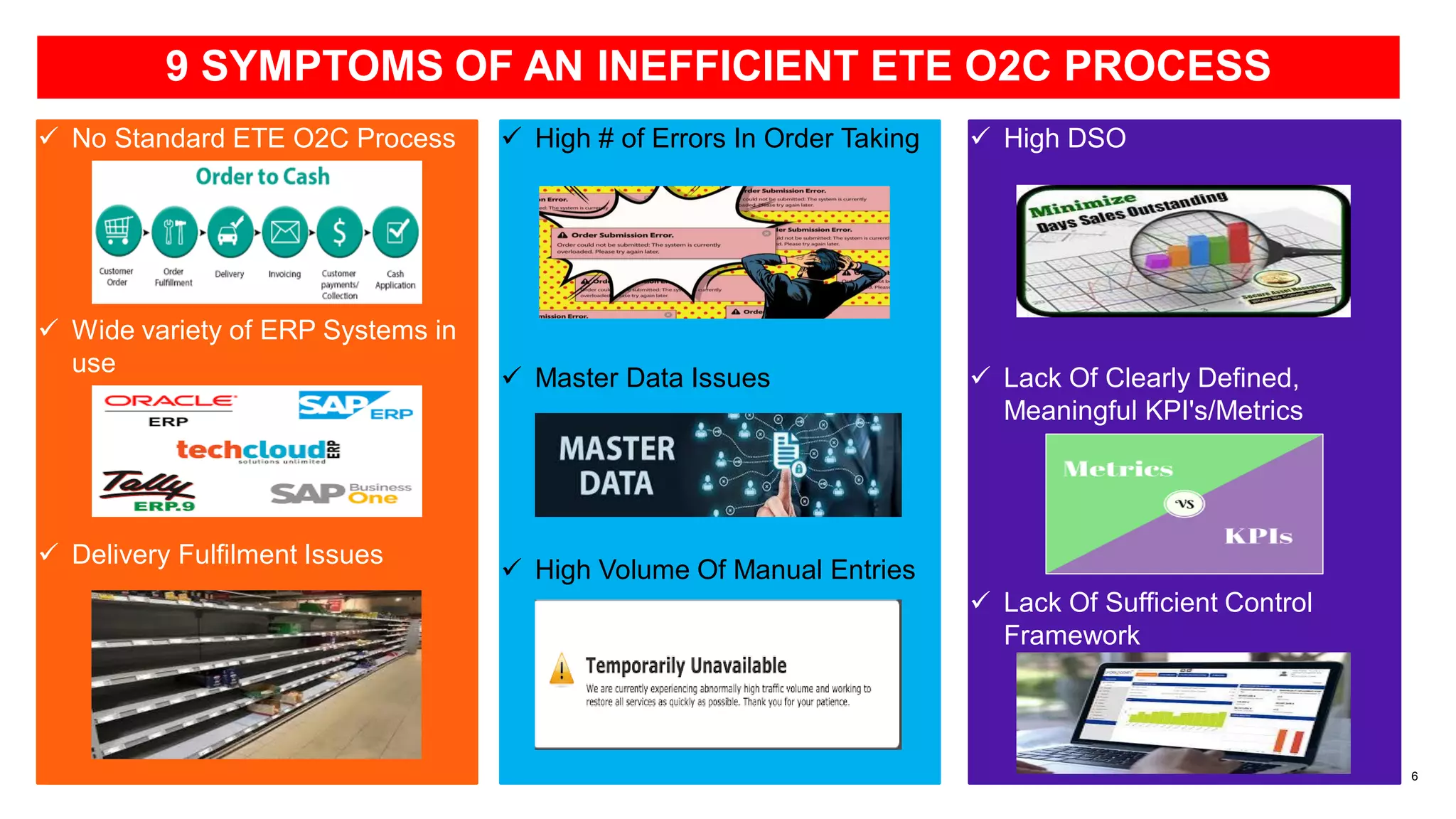

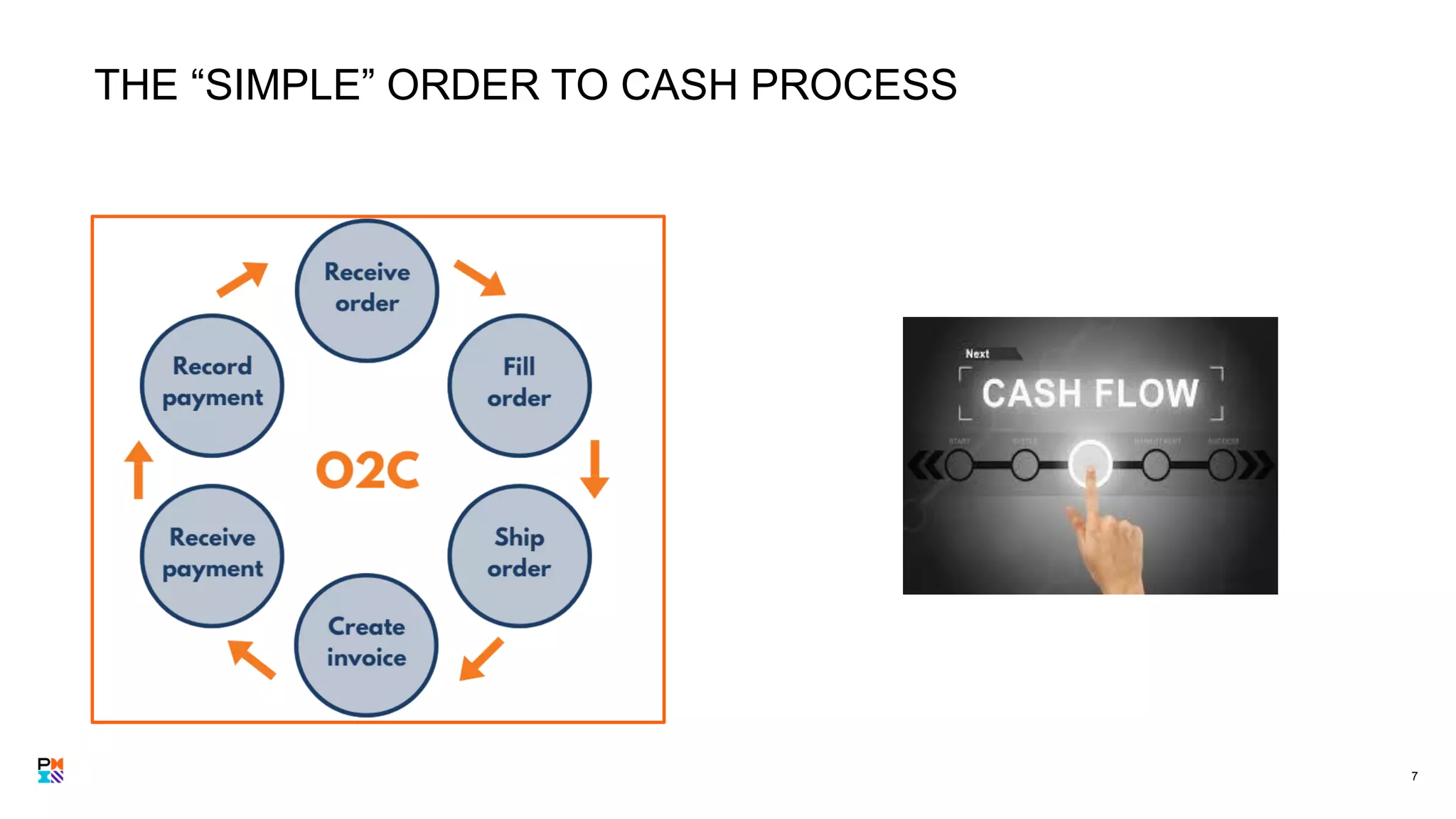

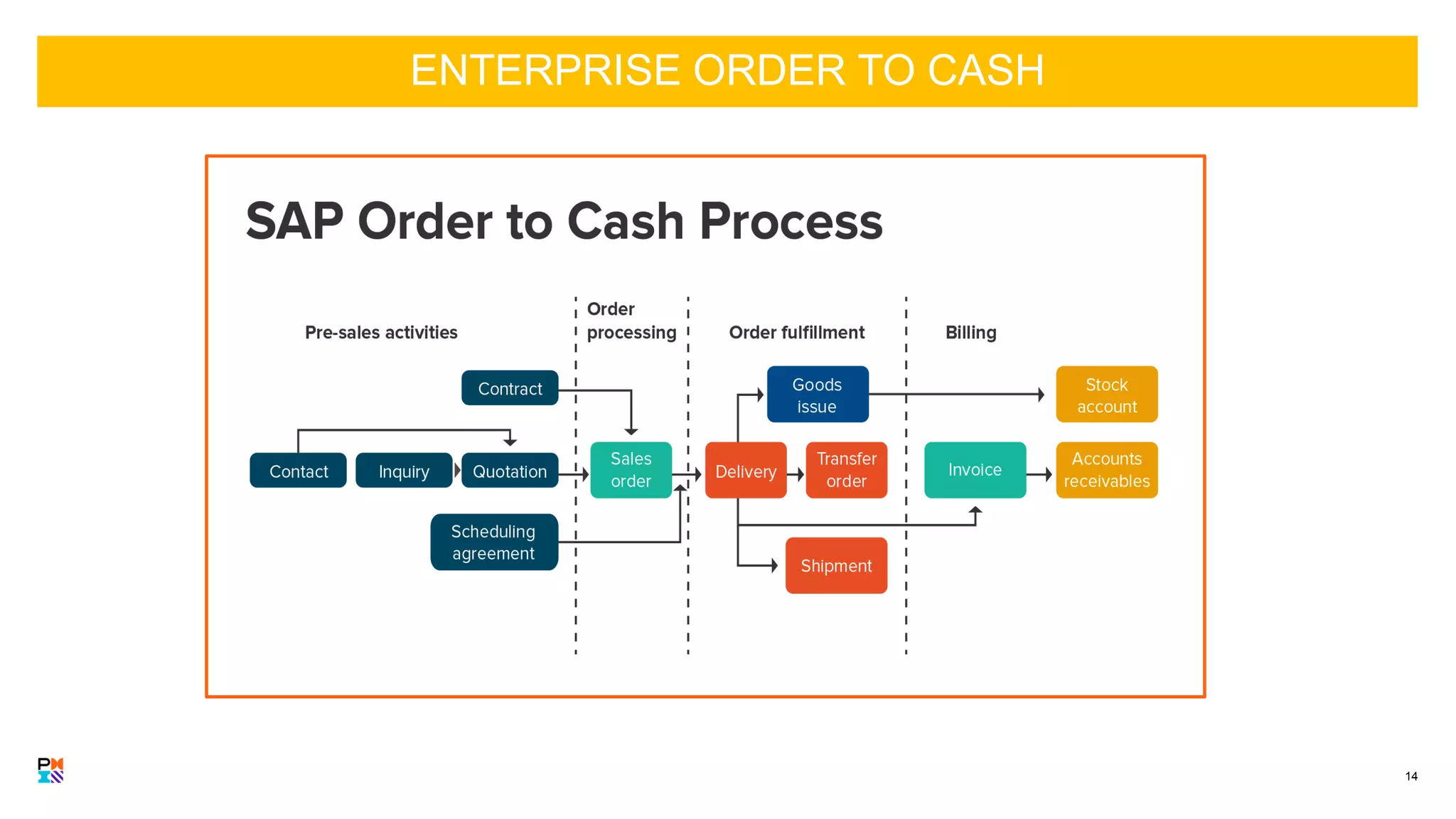

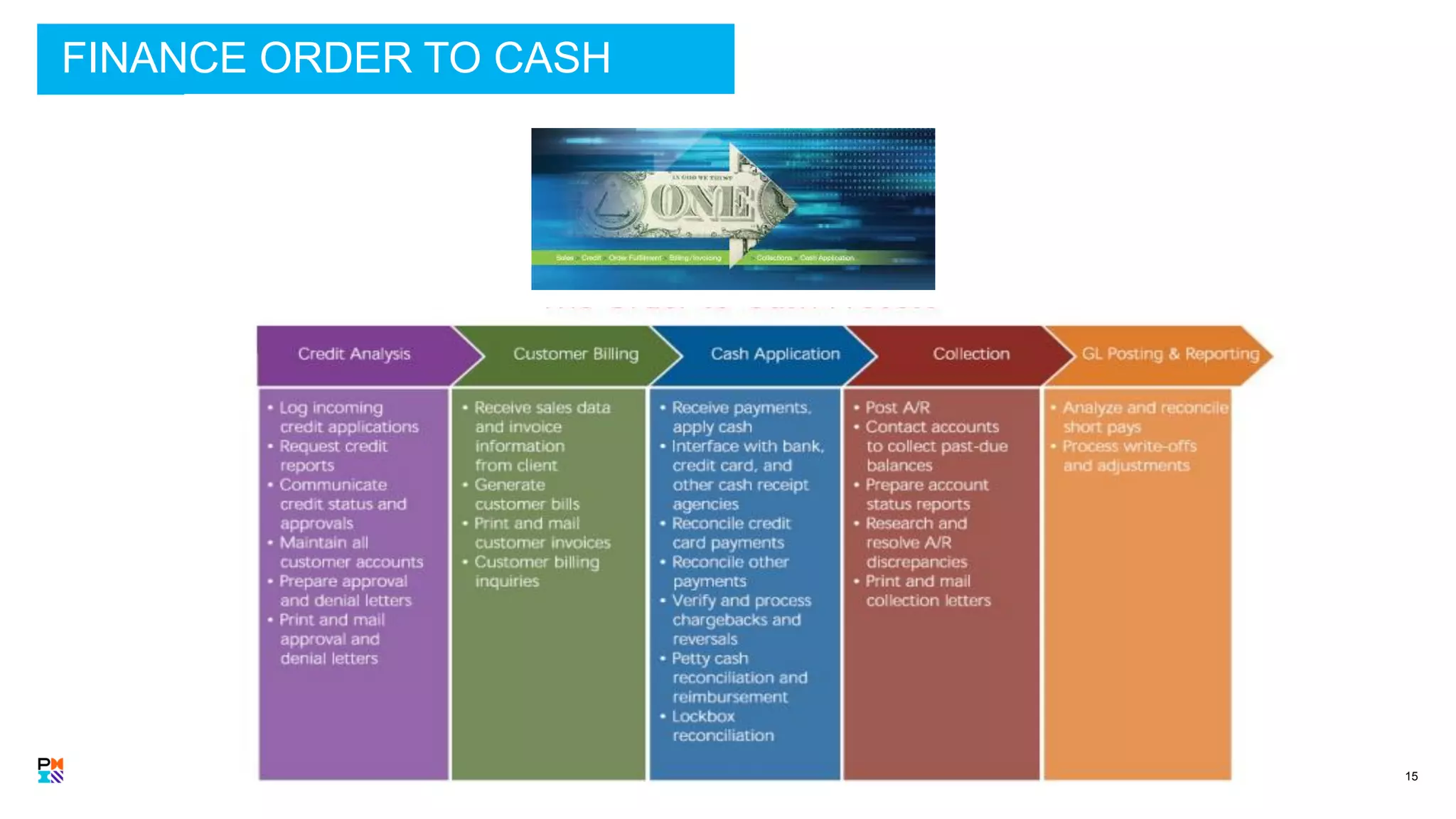

The order-to-cash (o2c) process is crucial for a company's success, defining customer relationships and impacting cash flow. Inefficiencies in this cycle can lead to elevated costs and loss of customer trust, necessitating improvements such as reduced non-value adding steps and automation. Key benefits of optimizing the o2c process include reduced days sales outstanding, lower fulfillment cycle times, and enhanced visibility over processes.