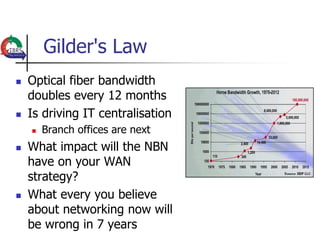

The IT landscape has changed significantly due to three major trends:

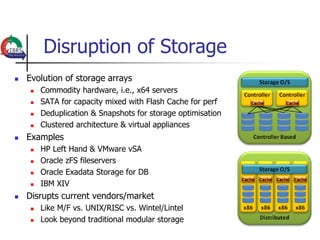

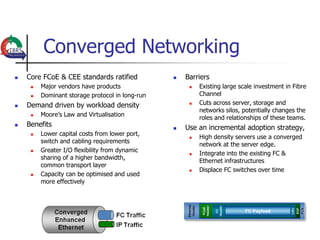

1) Moore's law has led to increased computing power and data storage capacity but managing complexity and power efficiency is now more important.

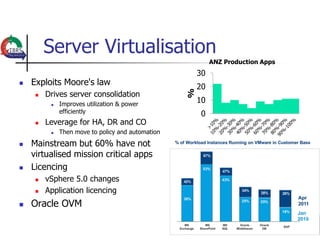

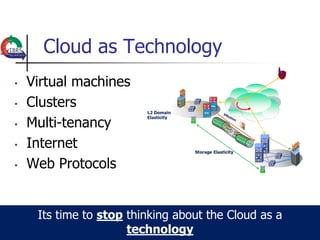

2) Server virtualization has improved utilization and flexibility but most organizations have not virtualized mission critical applications.

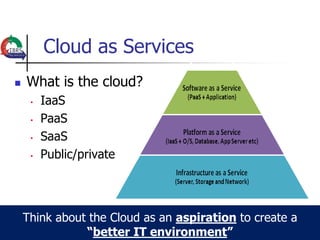

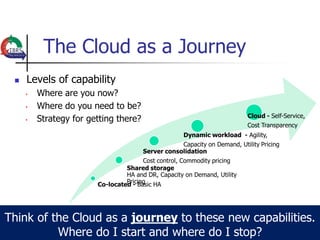

3) Cloud computing is seen not just as a technology but as capabilities around agility, efficiency, and cost that are aligned to business needs.