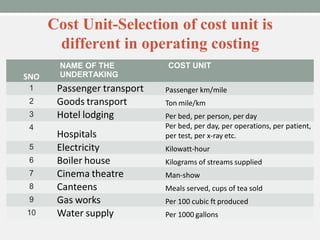

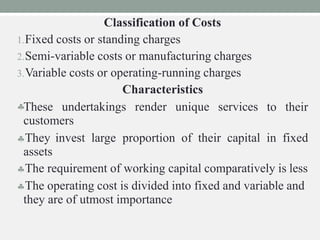

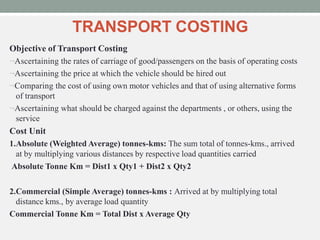

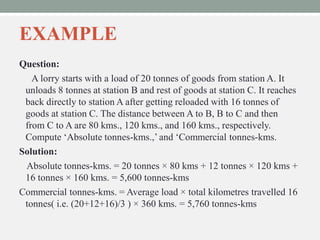

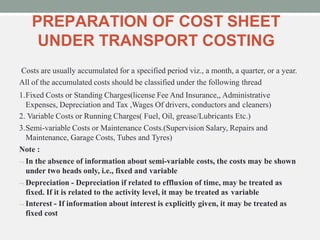

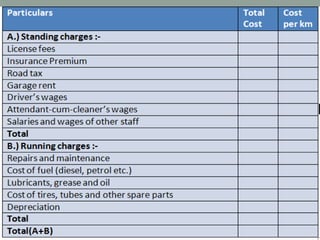

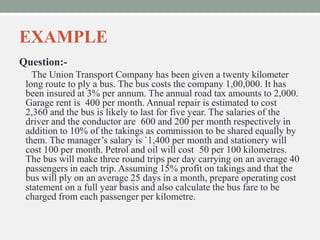

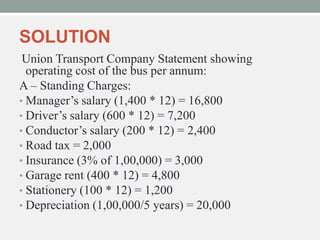

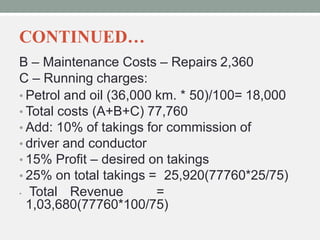

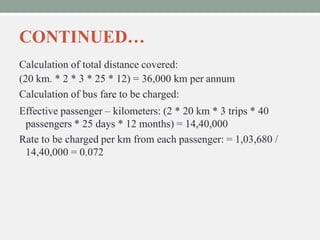

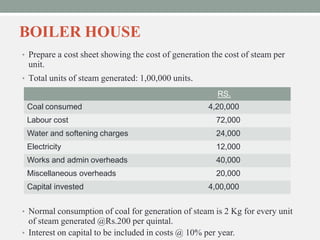

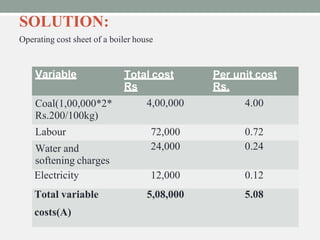

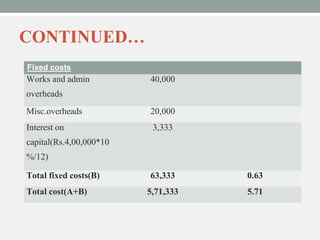

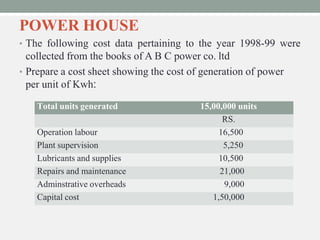

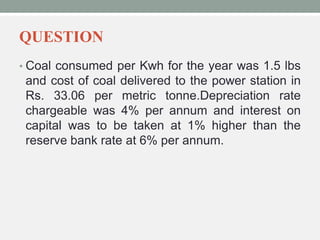

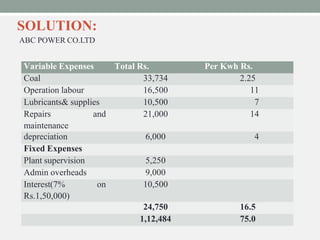

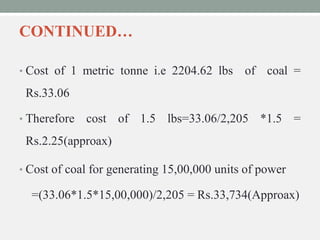

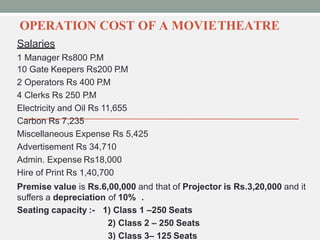

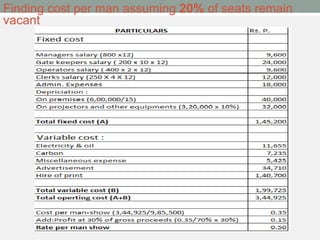

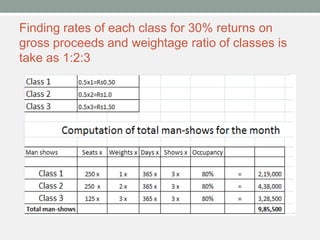

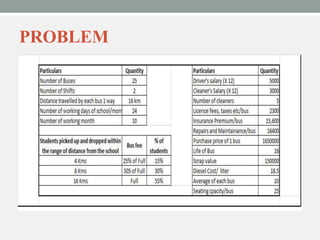

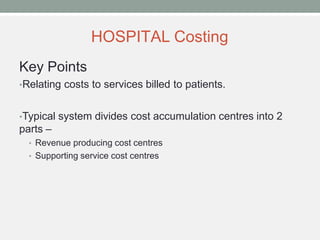

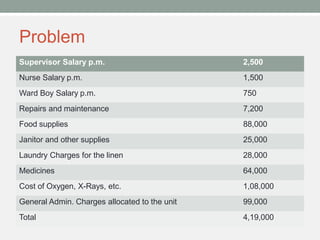

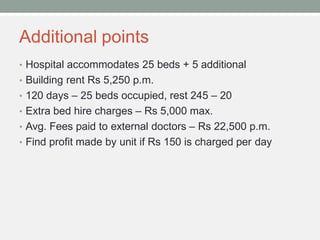

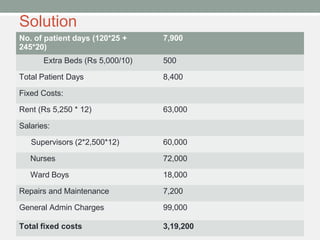

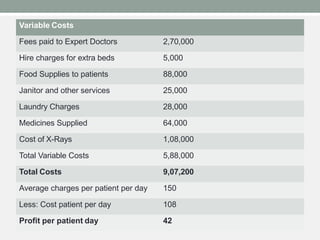

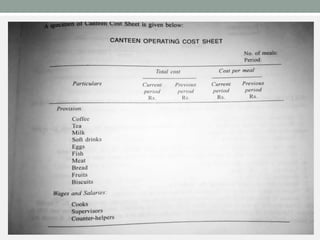

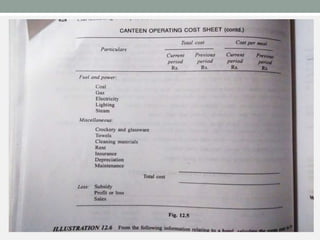

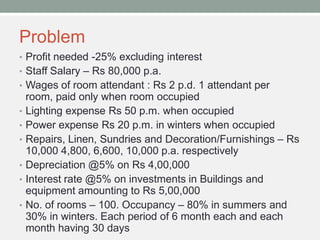

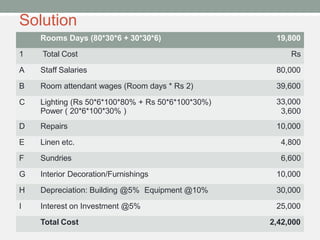

Operating costing is used to calculate the costs of services that do not produce tangible products but rather provide services. It involves accumulating costs and allocating them to appropriate cost units like passenger-km, room-night, or test performed. The document provides examples of industries that use operating costing like transportation, hotels, hospitals, and utilities. It also explains key concepts like classification of costs into fixed, variable, and semi-variable categories and selection of appropriate cost units. Transport costing and examples of cost sheets for different service industries like power plants and cinemas are discussed in detail.