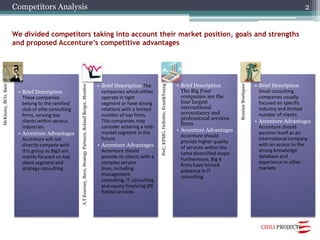

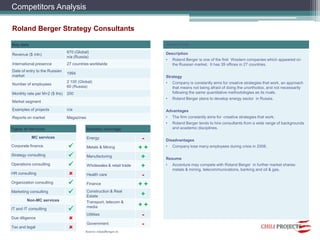

The Russian management consulting market is estimated at $250 million annually. It has seven major players serving top clients accounting for 75% of the market, while only one player focuses on the mid-market accounting for the remaining 25%. Accenture would benefit from entering the mid-market due to its high growth potential and management consulting opportunities. The best way for Accenture to enter is under its own brand to leverage its international reputation while avoiding disadvantages of other options like greenfield entry, joint ventures, or acquisitions. Accenture's long term goal is to achieve $100 million in revenue and a top three market share in Russia by 2020.