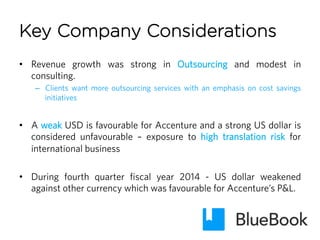

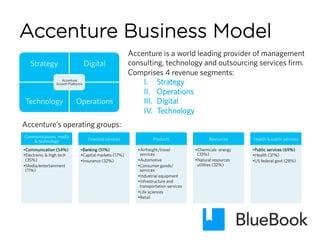

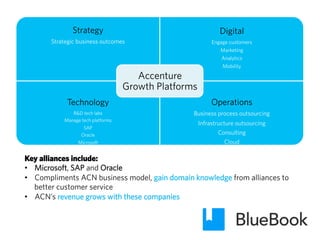

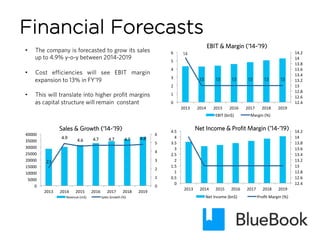

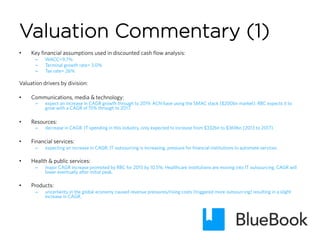

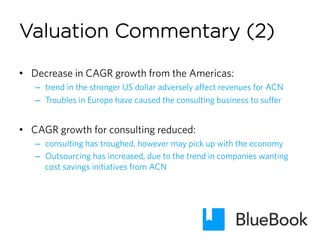

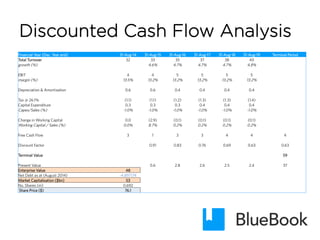

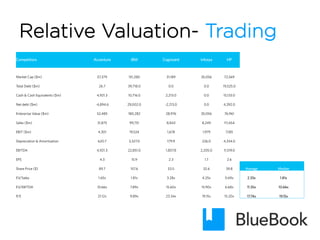

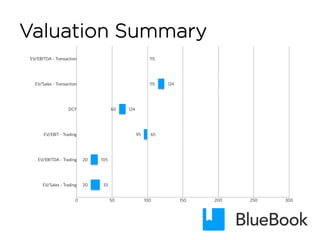

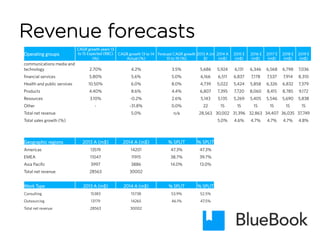

Accenture is a global consulting and outsourcing firm with operations in the Americas, EMEA, and APAC regions. It has experienced positive revenue growth in recent years due to increased demand for outsourcing services, investments in new technologies like cloud and analytics, and acquisitions that expand its domain expertise. Accenture has also shown profitability even under difficult economic conditions. Based on financial forecasts and valuation analyses comparing Accenture to competitors, the author concludes that Accenture's $60 billion market valuation is supported by its experience across industries and geographies, and that its shares are fairly valued based on assumed growth rates and discount rates.