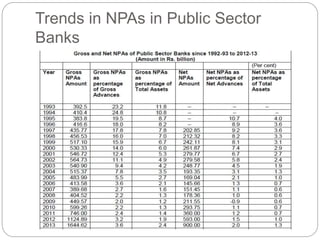

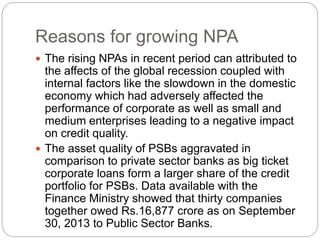

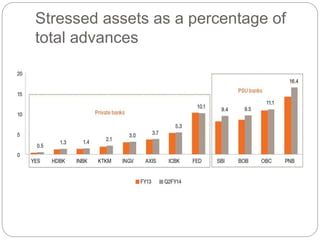

This document discusses non-performing assets (NPAs) in banks, particularly public sector banks in India. It notes that NPAs occur when borrowers default on loan repayments of principal or interest, representing credit risk for banks. Growing NPAs negatively impact banks by reducing profits from interest income, increasing provisioning costs, and eroding capital resources. The rise in Indian public sector bank NPAs in recent years was attributed to the global recession and domestic economic slowdown impacting corporate and SME borrowers. Data showed thirty large companies owed over $2 billion to public banks, and gross NPAs as a percentage of advances have been trending upward, representing stressed assets that banks must address going forward.