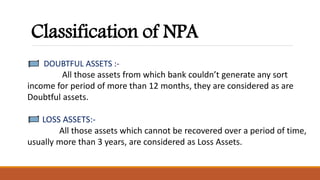

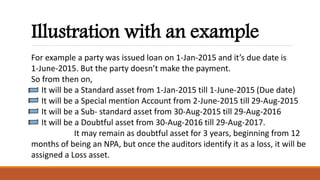

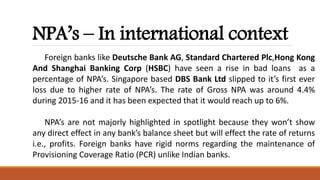

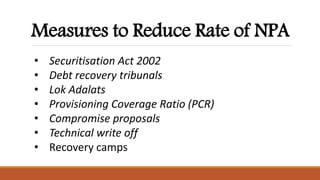

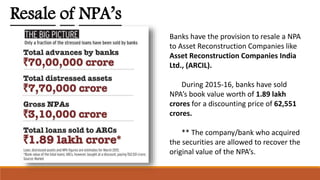

Non-performing assets (NPAs) are loans that are in default or close to being in default. In India, NPAs are classified as standard, sub-standard, doubtful, or loss assets depending on the period of default. The NPA rate in Indian banks peaked in 2015 at over 5% due to bad loans in sectors like infrastructure and steel. Measures to reduce NPAs include debt recovery tribunals, loan restructuring, and selling NPAs to asset reconstruction companies at a discount. High NPAs have significantly impacted Indian bank profits in recent years.