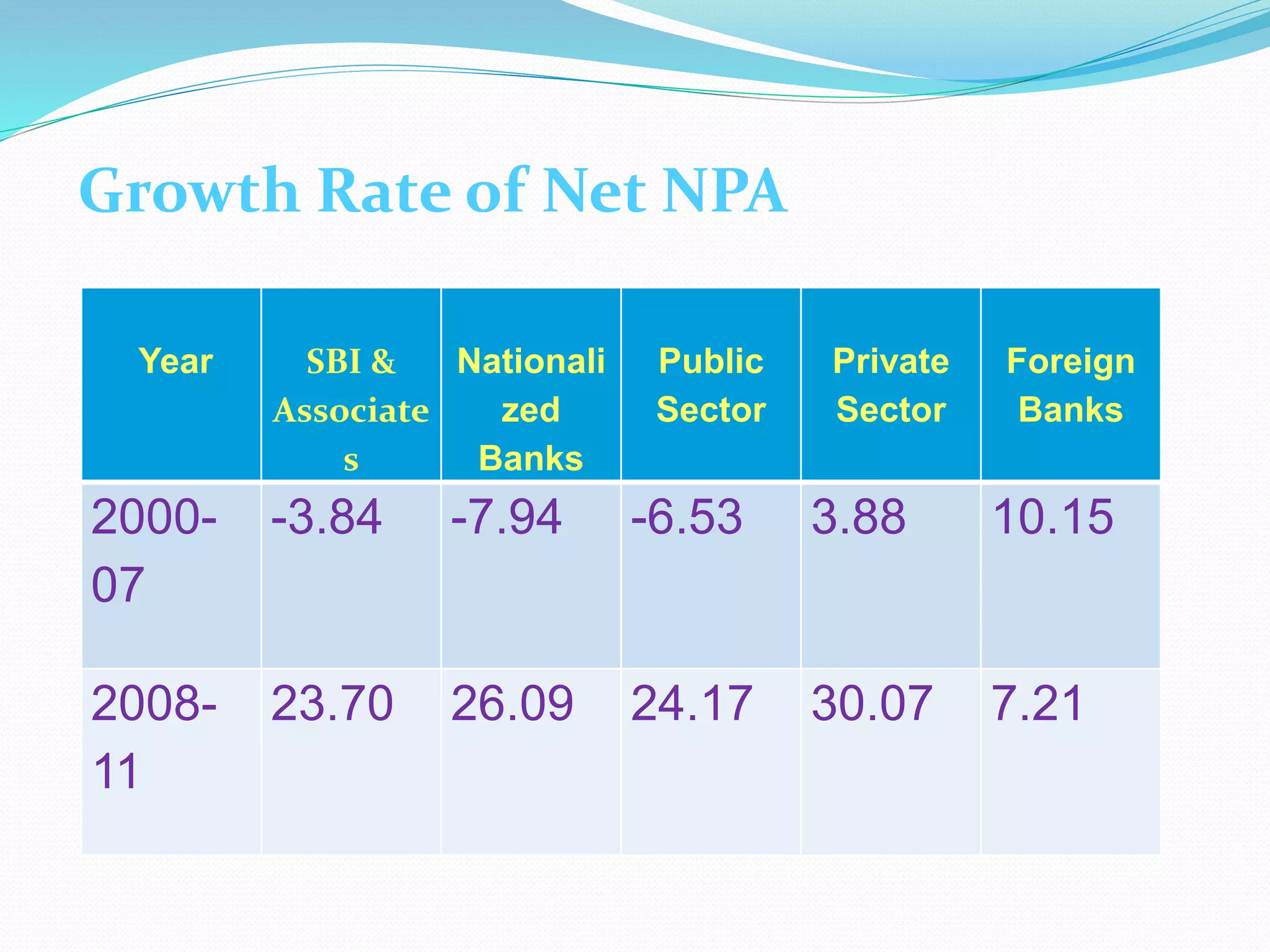

This document discusses non-performing assets (NPAs) in the Indian banking sector. It defines NPAs as loans that are overdue for over 90 days. Growing NPAs negatively impact banks' profitability, asset quality, and ability to lend. The document analyzes NPA growth rates between 2000-2011 and the effects of high NPAs, which include reduced returns, higher costs of capital, and banks focusing more on recovery than expanding business. It also discusses strategies for managing NPAs, like quick identification, containment, and timely monitoring and assessment of borrowers.