1. Analyze analog businesses like other lemonade stands to understand revenue, costs, and profitability.

2. Identify Johnny's goals and hypotheses to test, such as whether people will buy lemonade.

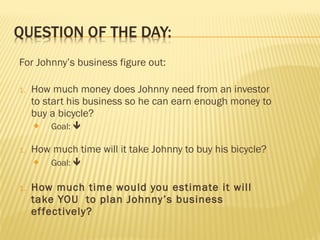

3. Create a minimum viable business plan with estimates for startup costs, revenue, expenses and profit to buy a bicycle in a target time period.