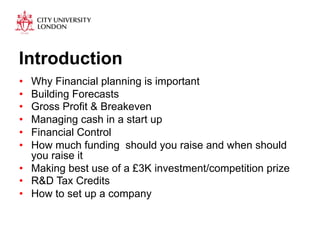

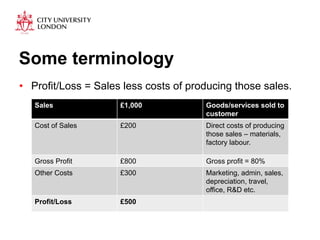

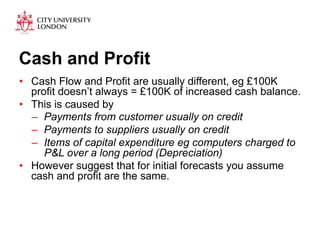

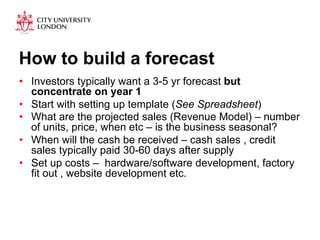

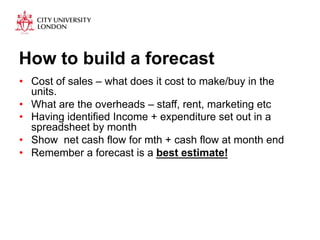

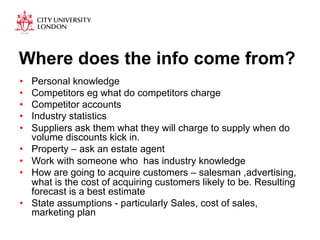

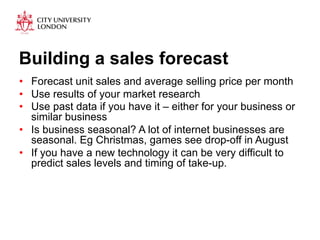

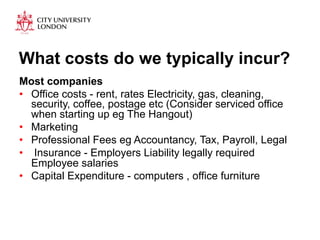

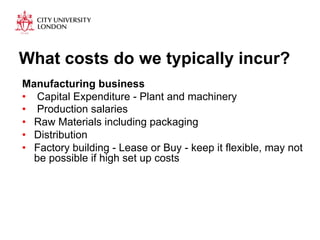

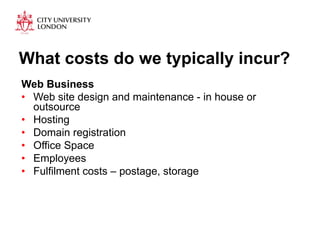

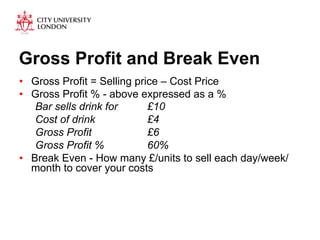

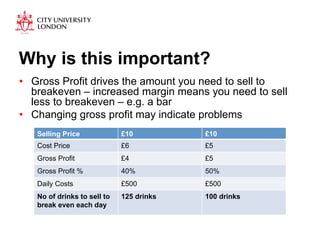

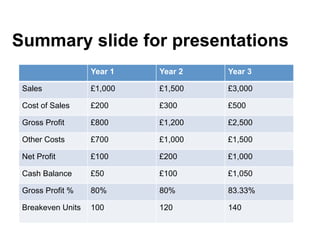

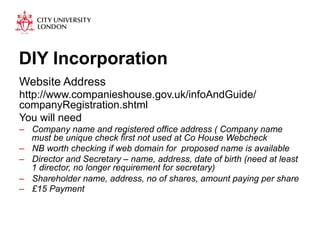

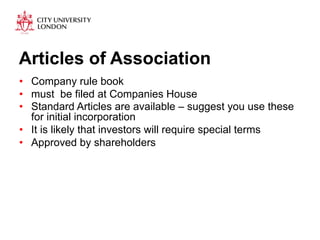

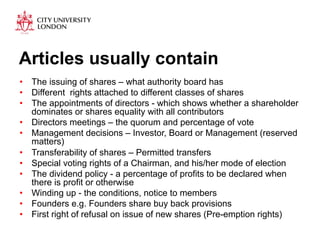

This document summarizes a seminar on financial planning and management for startups. It discusses building financial forecasts, including developing sales forecasts and estimating costs. It explains key financial concepts like gross profit, break-even analysis, and cash flow. It emphasizes the importance of financial planning to ensure business viability and support fundraising. The document provides guidance on managing cash flow in startups, financial controls, making use of small investments, R&D tax credits, and setting up a limited company.