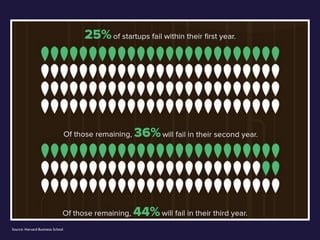

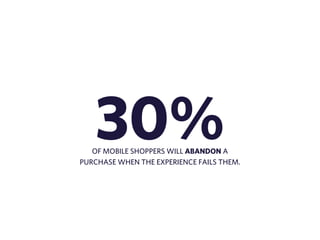

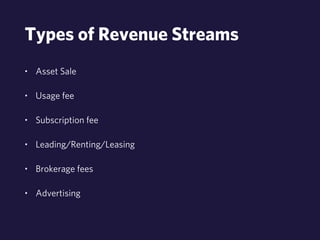

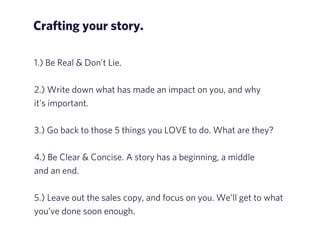

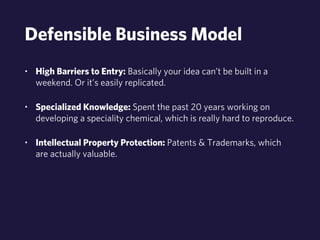

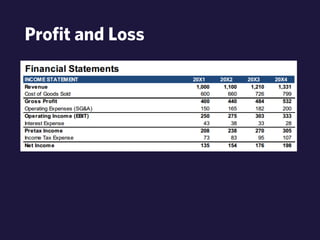

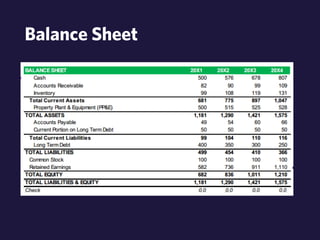

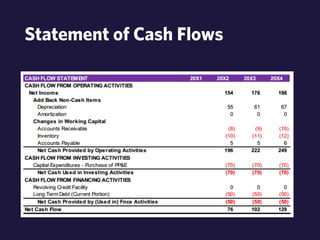

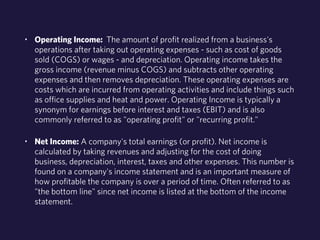

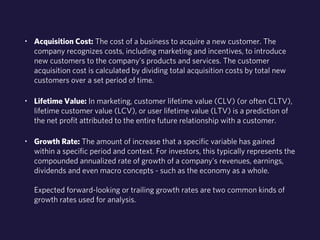

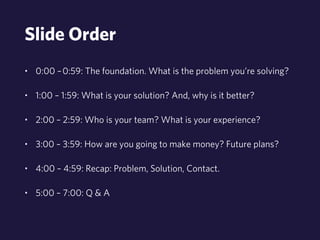

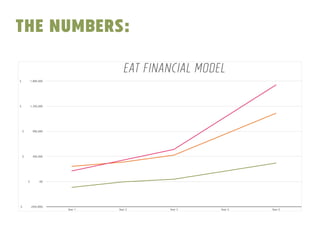

The document outlines insights and strategies for crafting a successful business model, focusing on branding, financial models, and the importance of storytelling in marketing. It features contributions from industry experts, including their personal experiences and statistics on business trends such as e-commerce growth. Additionally, it emphasizes the need for businesses to create shared value and adapt to market demands, particularly in the context of mobile shopping.