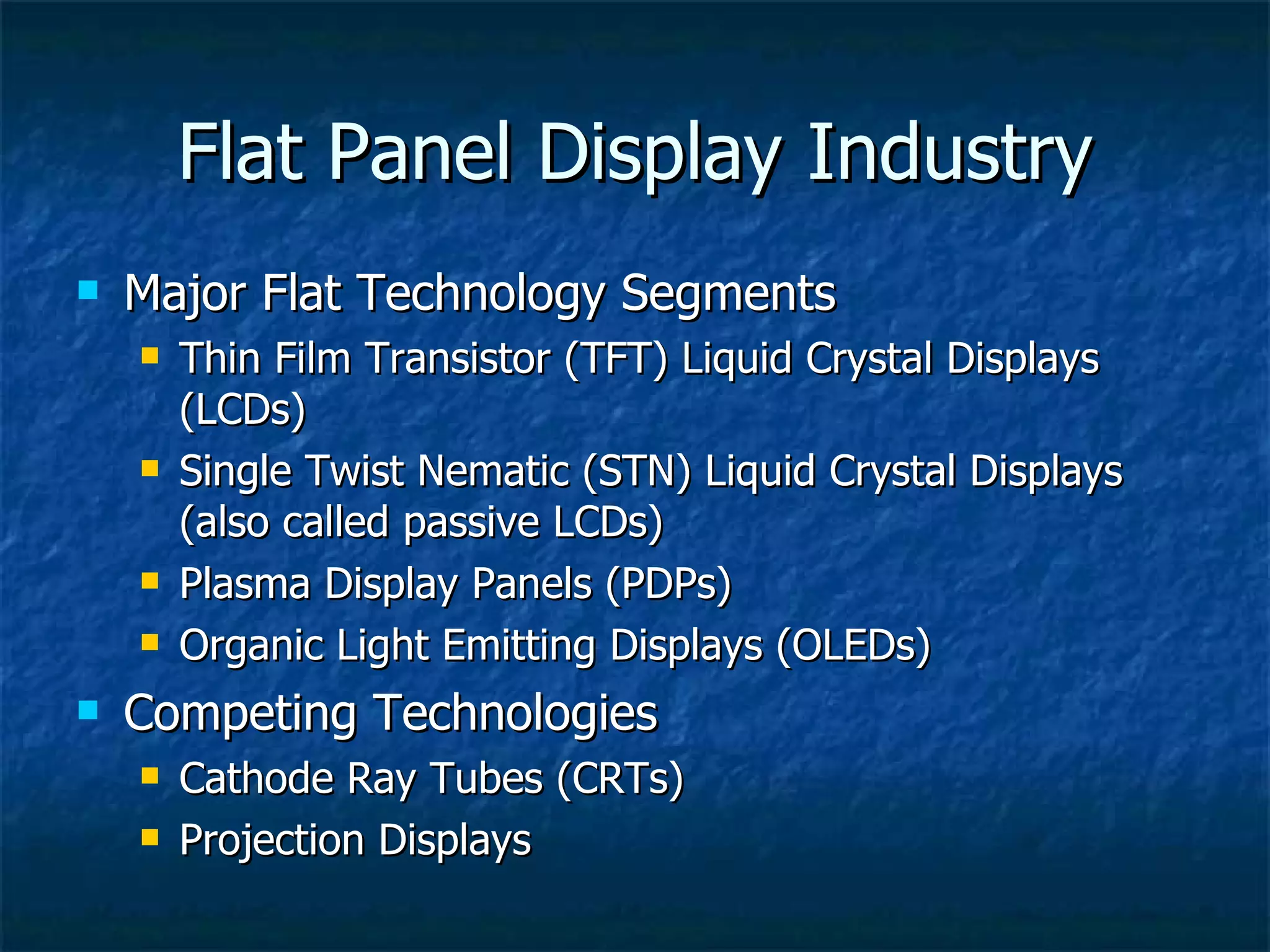

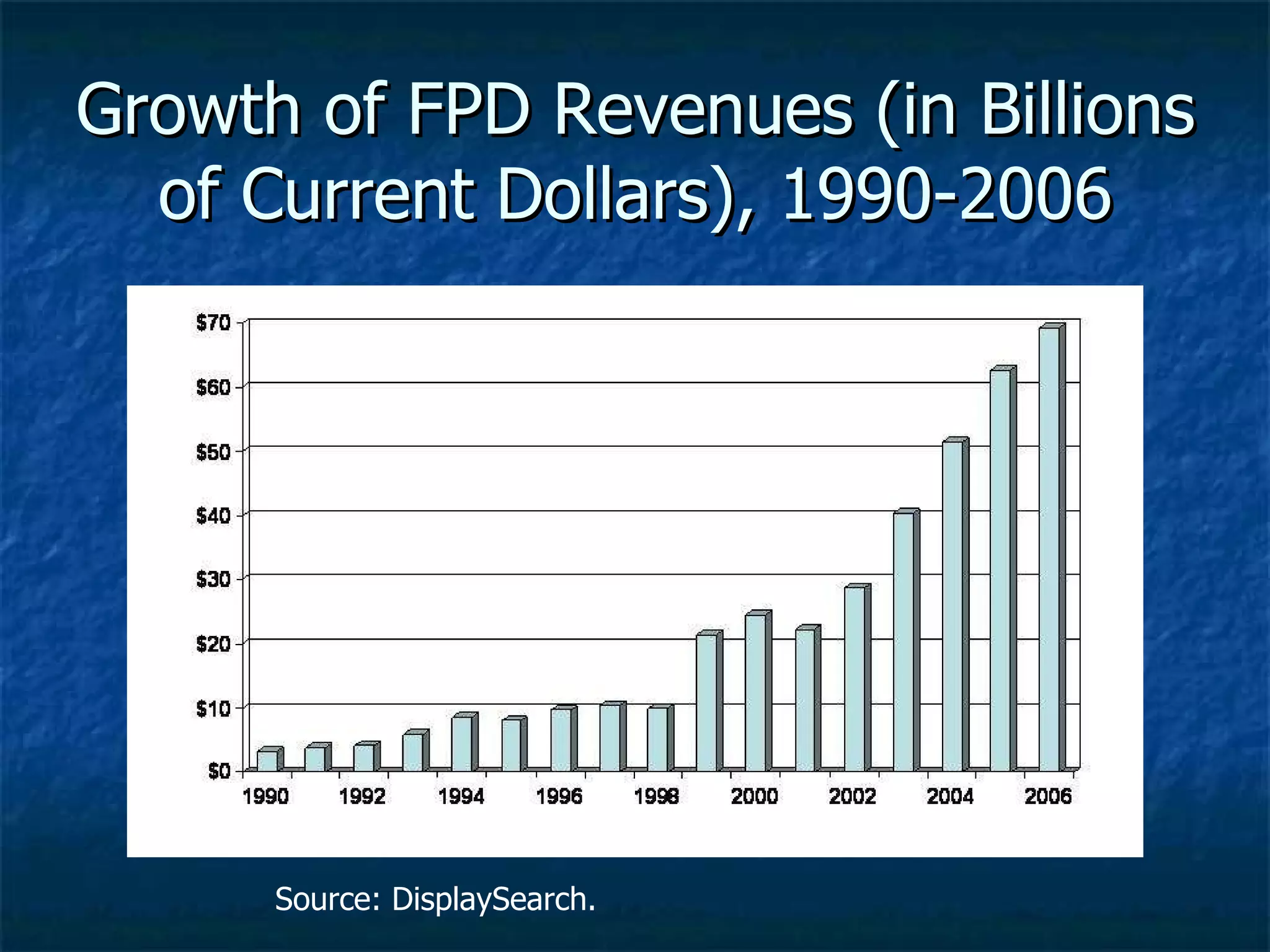

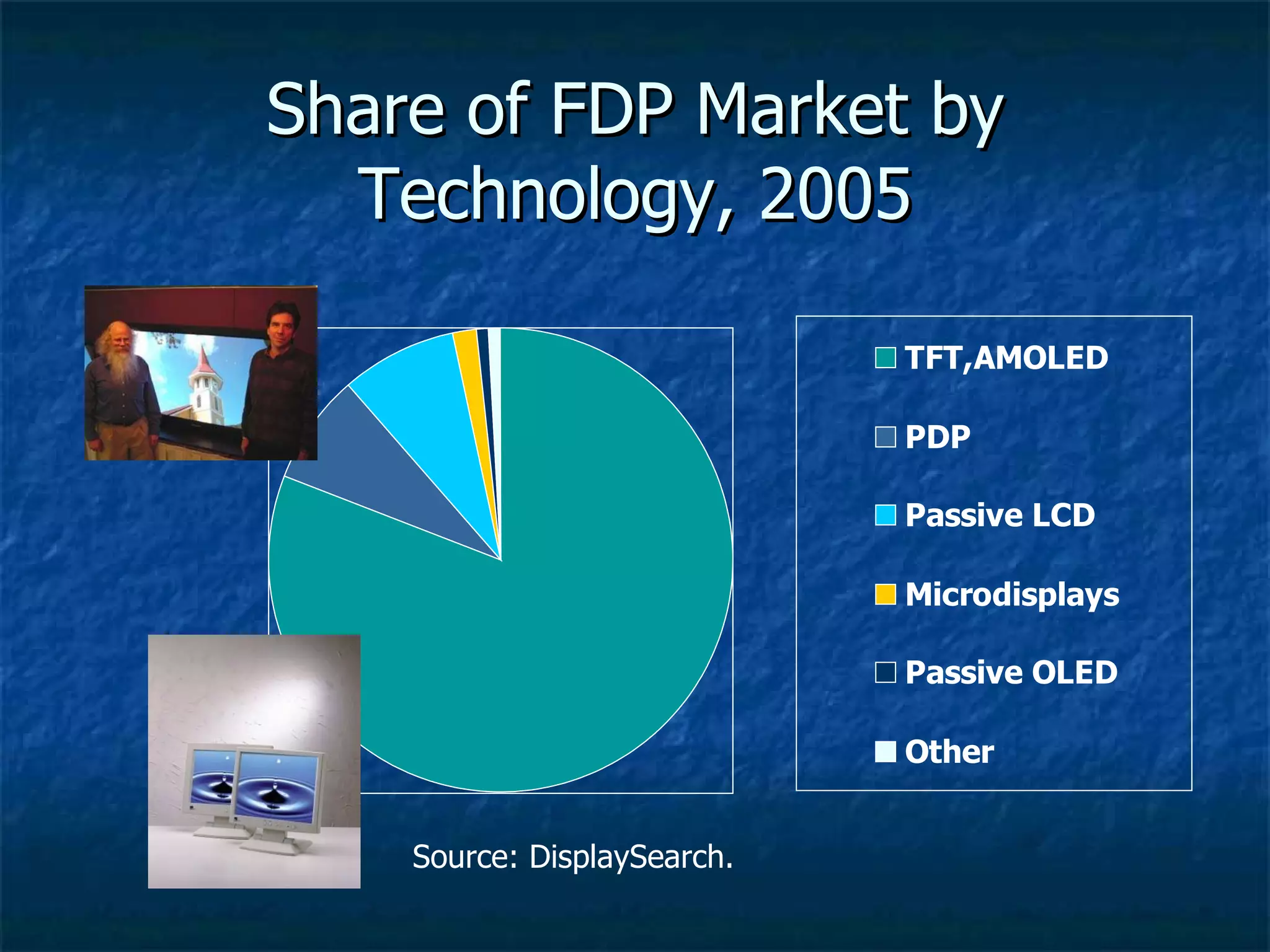

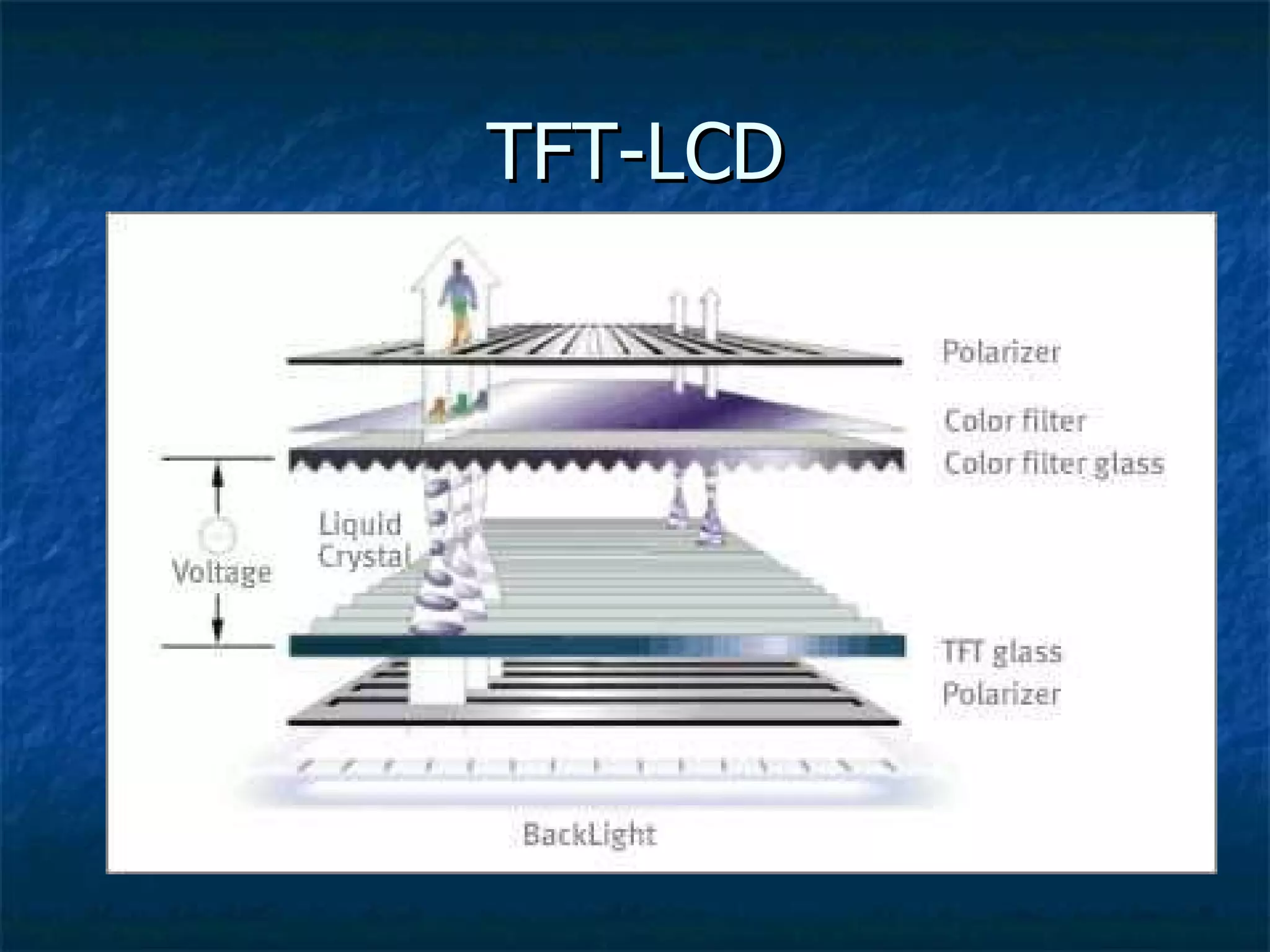

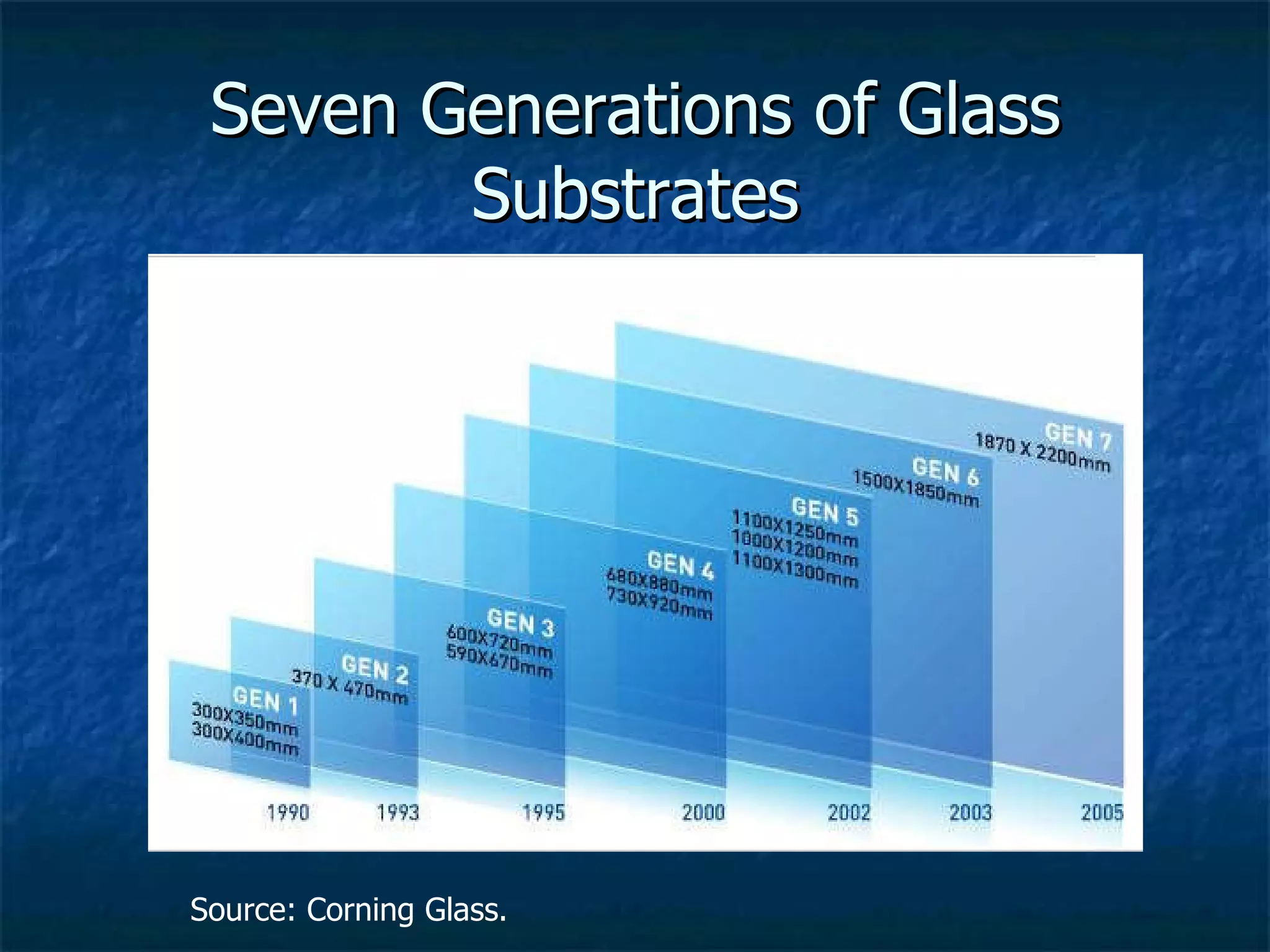

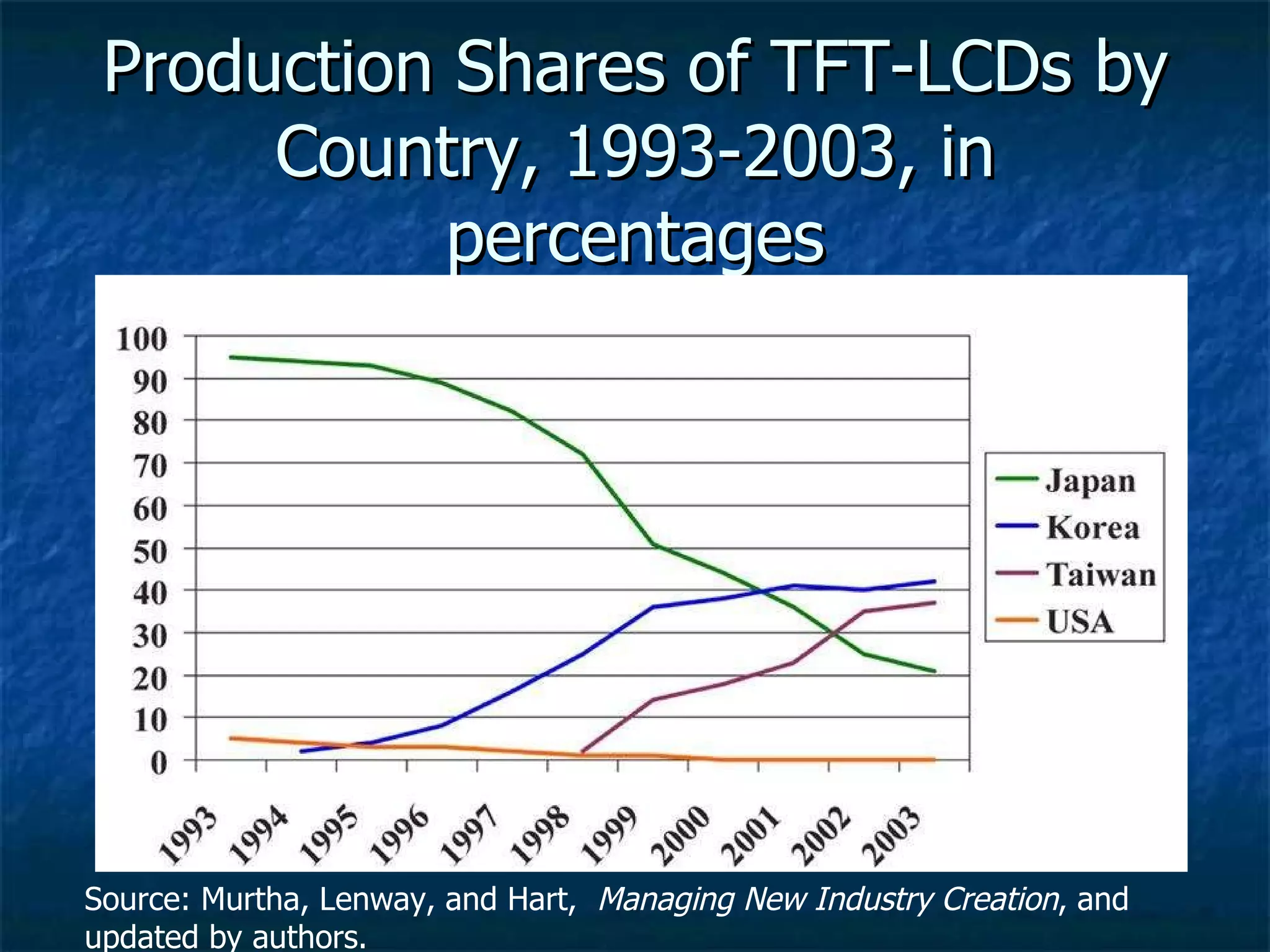

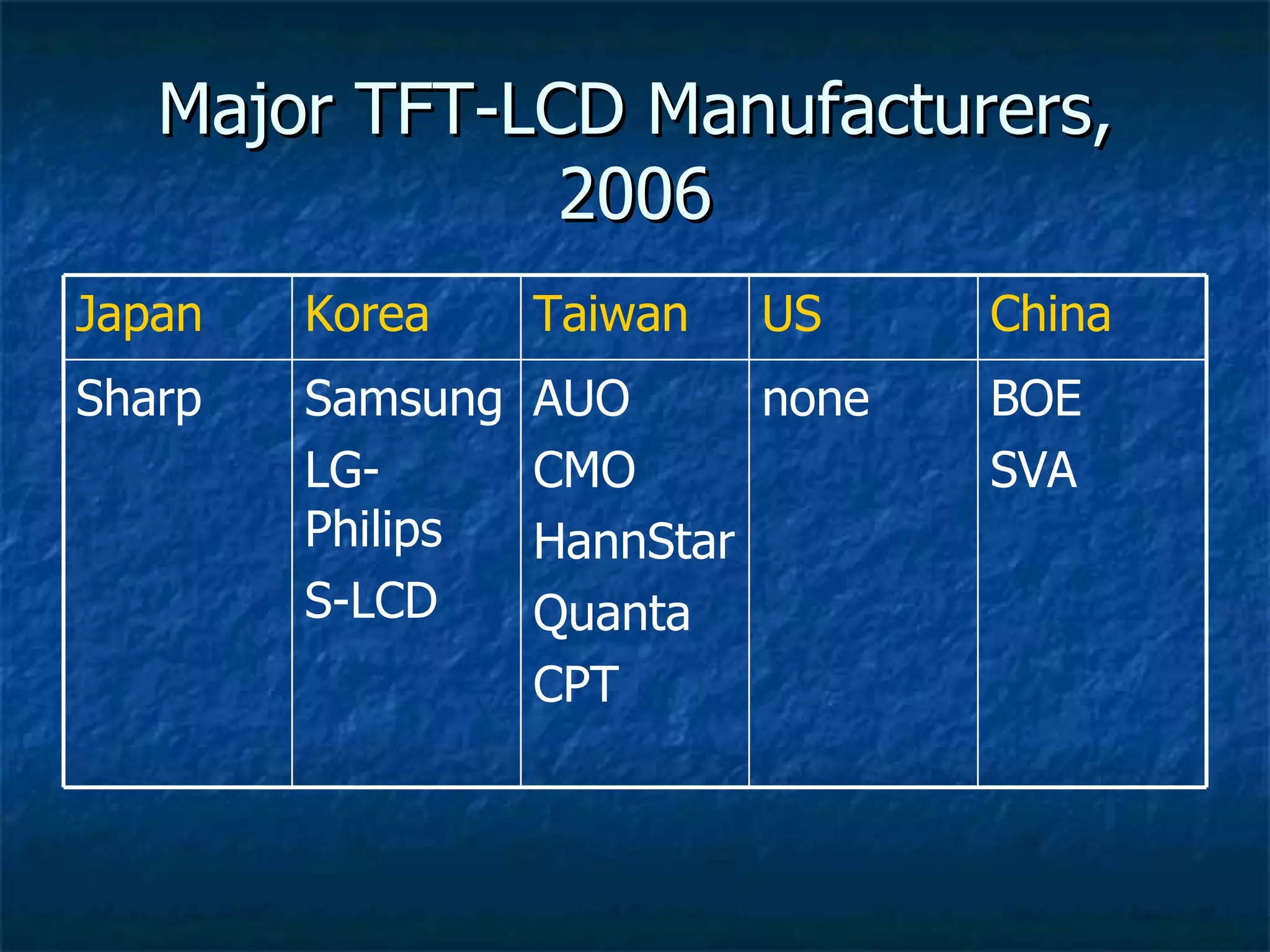

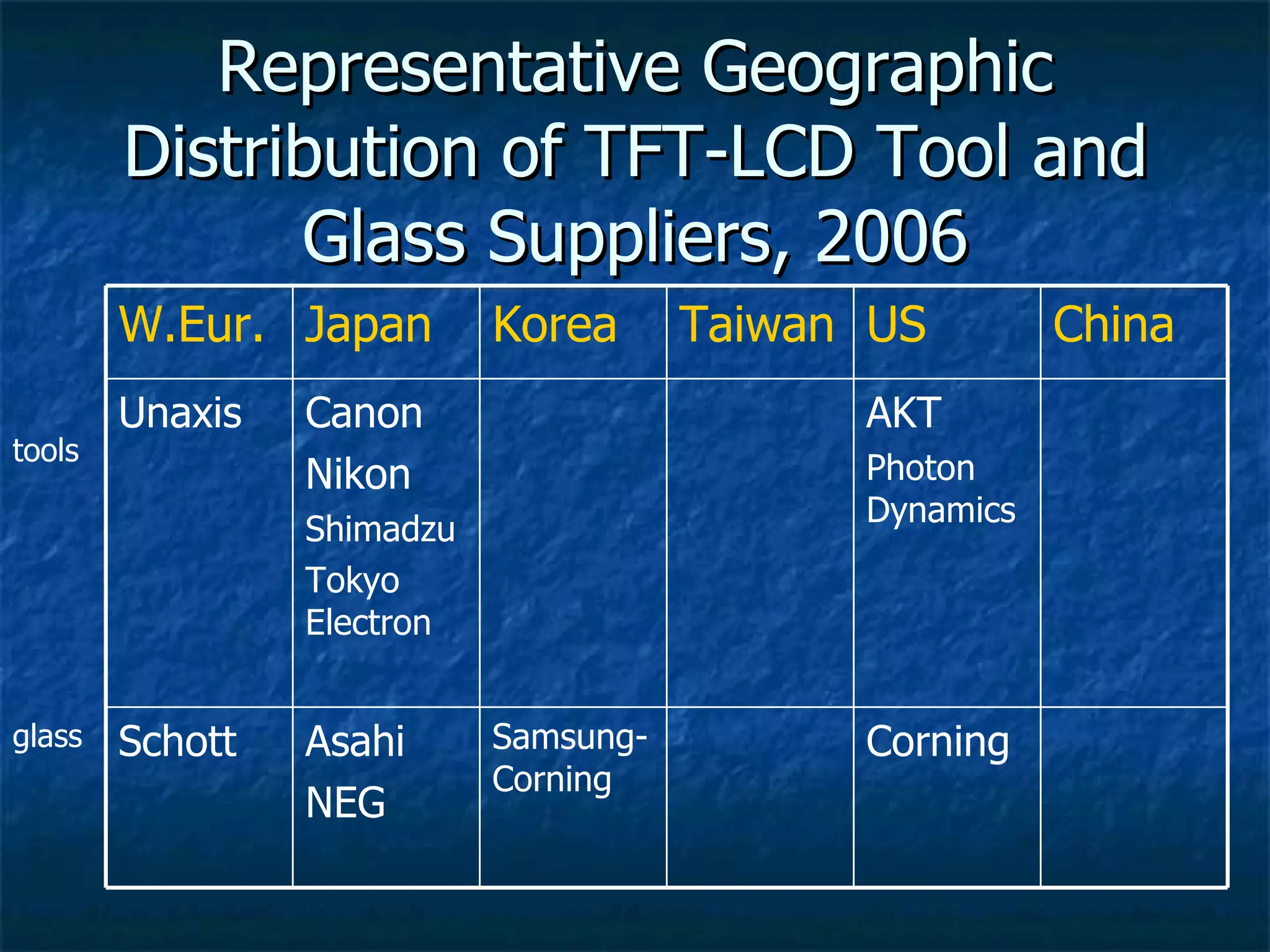

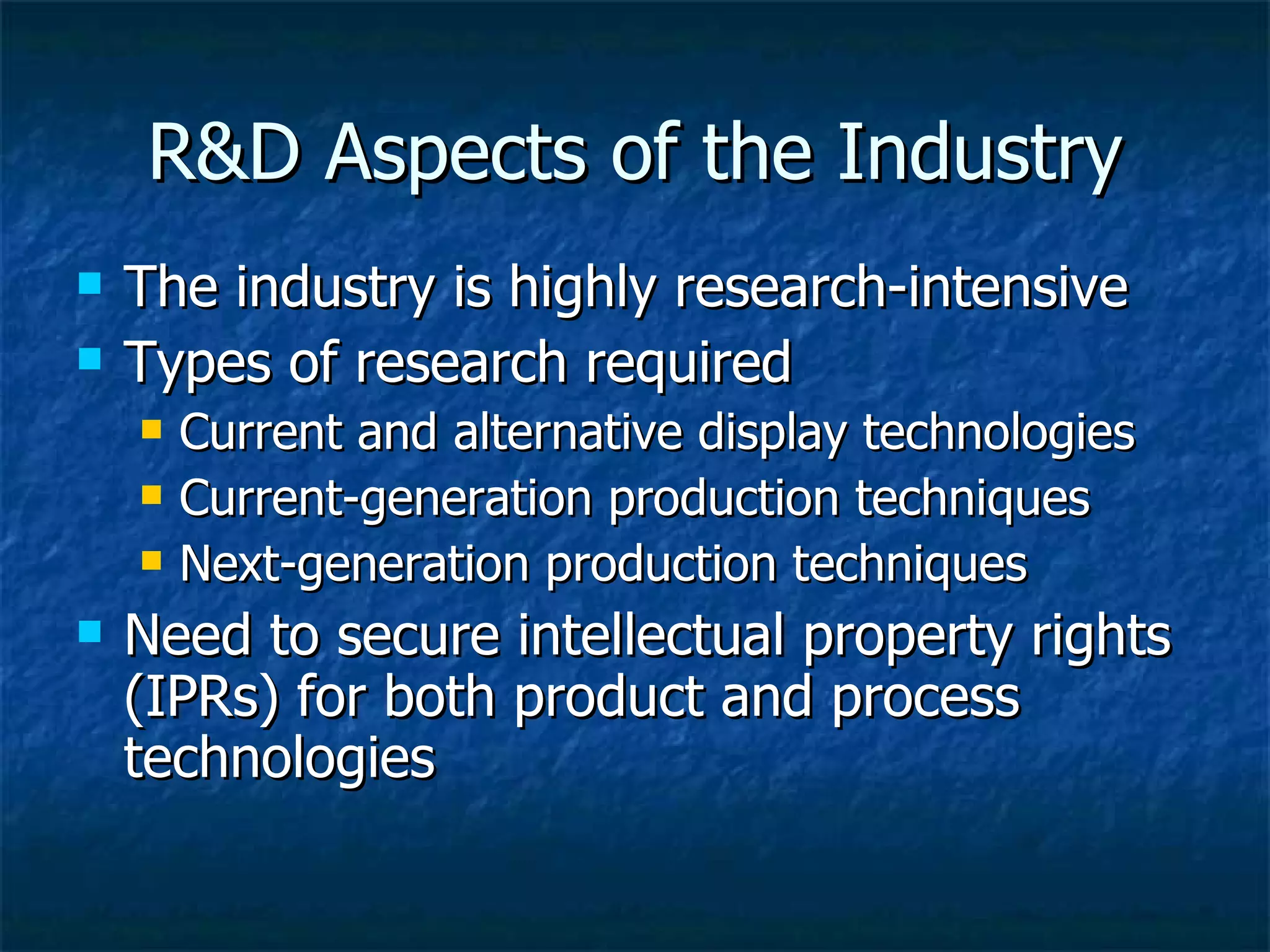

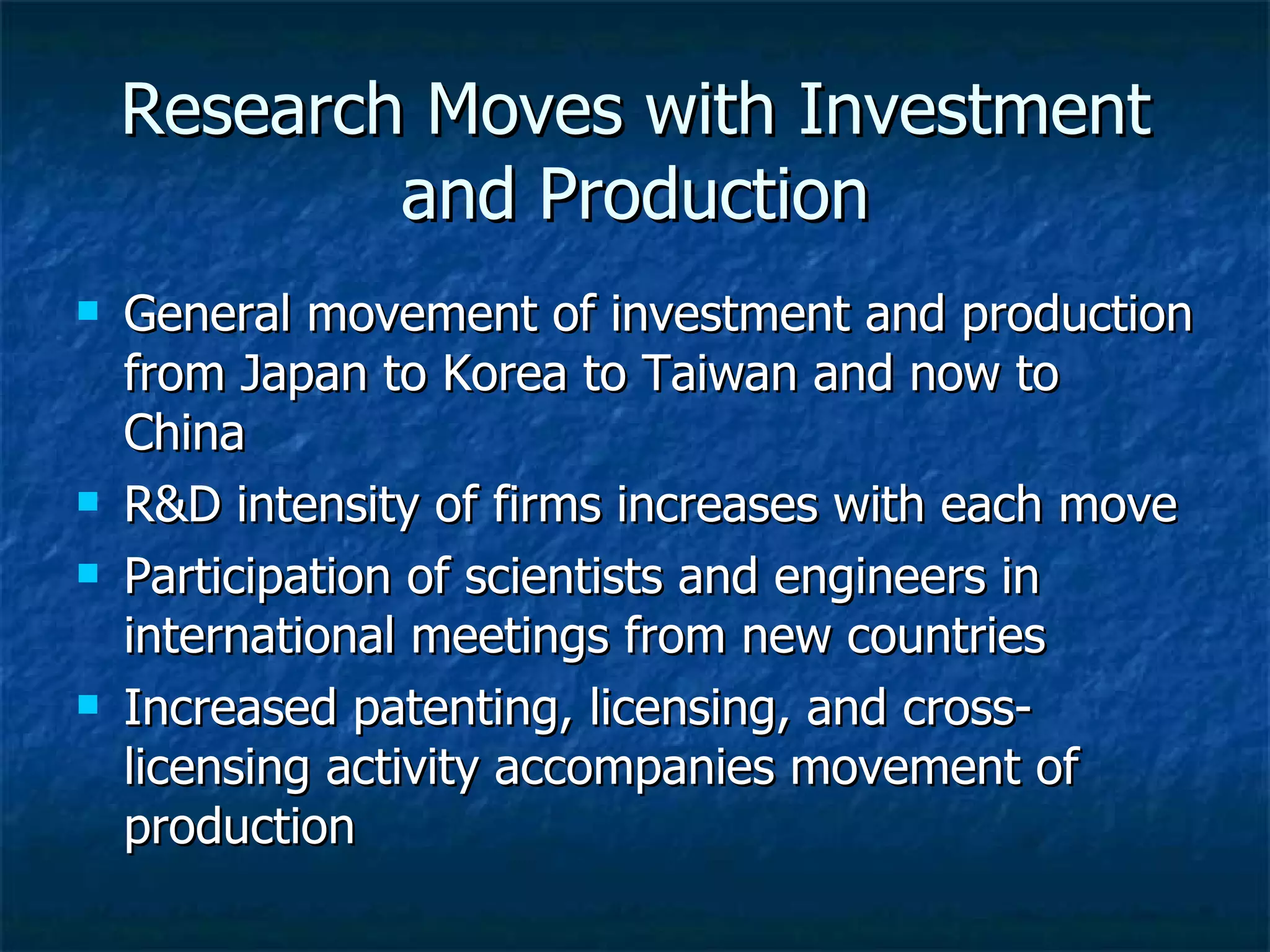

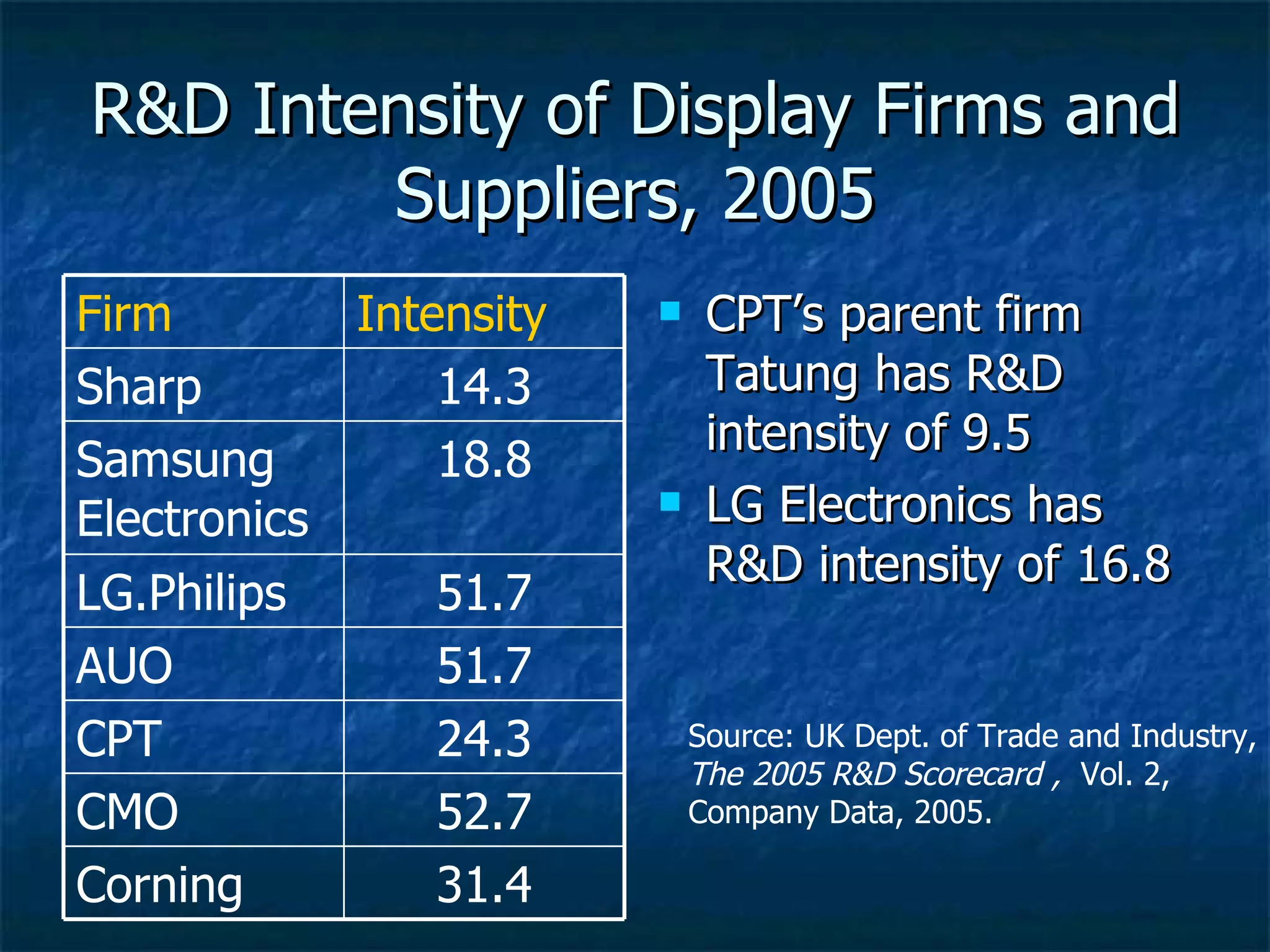

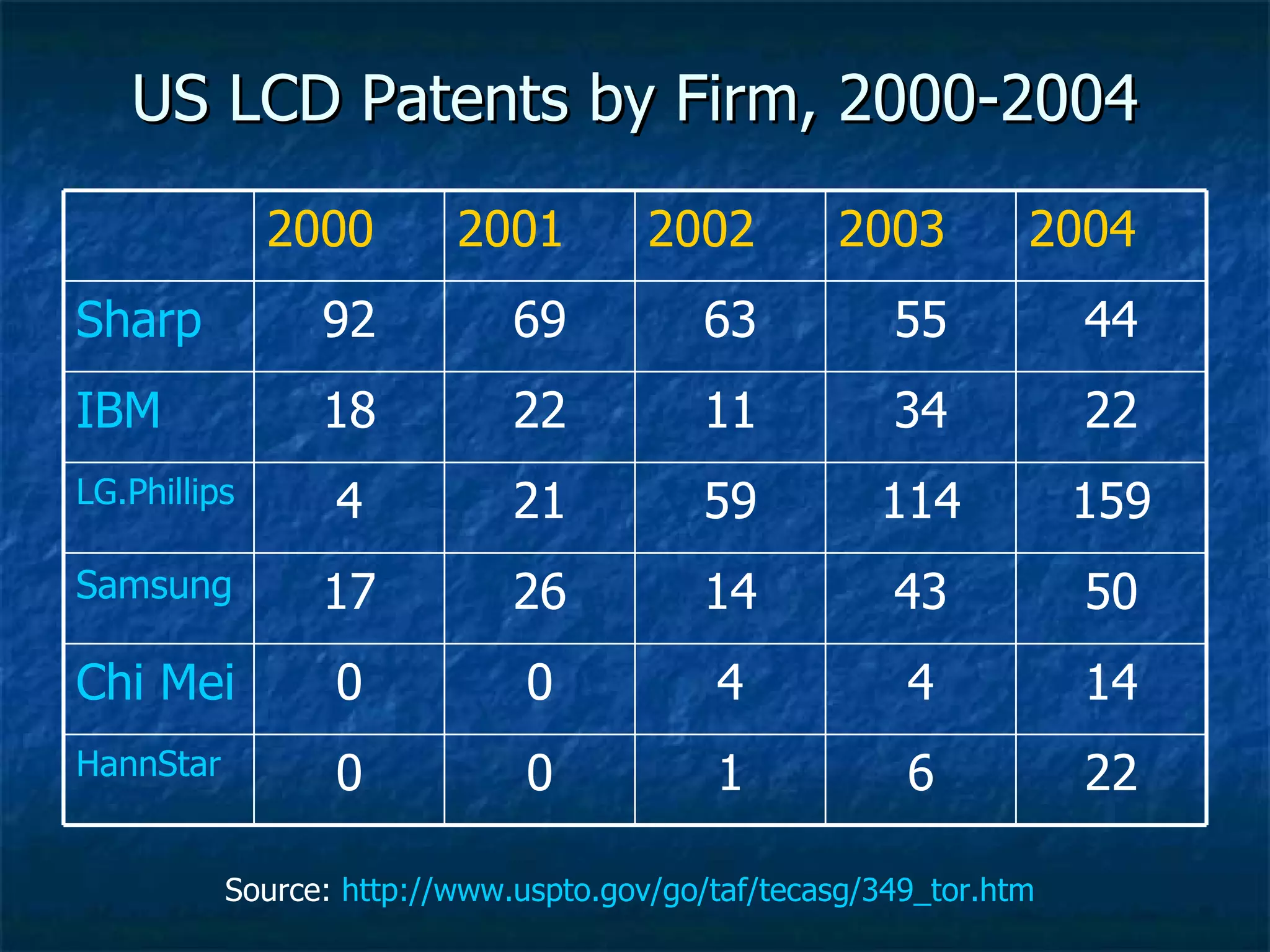

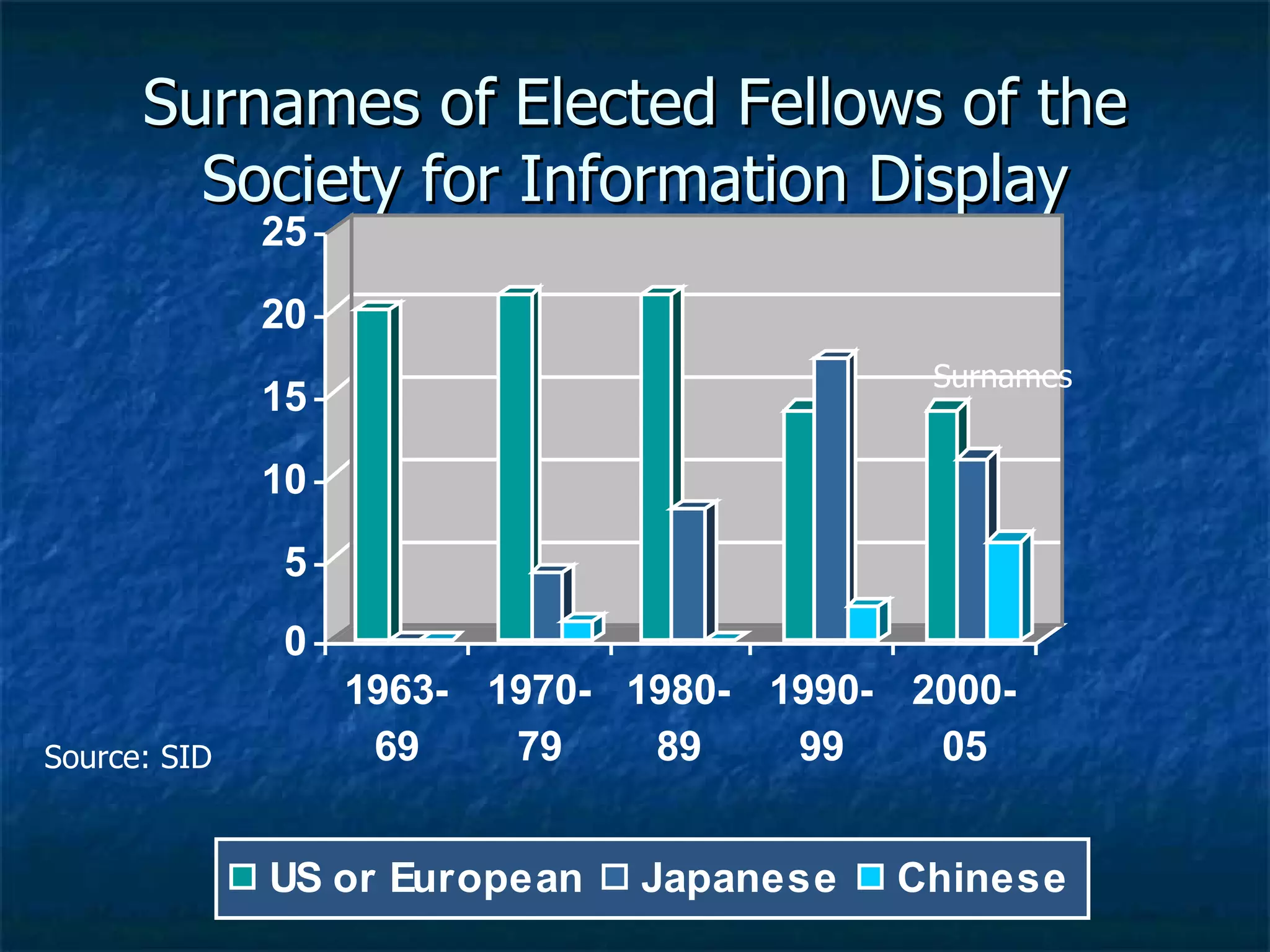

The document discusses the flat panel display industry and focuses on liquid crystal displays (LCDs) and plasma display panels (PDPs). It notes that LCD technology has grown significantly from 1990-2006, with thin-film transistor LCDs now dominating the market. The document also describes the geographic distribution of LCD manufacturers and suppliers, with companies from Taiwan, Korea, Japan, the US, and increasingly China playing major roles. It discusses how research and development has moved along with investment and production to different countries over time.

![Contact Information Jeffrey Hart, Dept. of Political Science, Indiana University, Bloomington, IN 47405 Tel: (812) 855-9002 Email: [email_address] Web: http://mypage.iu.edu/~hartj Flat panel web site: http://php.indiana.edu/~hartj/FlatPanl/fpdindex.htm](https://image.slidesharecdn.com/natacad06-12542612786443-phpapp01/75/Flat-Panel-Displays-2-2048.jpg)