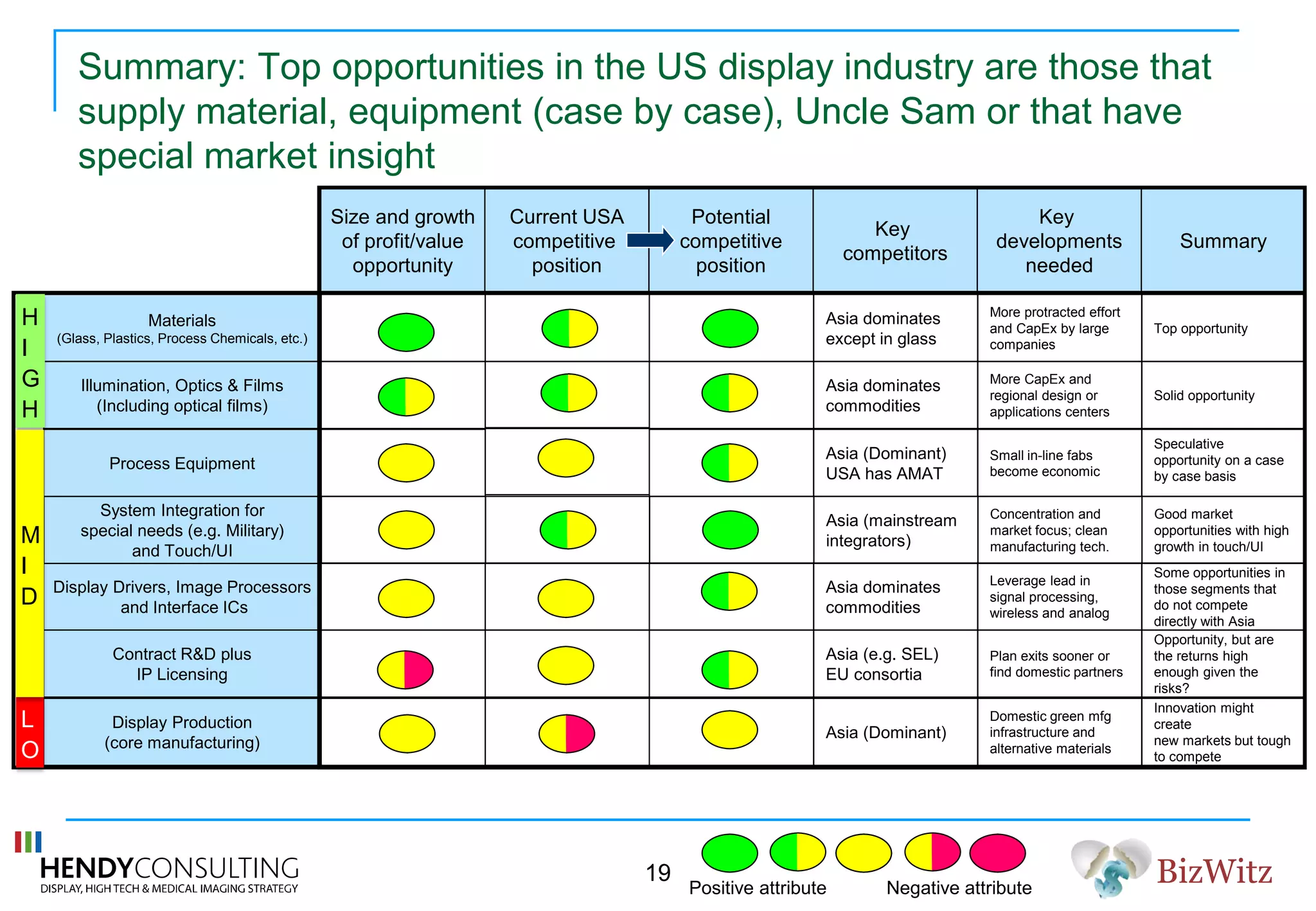

The document provides an overview and strategic assessment of the US displays industry in January 2011. It finds that the US industry includes over 130 businesses in the display value chain, with average revenues of $140 million. It identifies several themes for the industry, including that the largest players like 3M and Corning still dominate but face new challenges, and that the US has a strong position in areas like touch technology and microdisplays due to support from the government and military applications. However, the document also notes mixed results for intellectual property and licensing businesses, and questions if more can be done to support equipment manufacturers and novel materials companies in the US.