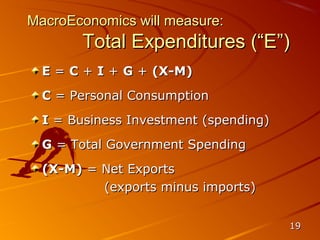

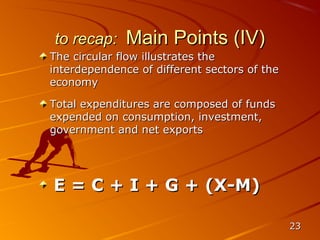

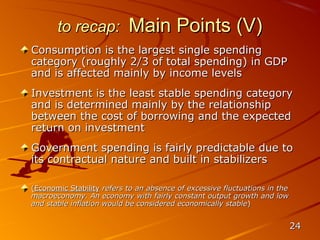

1) Macroeconomics investigates relationships between different economic sectors and the effects of changes in variables like consumption, investment, government spending, and net exports. Its goals are full employment, price stability, and economic growth.

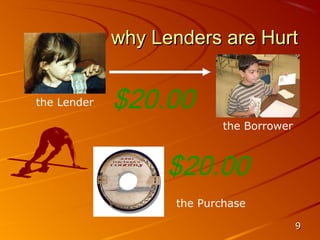

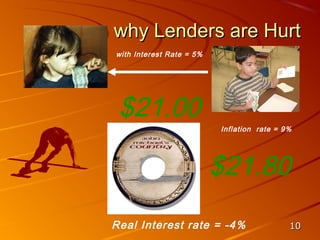

2) Inflation is defined as a sustained rise in the general price level. It redistributes purchasing power arbitrarily and distorts price signals. The real interest rate is the nominal rate minus the inflation rate.

3) Economic growth is measured by the annual percentage change in real GDP. Strong growth generates employment while avoiding inflation.

![with respect to Economic Growth

To engage the process of

[+]

measuring the rate of economic

growth use the formula:

∆ GDP(r) = Real GDP2 - Real GDP1

Real GDP1

16](https://image.slidesharecdn.com/mpp016macroeconomics-introduction-24-130318231742-phpapp01/85/Mpp-016-macro-economics-introduction-24-16-320.jpg)