The document outlines key concepts related to the goods market, IS curve, money market, and LM curve. It discusses how:

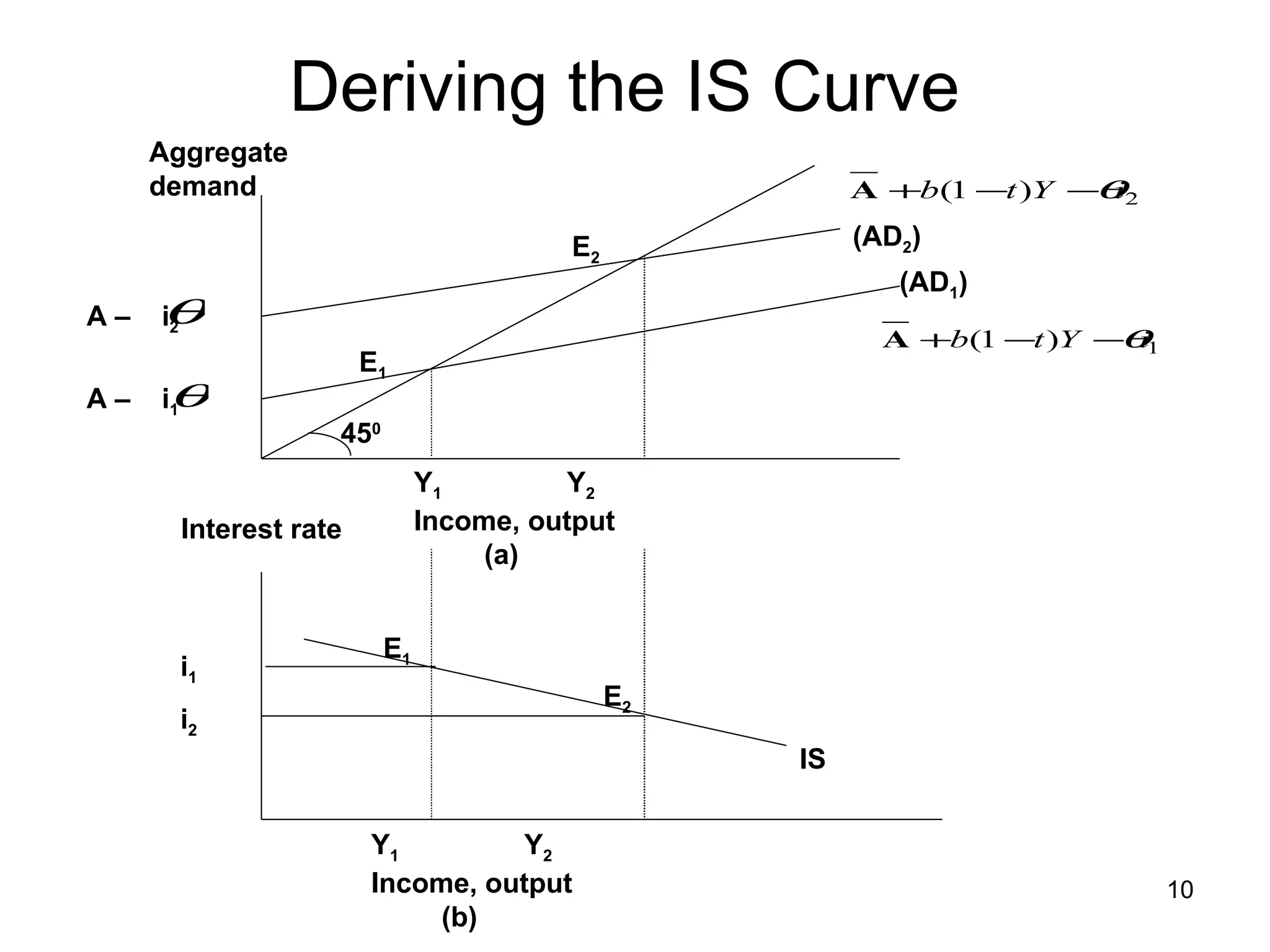

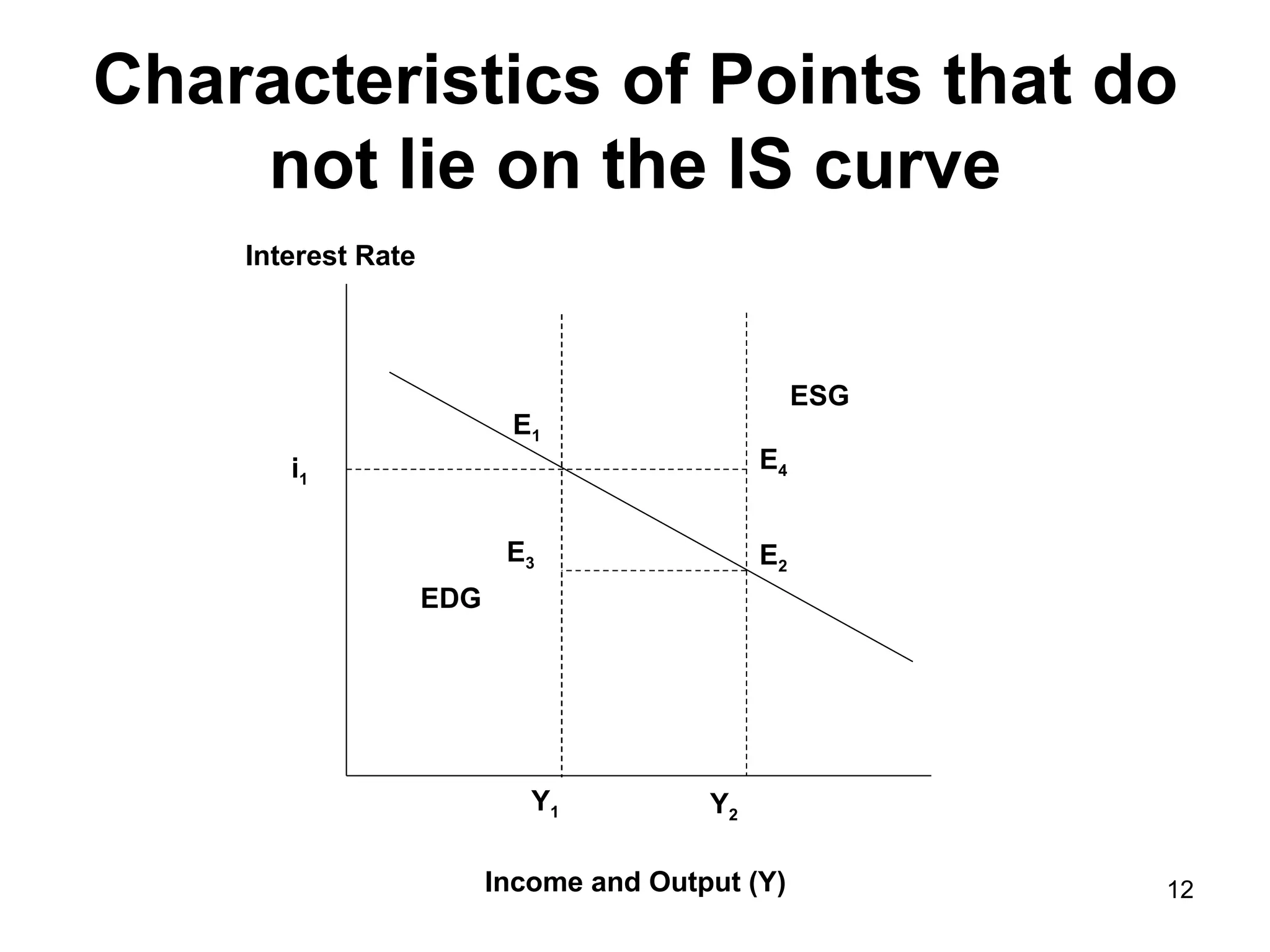

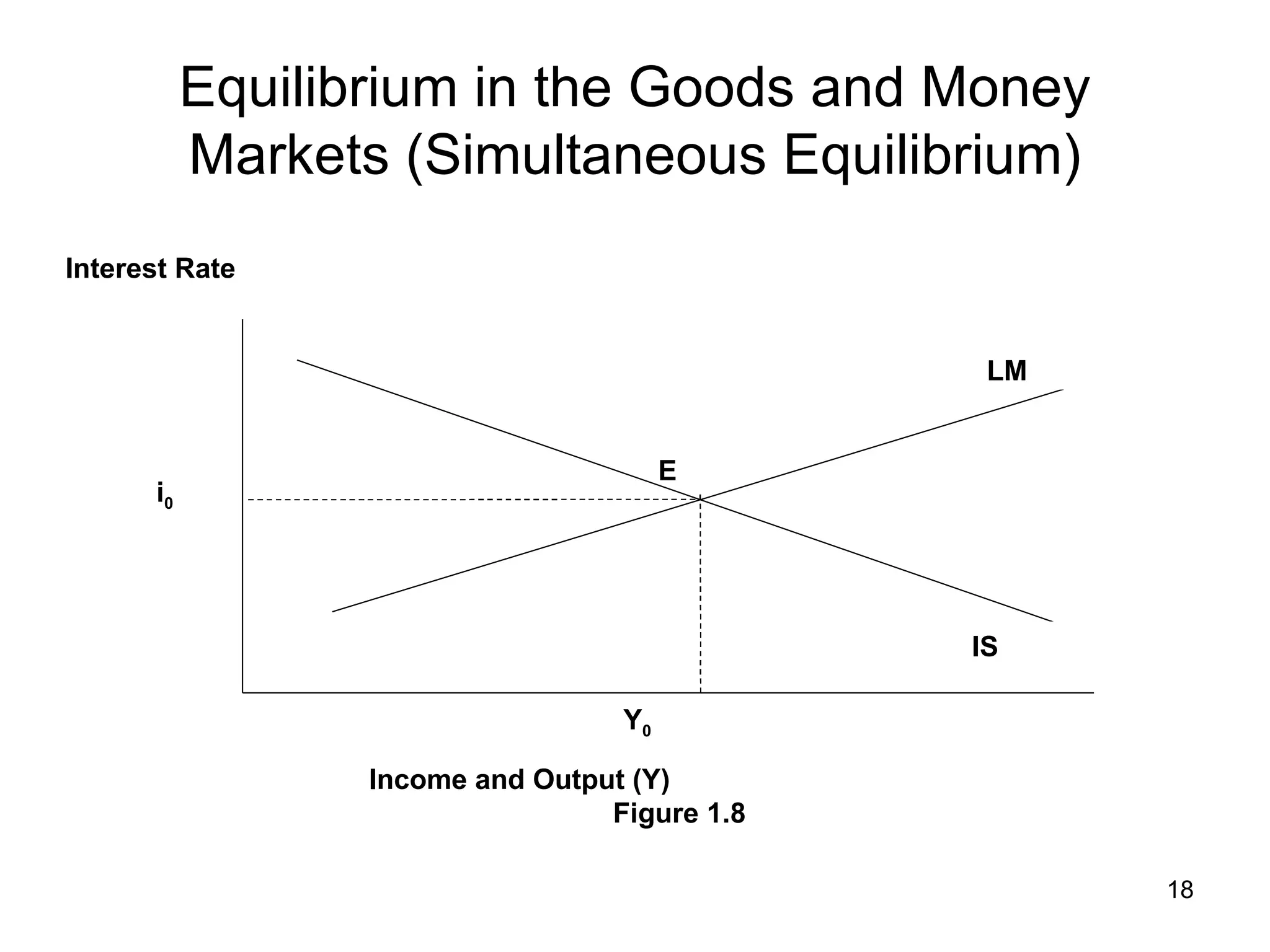

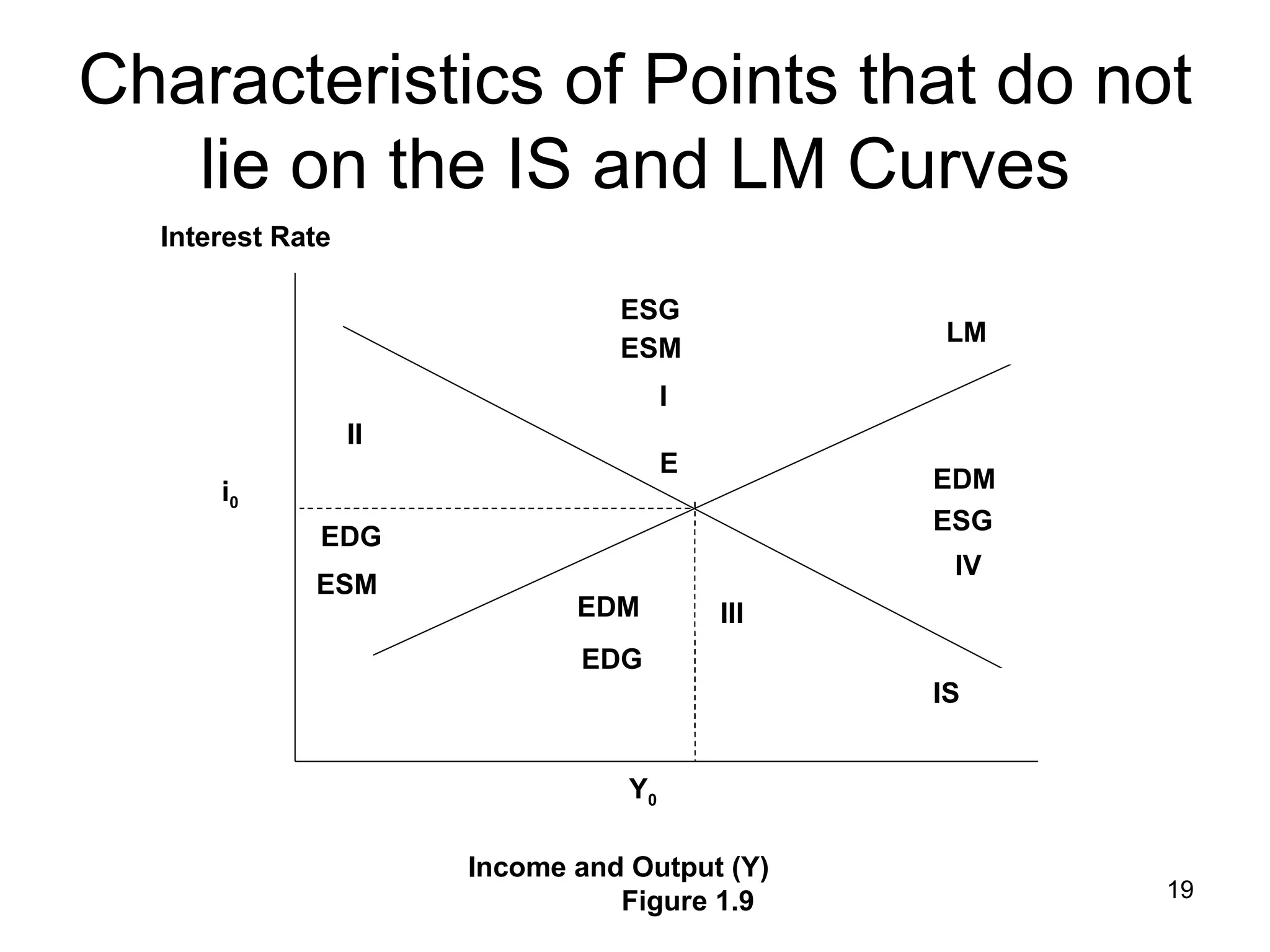

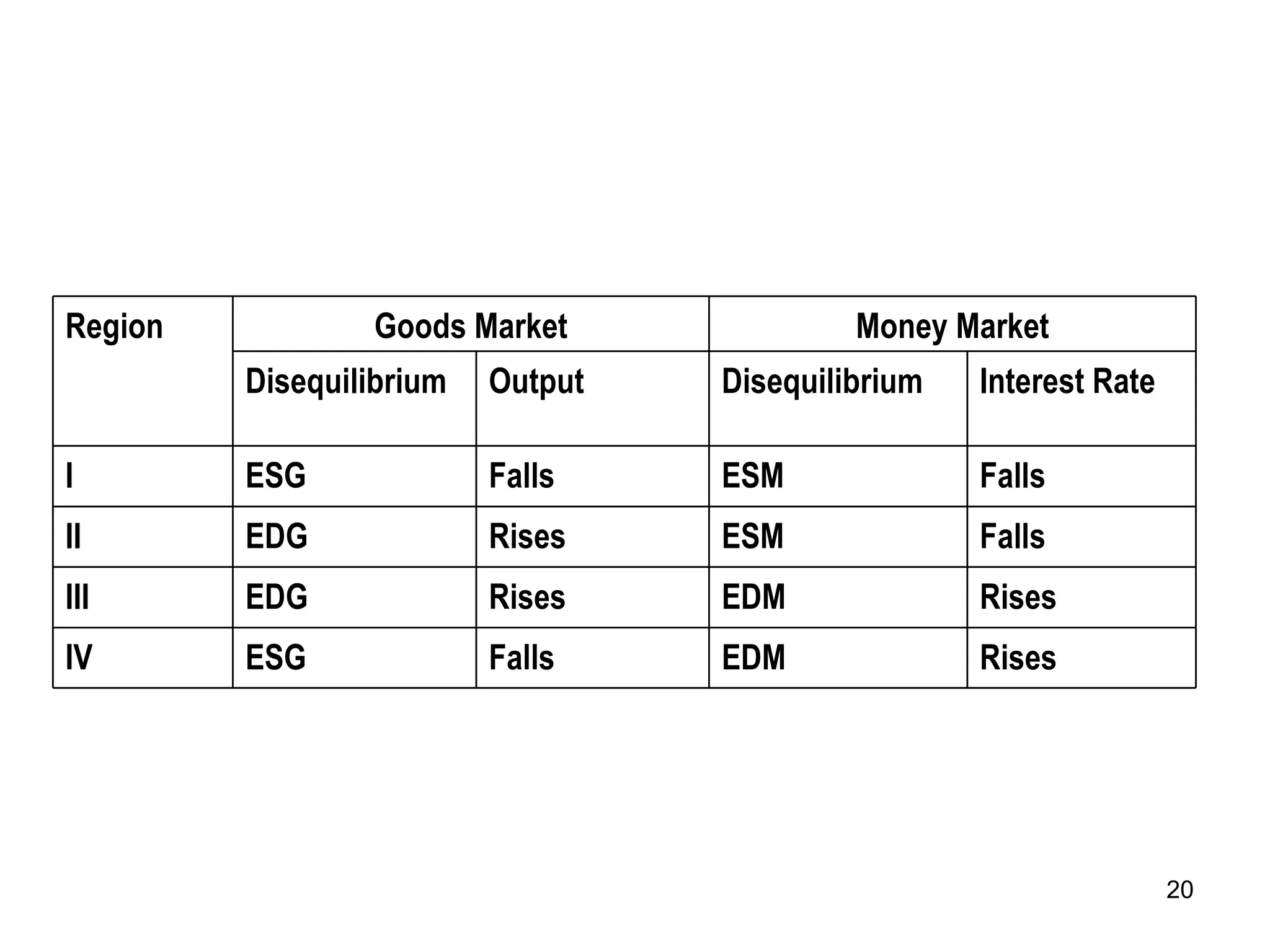

- The IS curve shows combinations of interest rates and income where saving equals investment in the goods market.

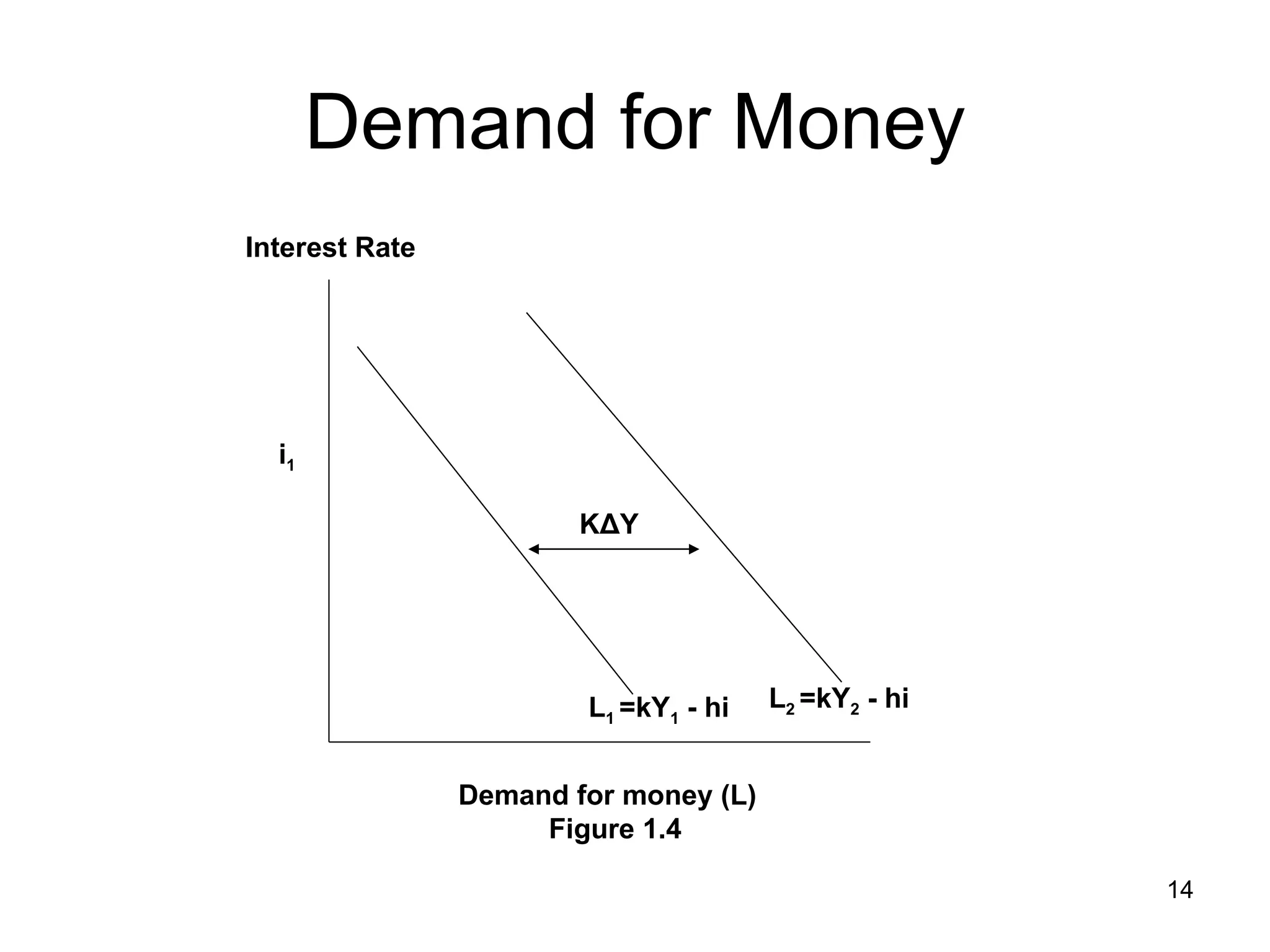

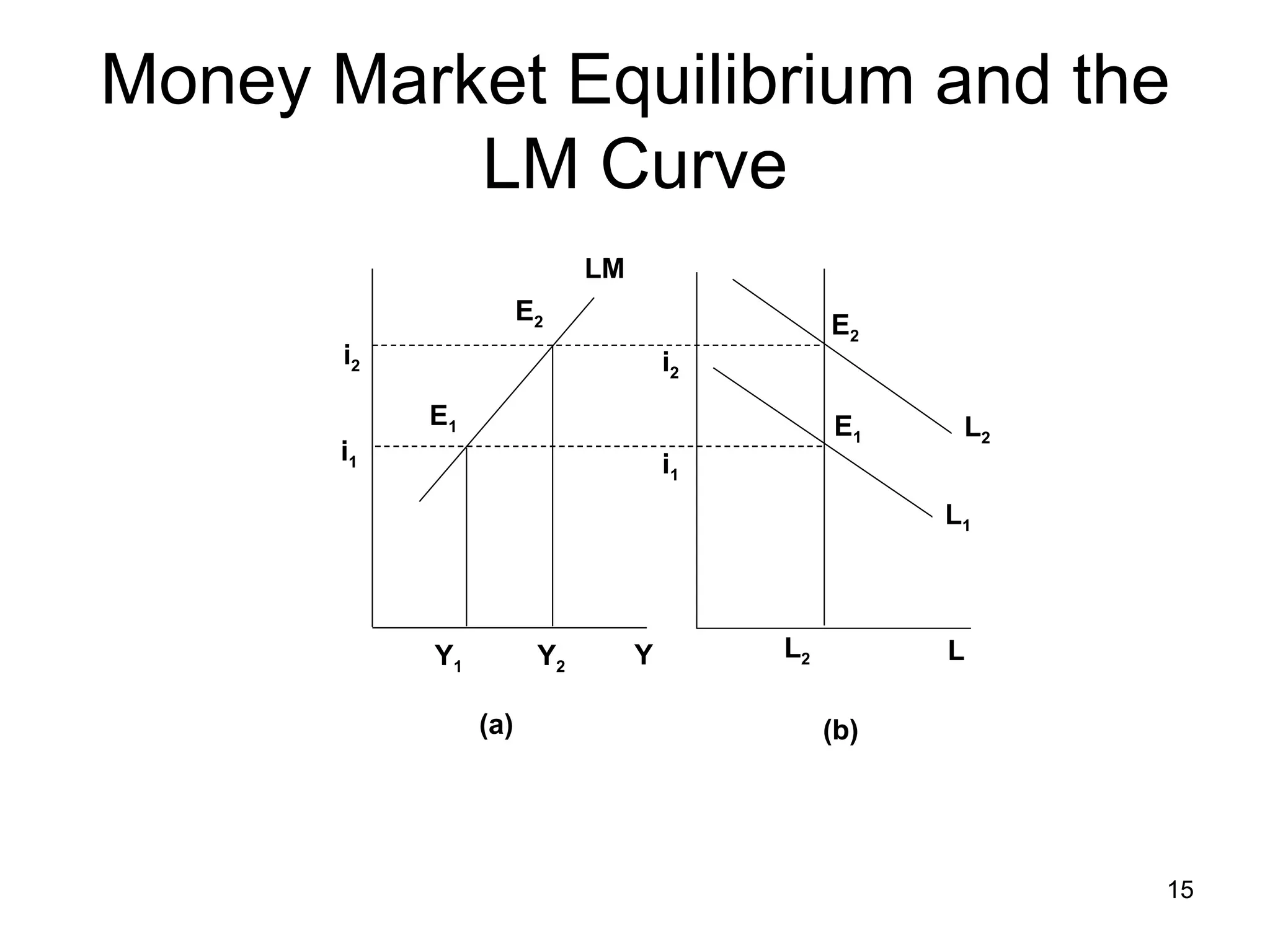

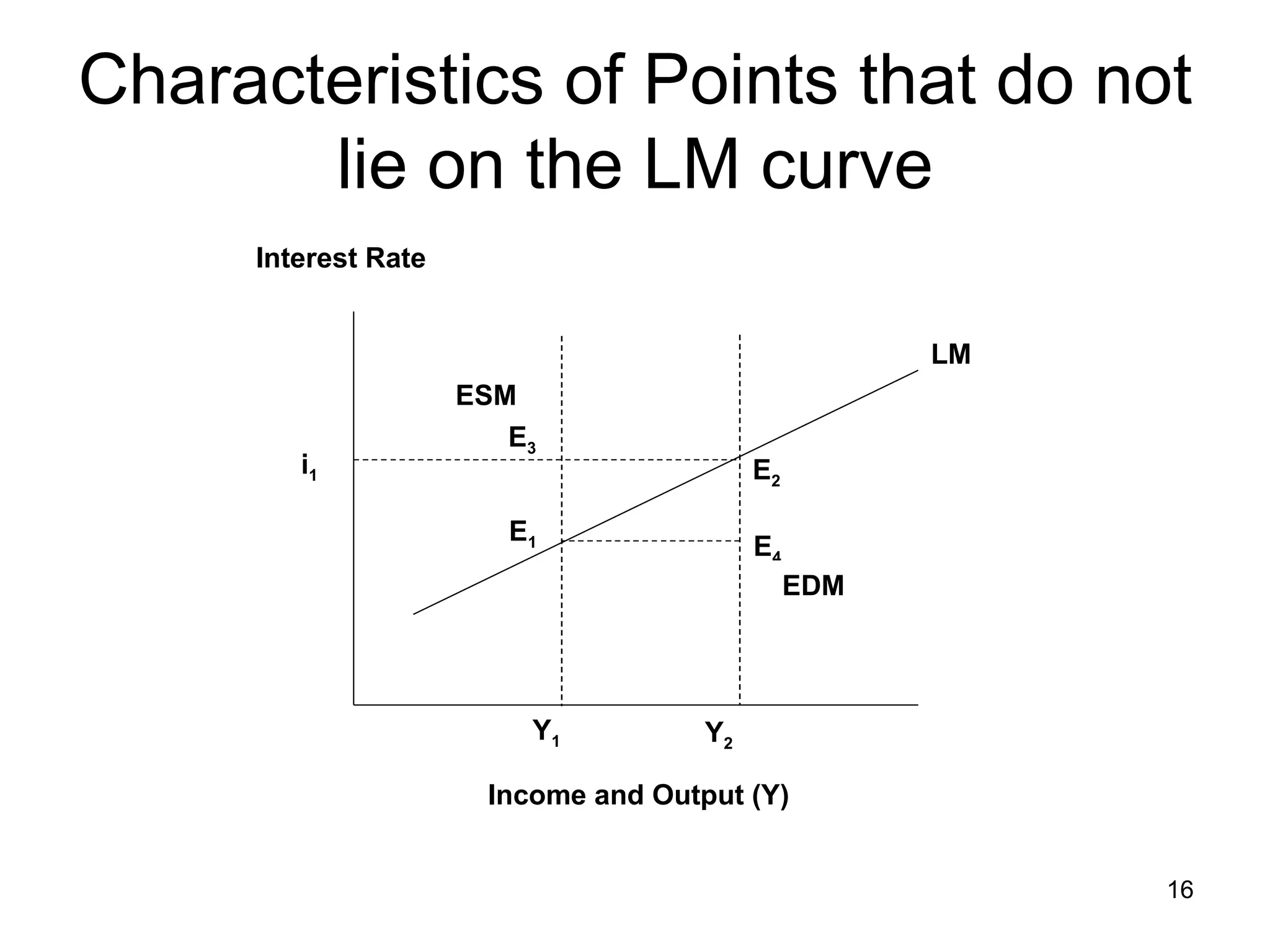

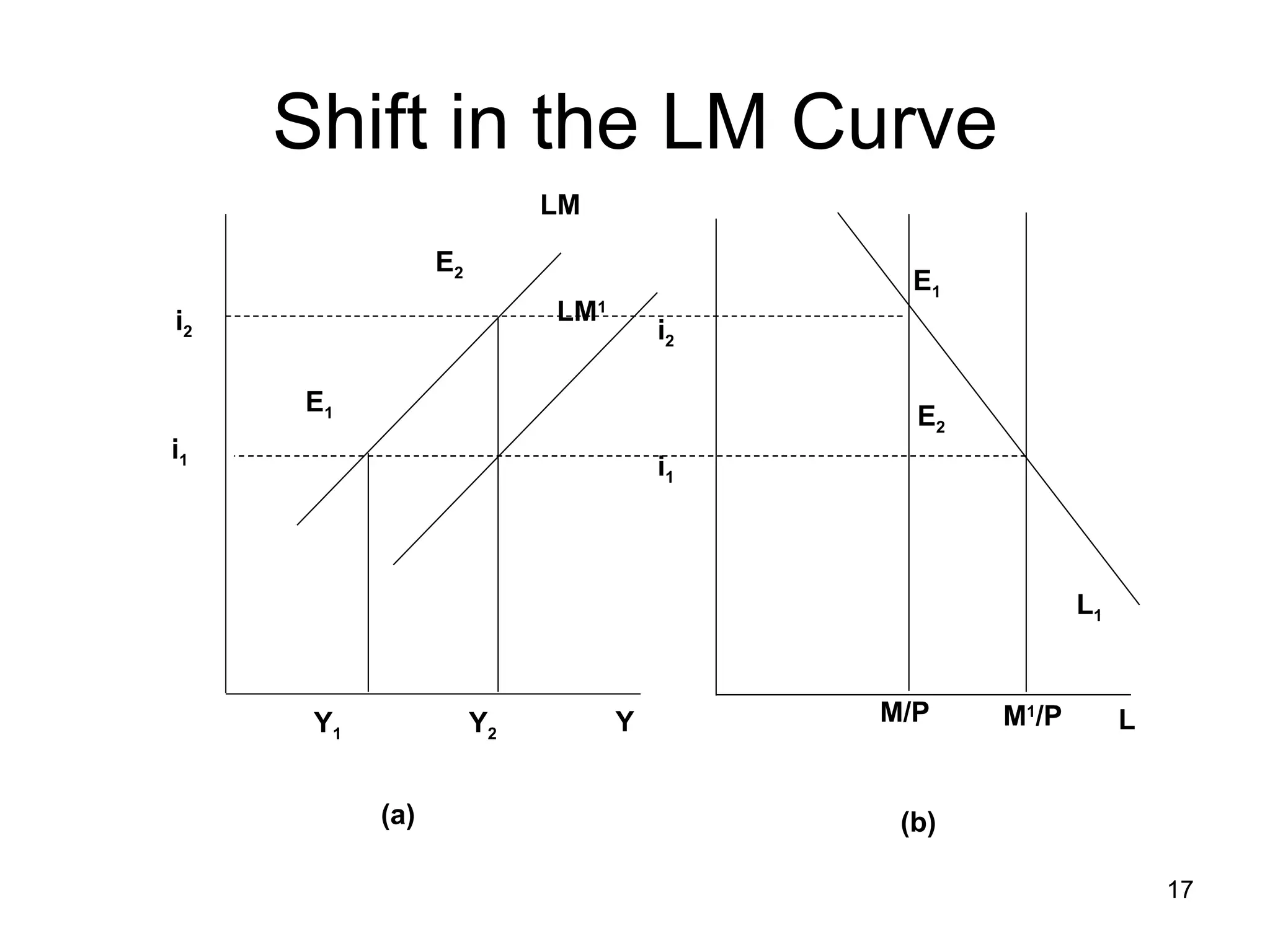

- The LM curve shows combinations of interest rates and income where demand for money equals supply of money in the money market.

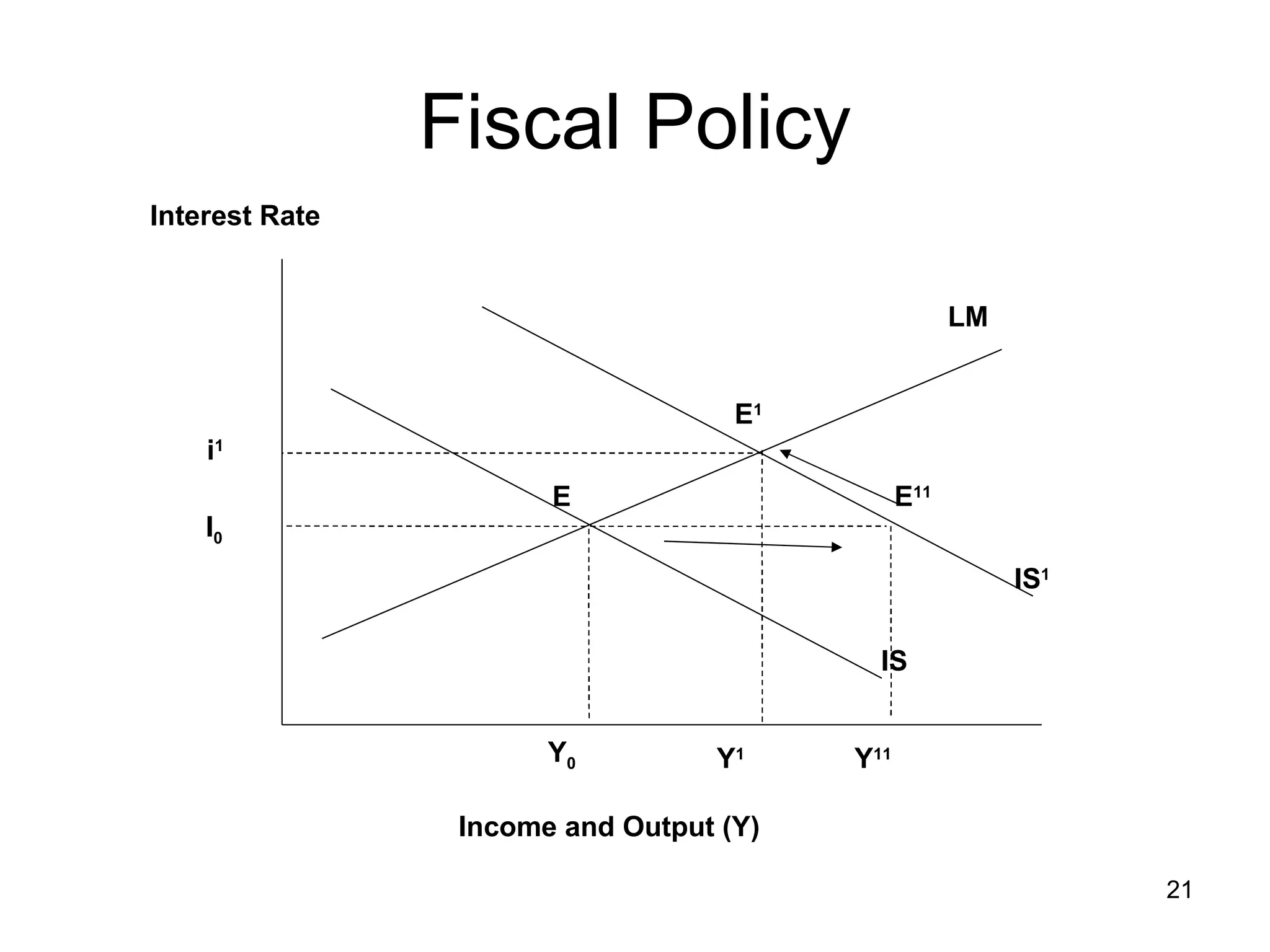

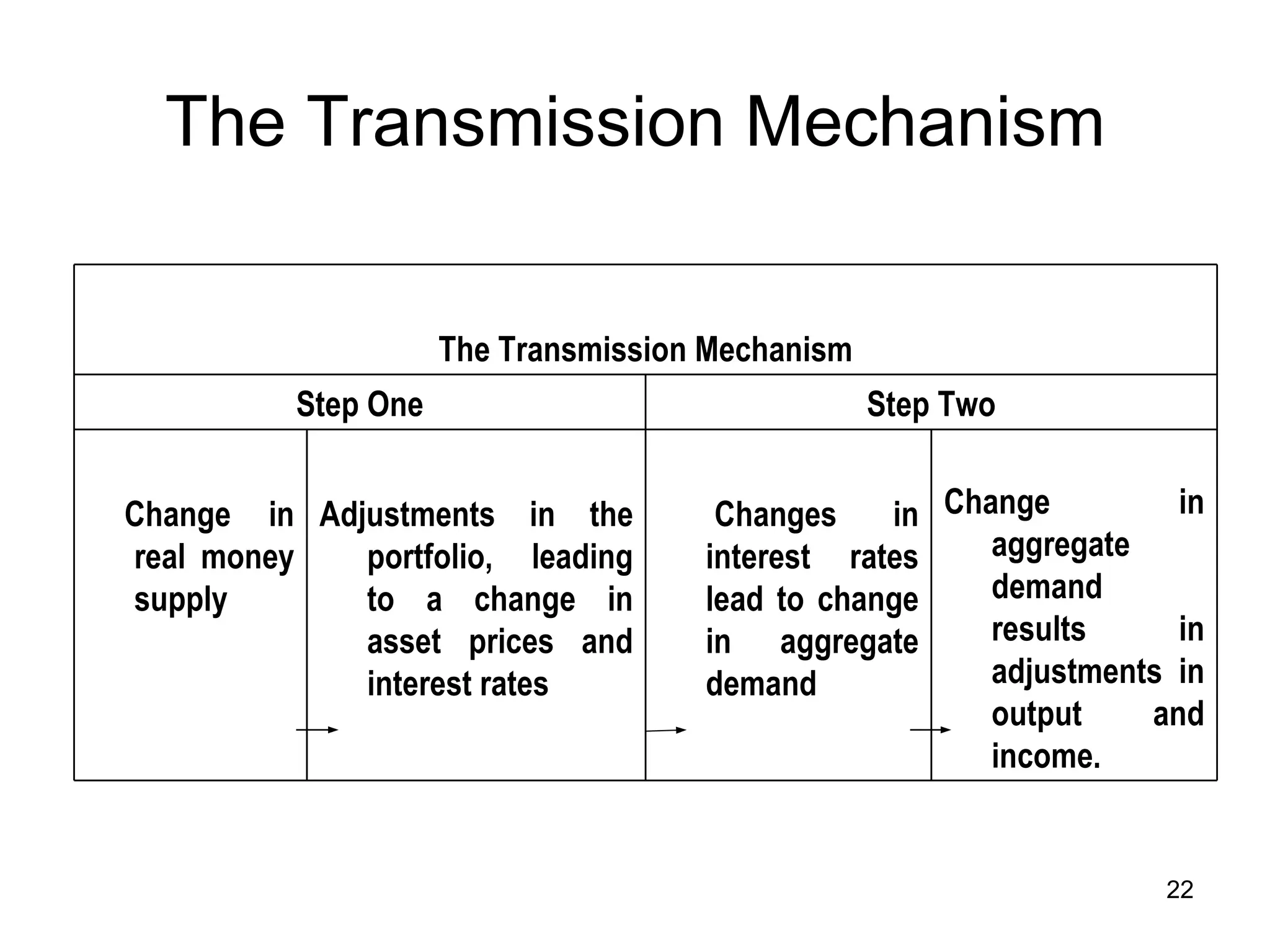

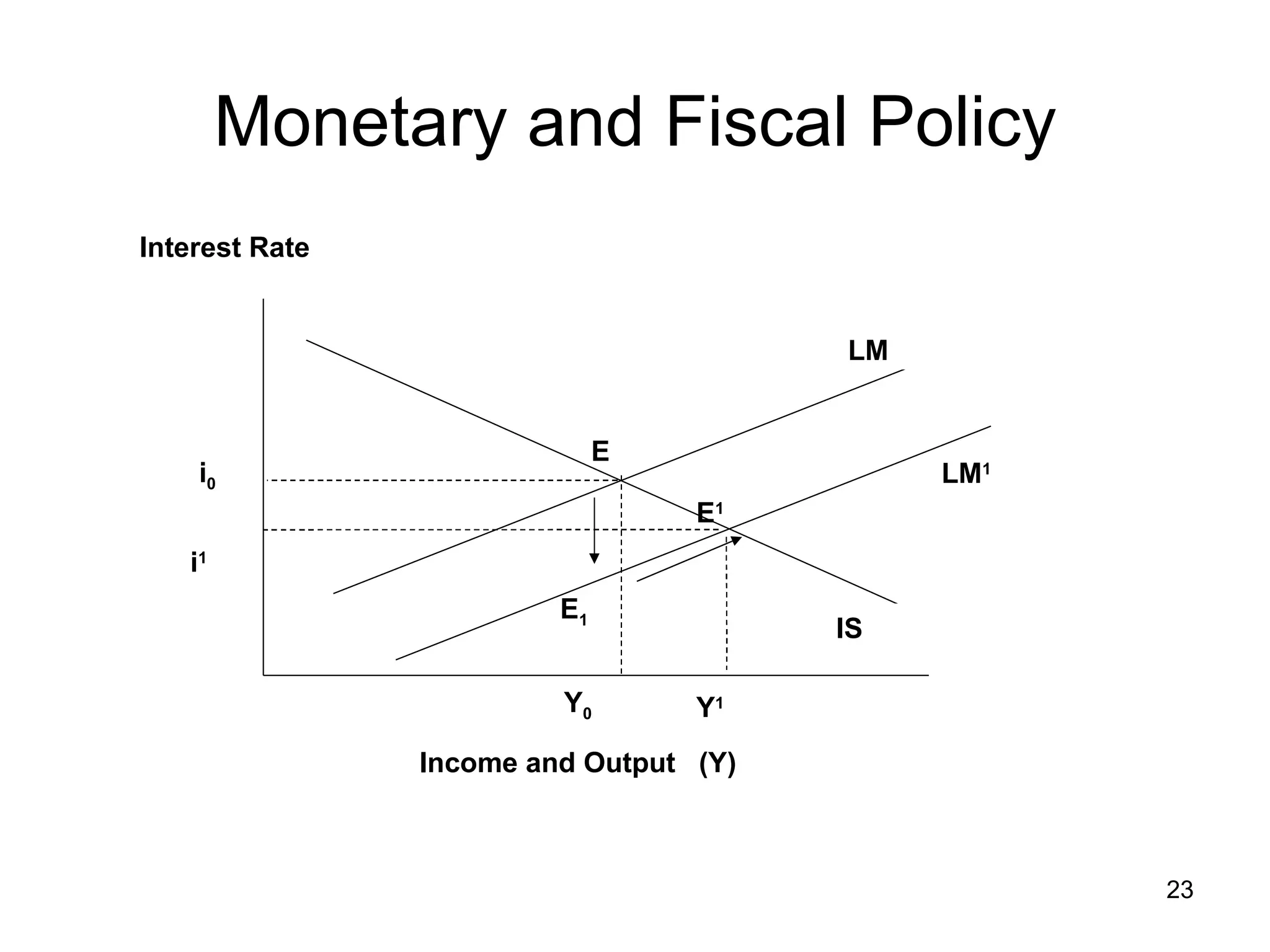

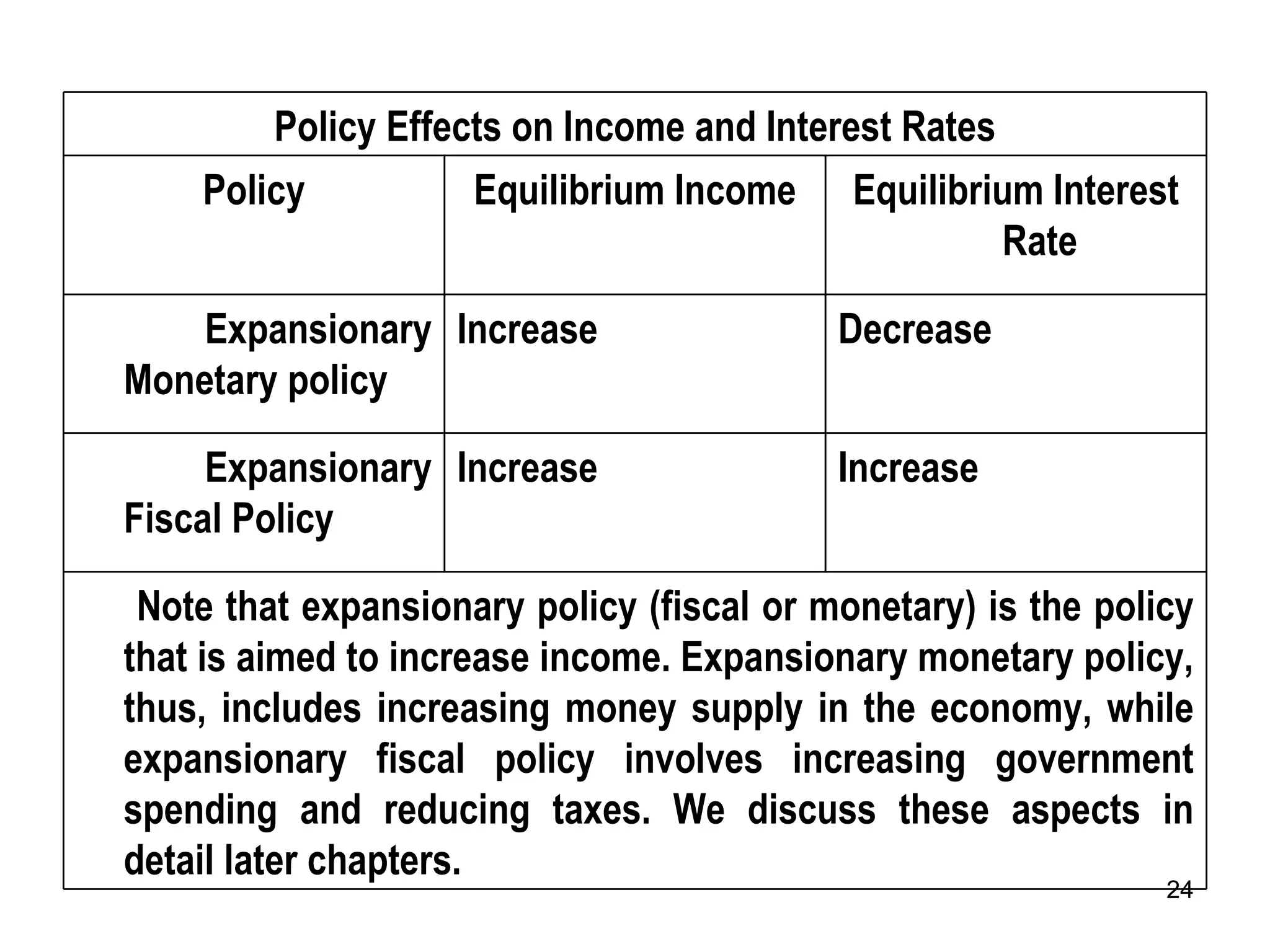

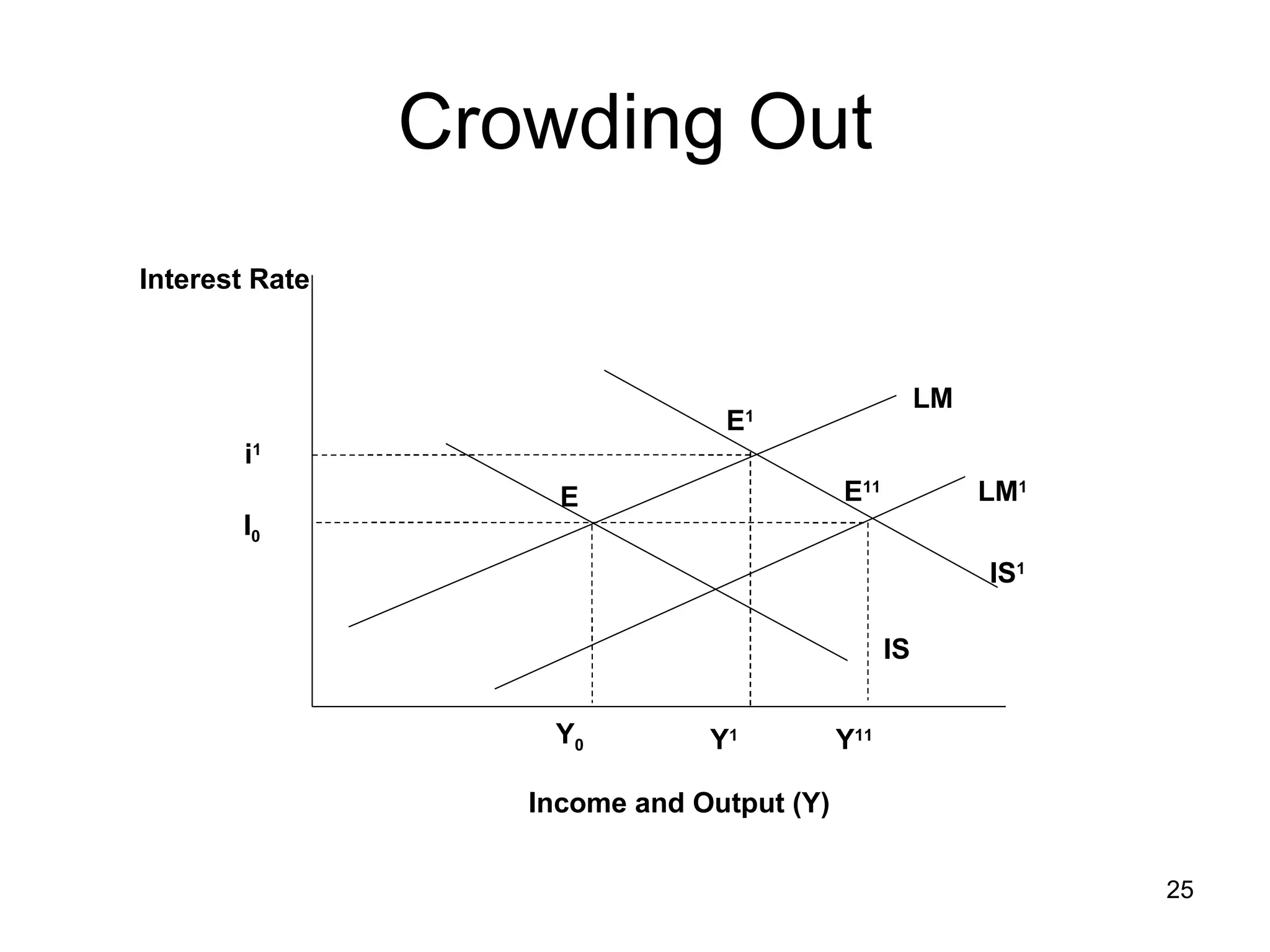

- Equilibrium in both markets simultaneously determines the equilibrium interest rate and income on the IS-LM model. Fiscal and monetary policies can shift the curves and impact equilibrium.