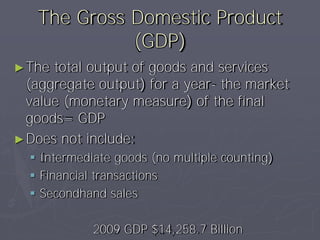

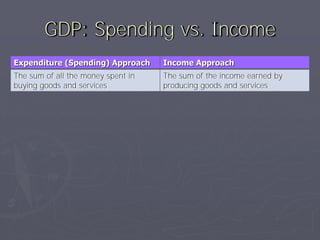

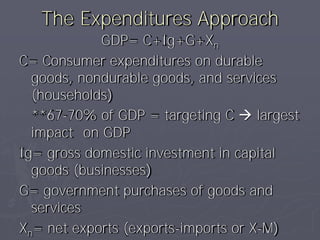

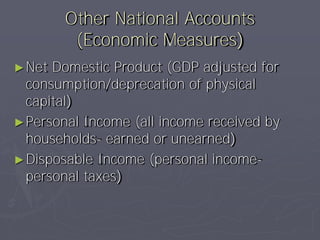

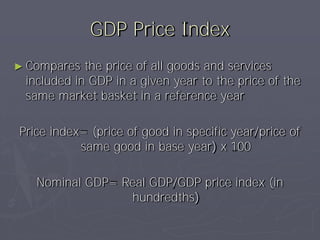

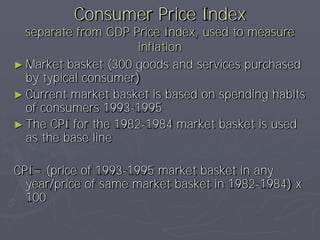

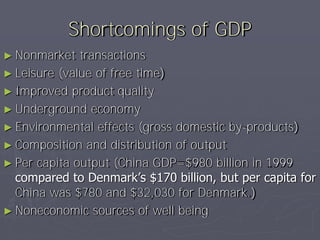

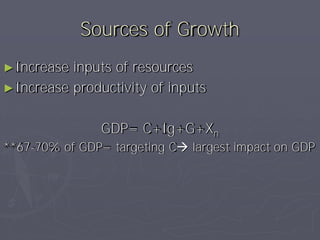

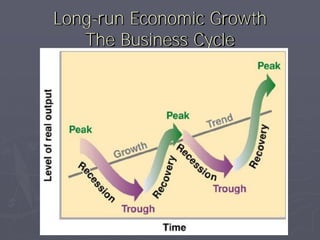

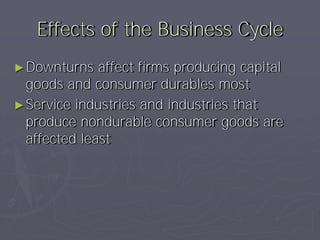

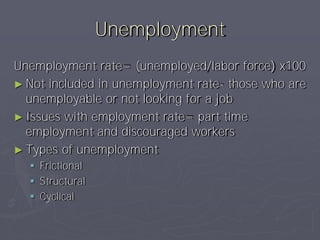

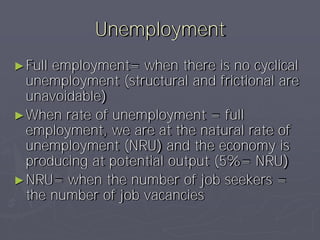

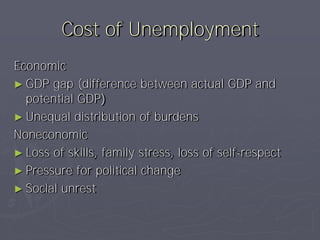

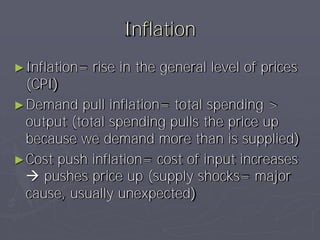

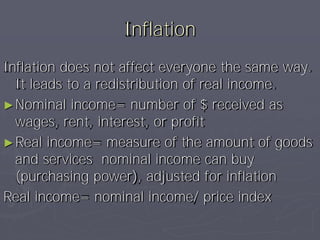

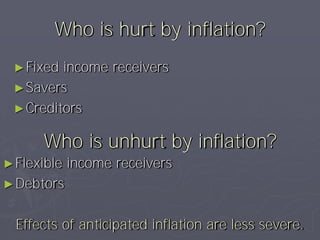

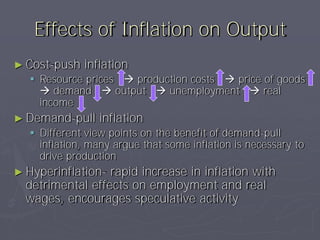

The Bureau of Economic Analysis assesses the health of the US economy by tracking key macroeconomic measures like GDP. GDP is the total market value of goods and services produced in a year, measured in two ways - expenditure and income. GDP growth and stability are influenced by factors like consumption, investment, government spending, net exports, productivity, and the business cycle. Unemployment and inflation also impact the economy and can be caused by demand and supply influences.