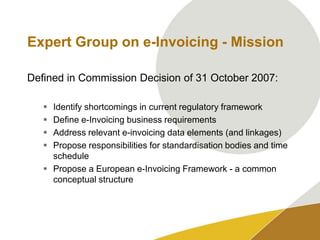

1) The expert group on e-invoicing identified the importance of e-invoicing for business competitiveness, cost savings, and service innovations.

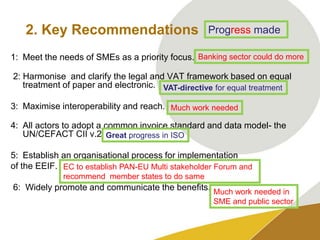

2) Key recommendations included meeting SME needs, harmonizing legal frameworks, maximizing interoperability, adopting common standards, and establishing implementation processes.

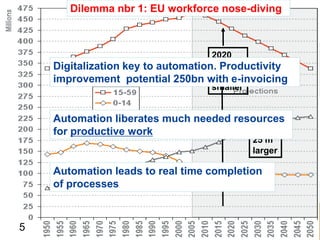

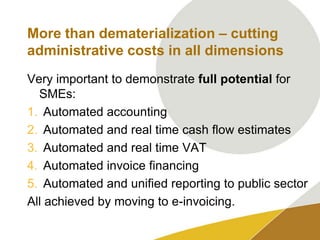

3) E-invoicing could automate administrative processes and cut costs in half for enterprises, particularly helping SMEs, and yield large savings for the public sector.