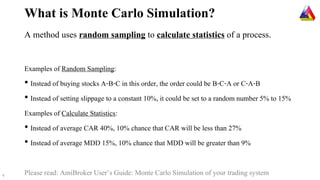

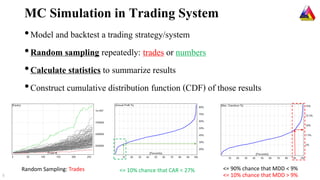

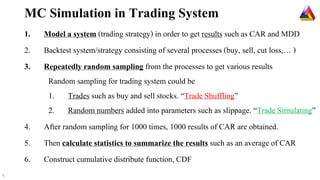

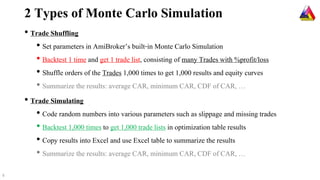

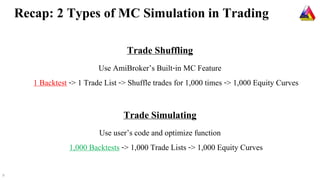

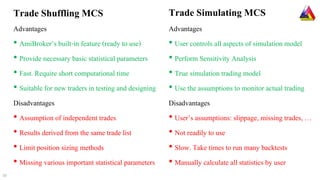

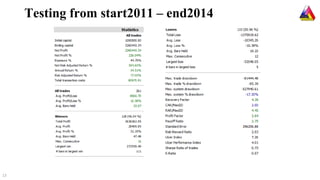

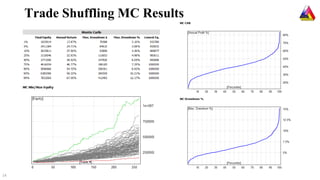

The document outlines the concept and application of Monte Carlo simulation in trading systems, highlighting its importance for assessing risk and strategy robustness. It describes the method as involving random sampling to generate statistics and presents two types of simulations: trade shuffling and trade simulating, each with distinct advantages and disadvantages. The document emphasizes the iterative nature of the simulation process and the use of statistical analysis to interpret results.