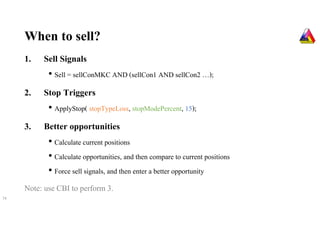

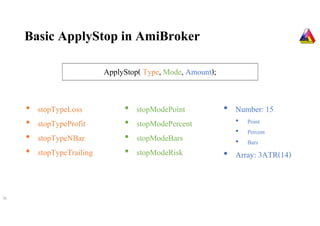

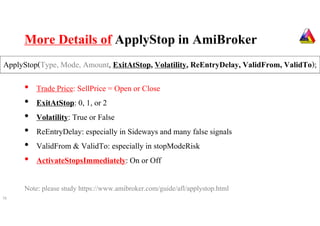

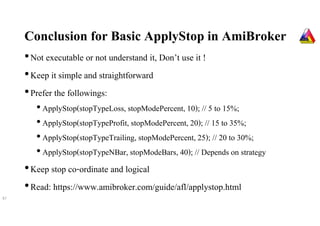

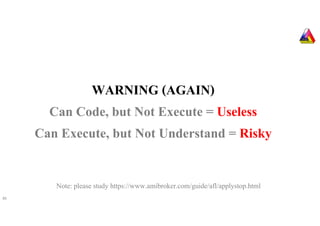

The document outlines the 'applystop' function in AmiBroker for quant trading, detailing various types of stop signals and their configurations. It emphasizes the significance of compatibility between stop types and modes, as well as the necessity for simplicity in trading strategies. Key recommendations include specific stop configurations to optimize profit while managing risks effectively.