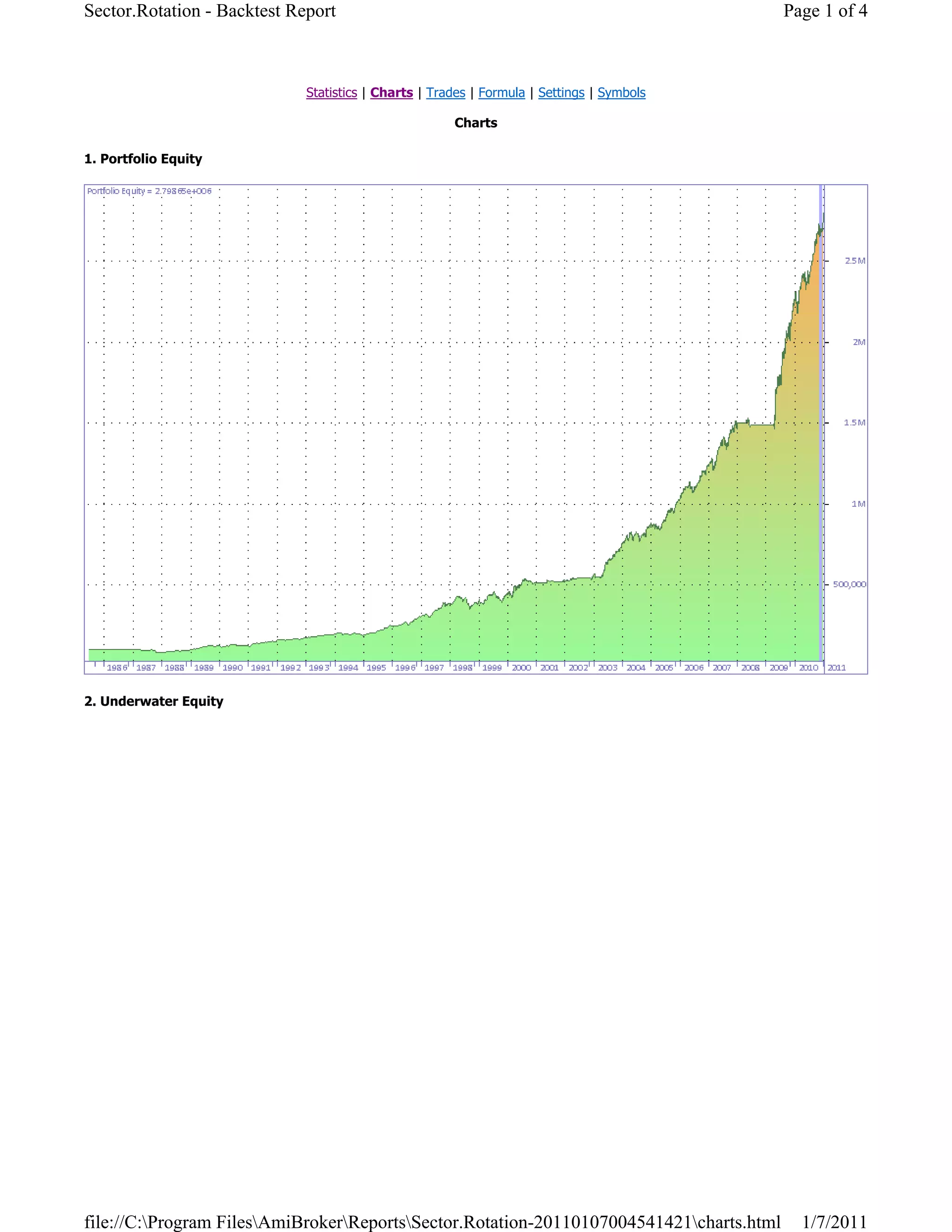

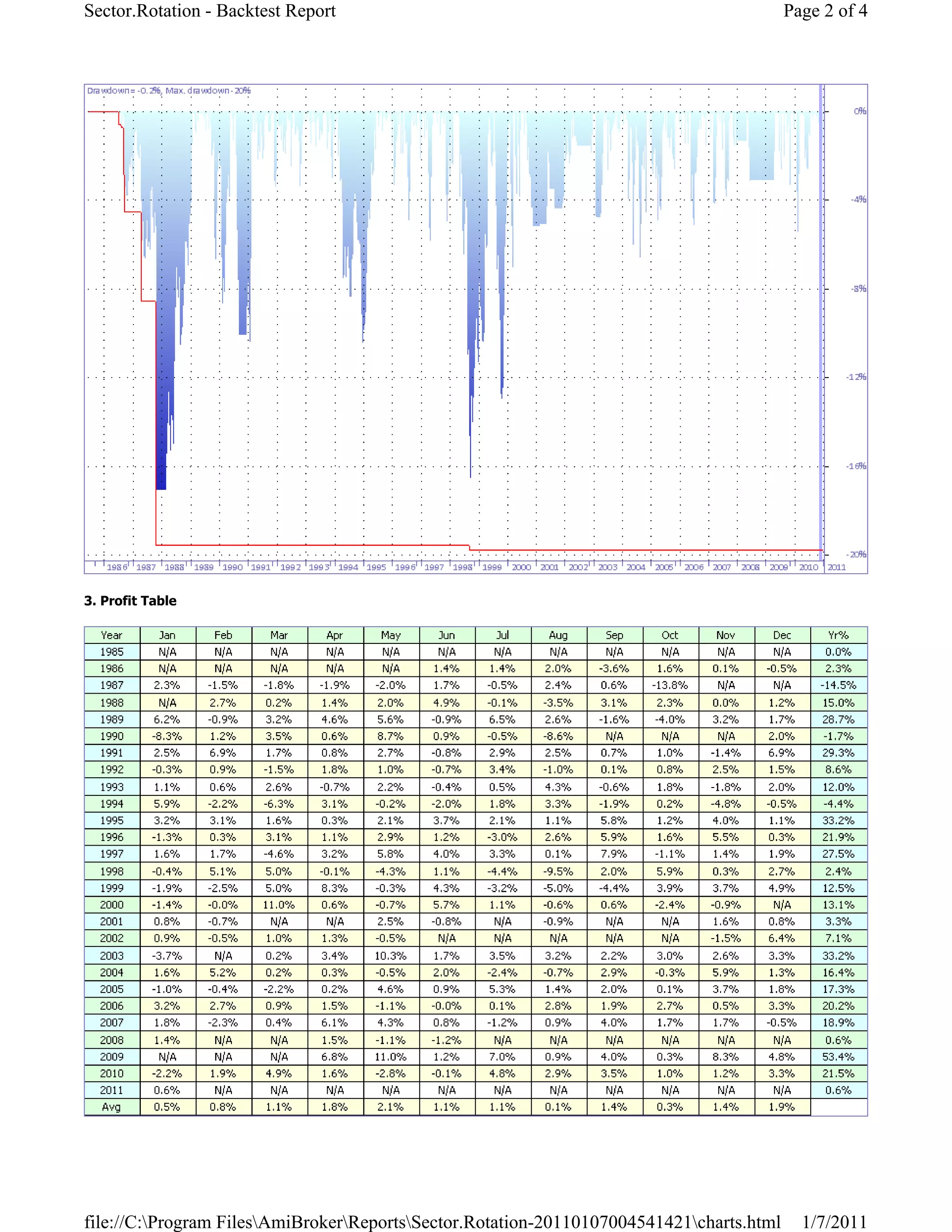

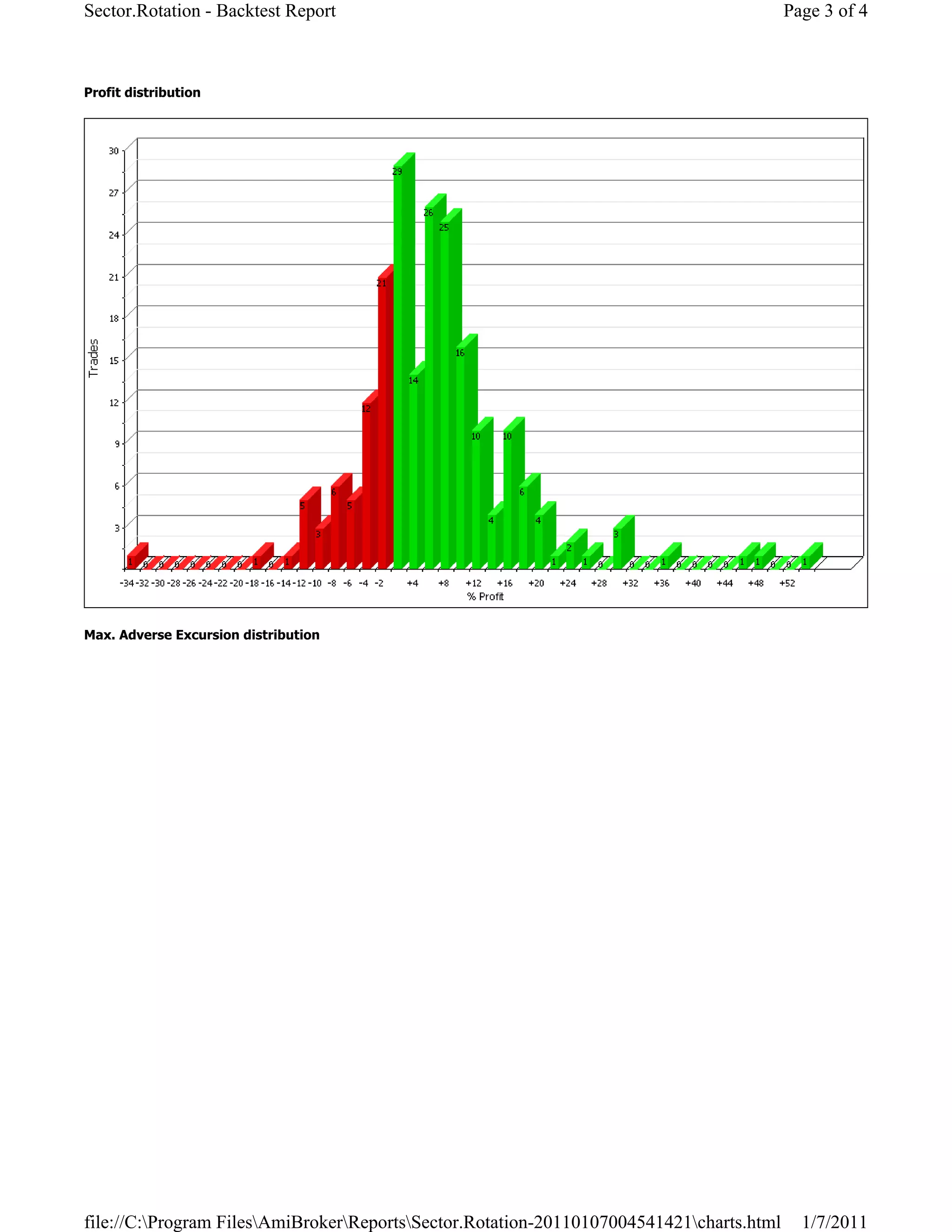

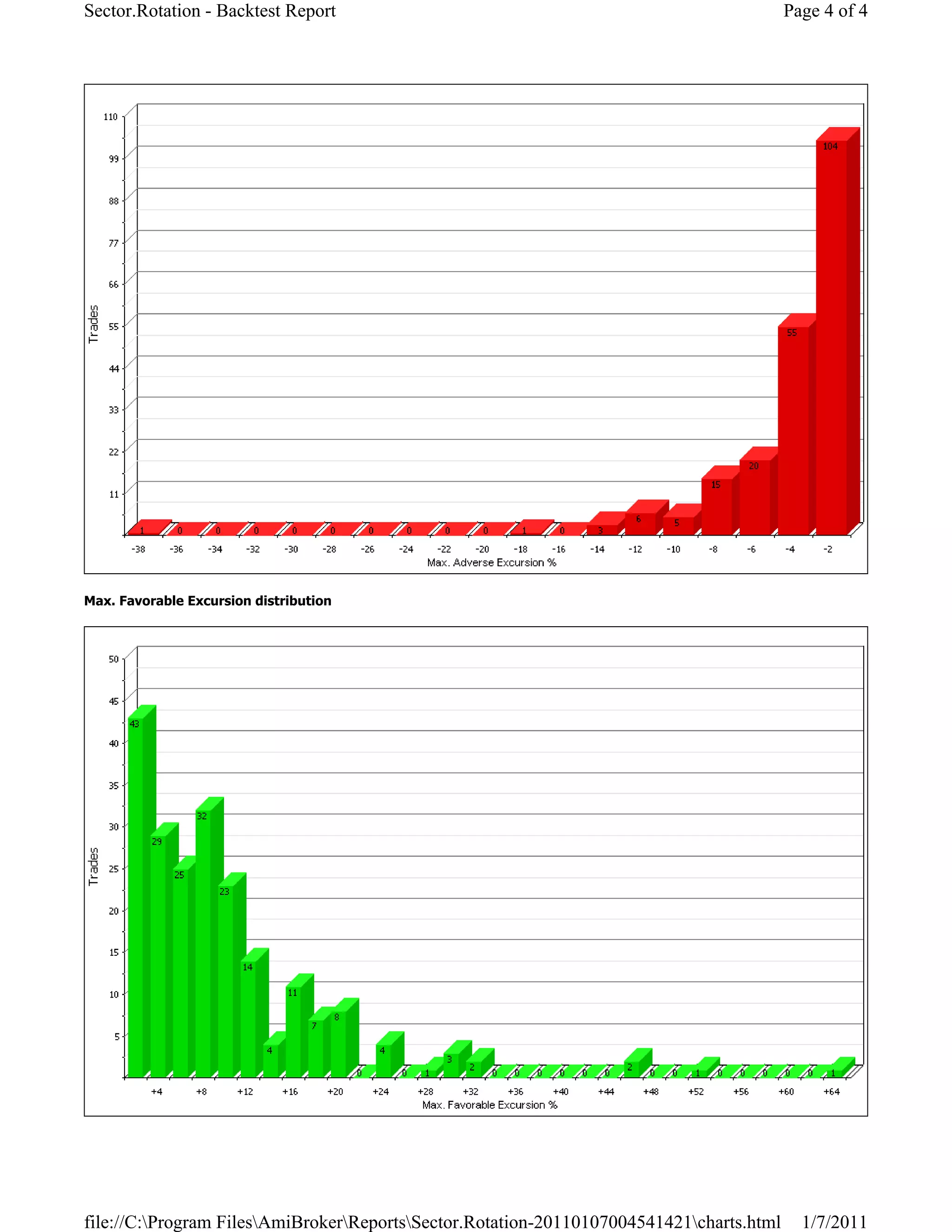

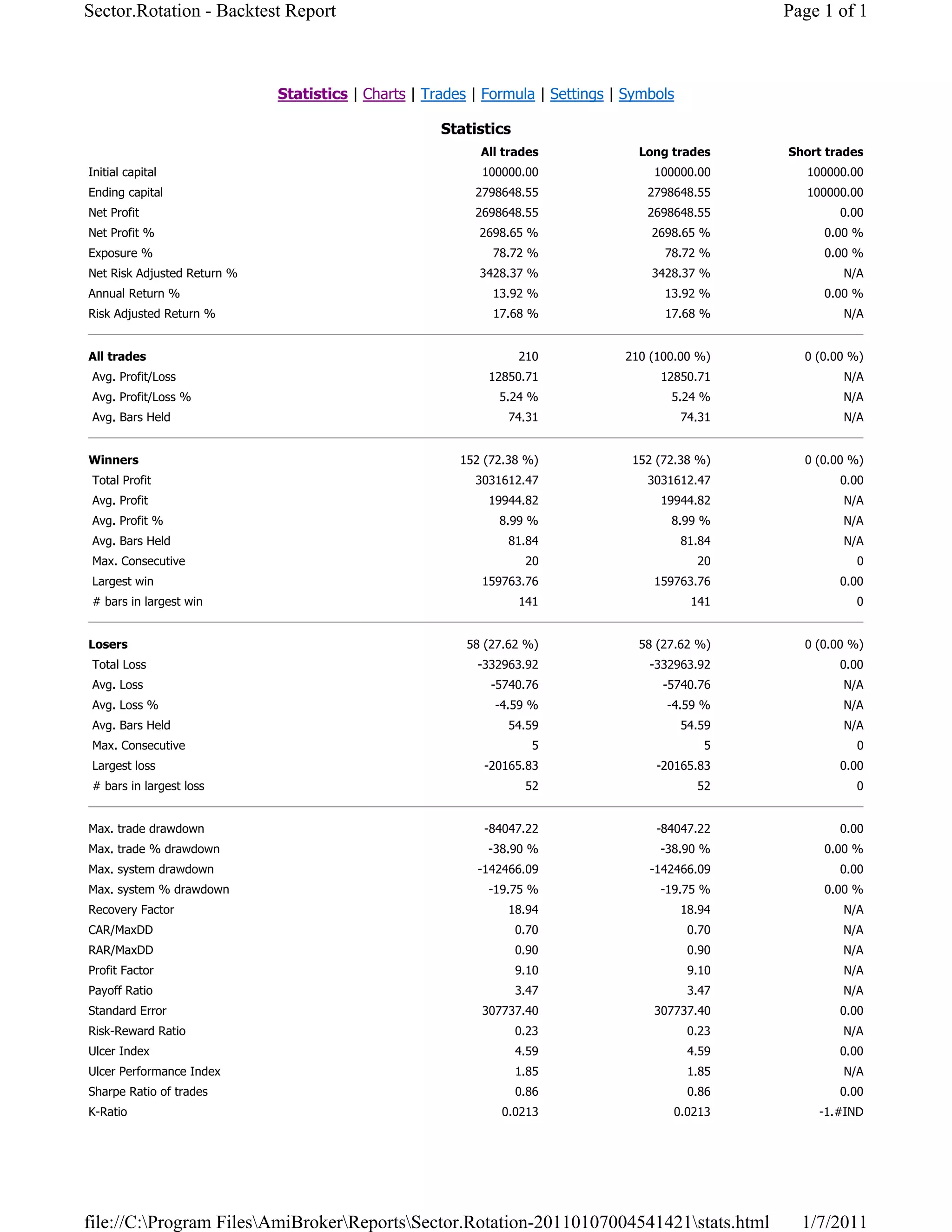

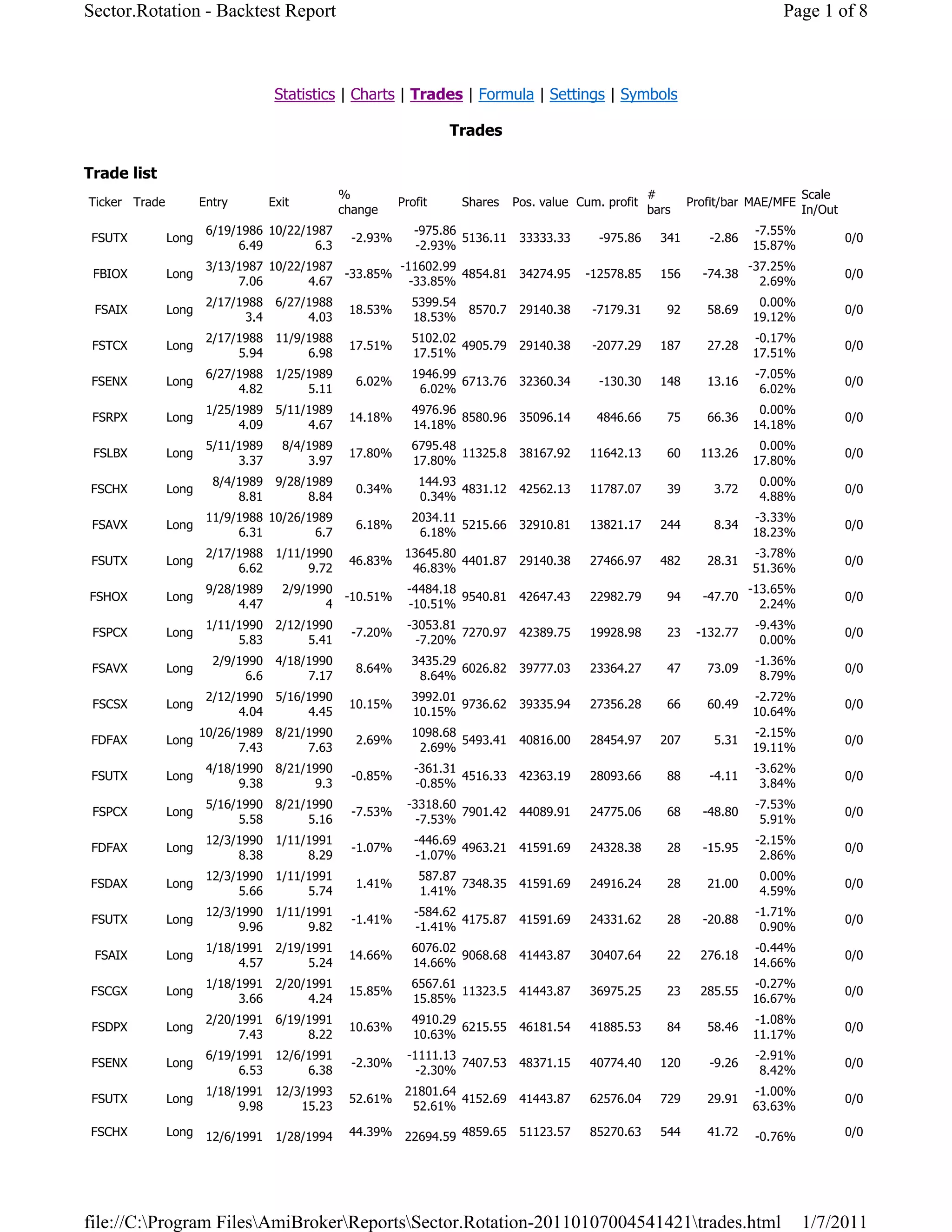

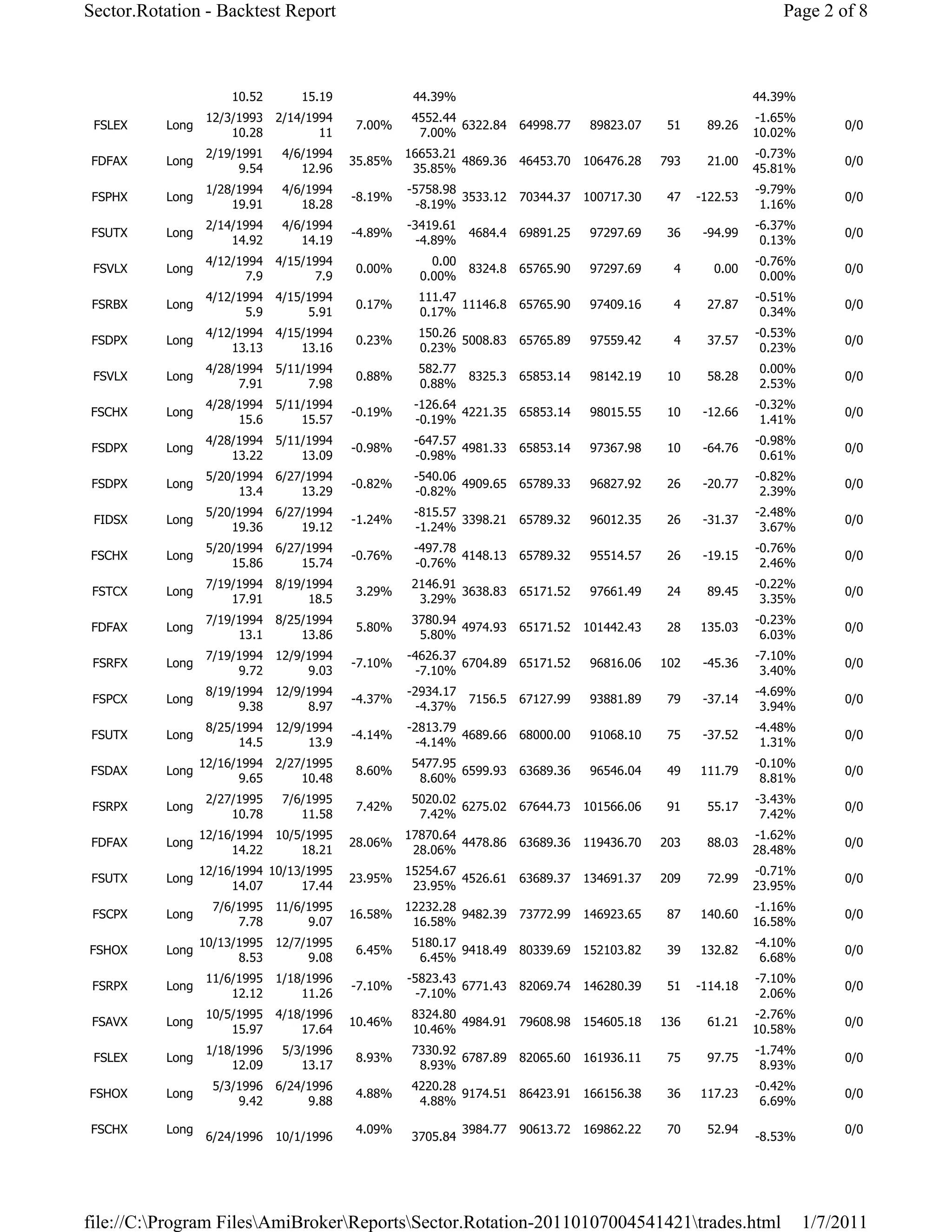

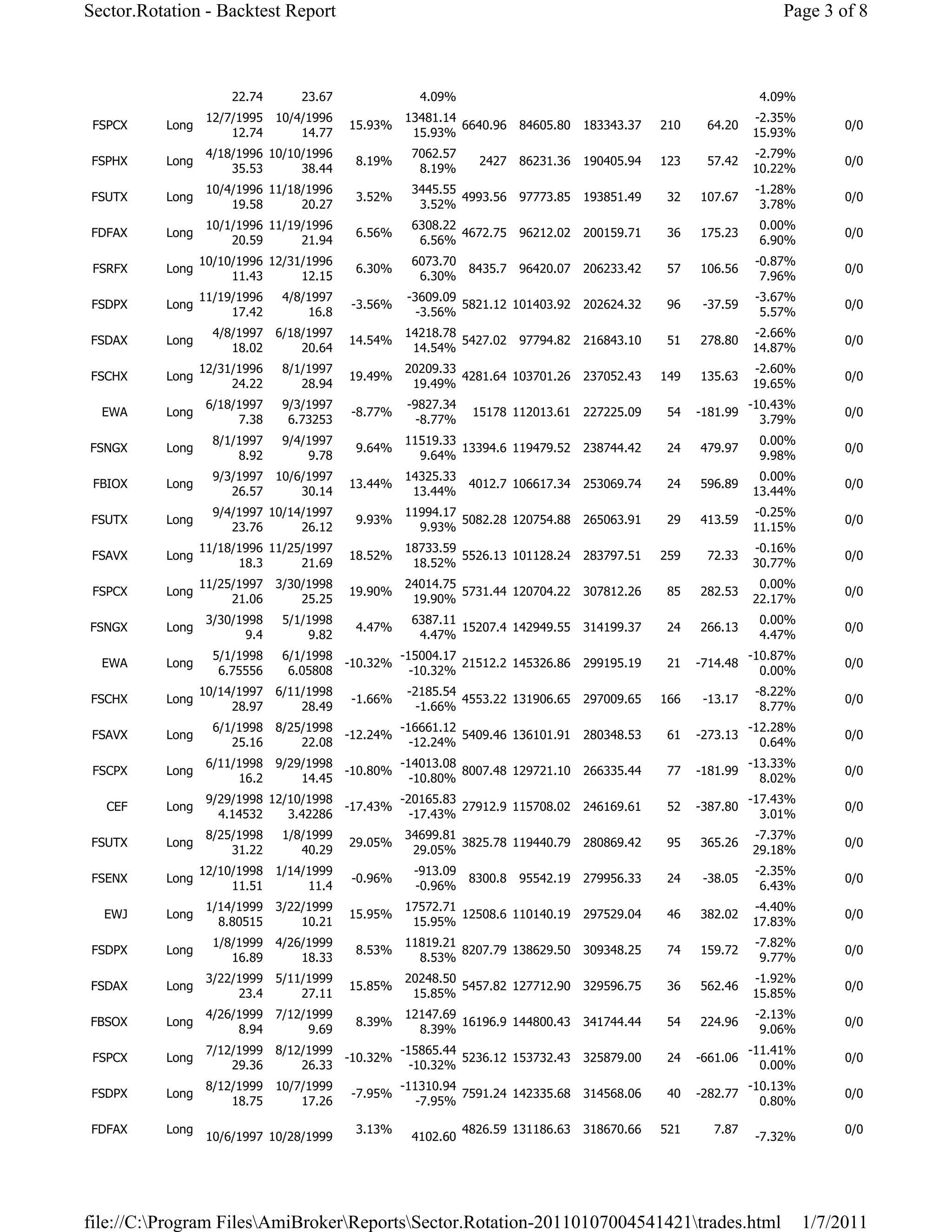

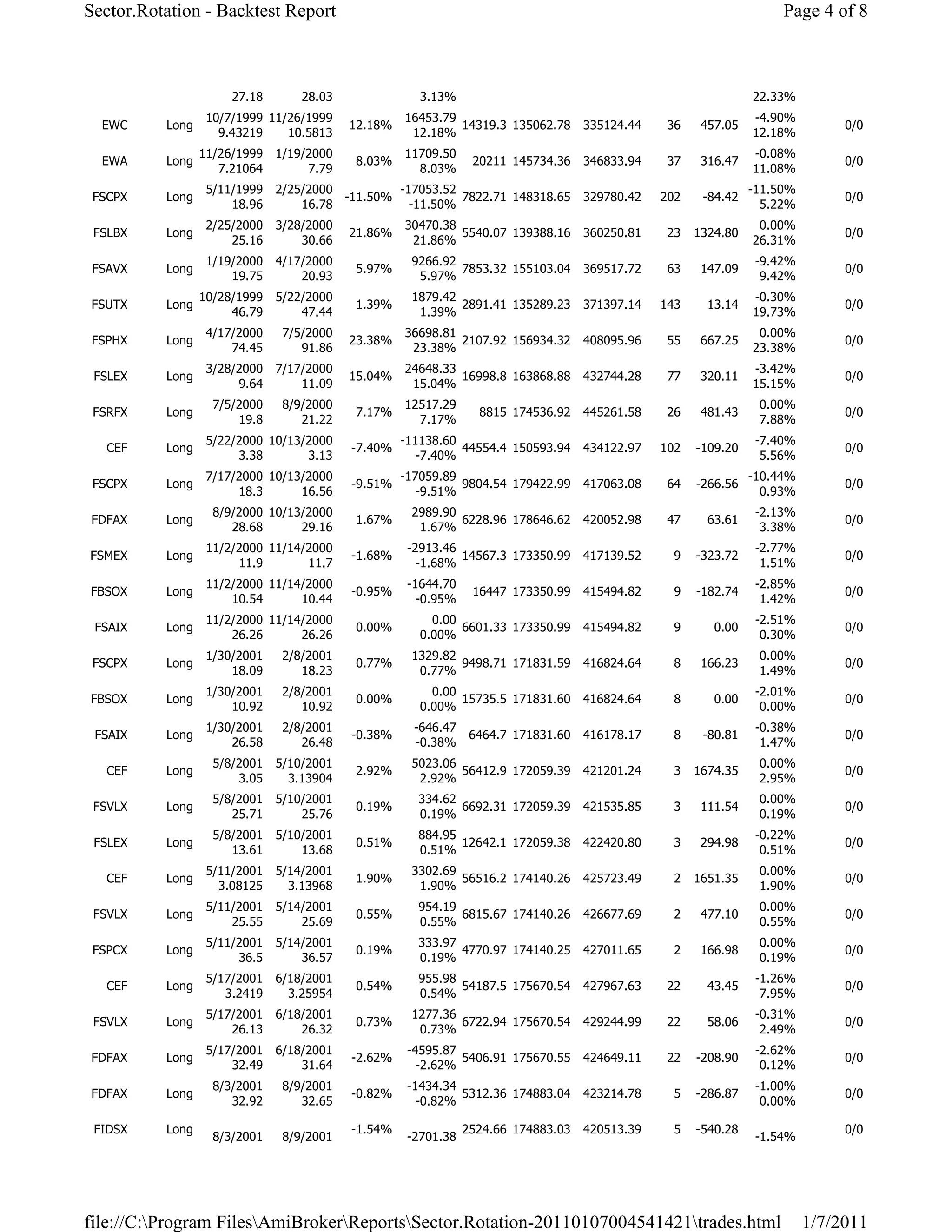

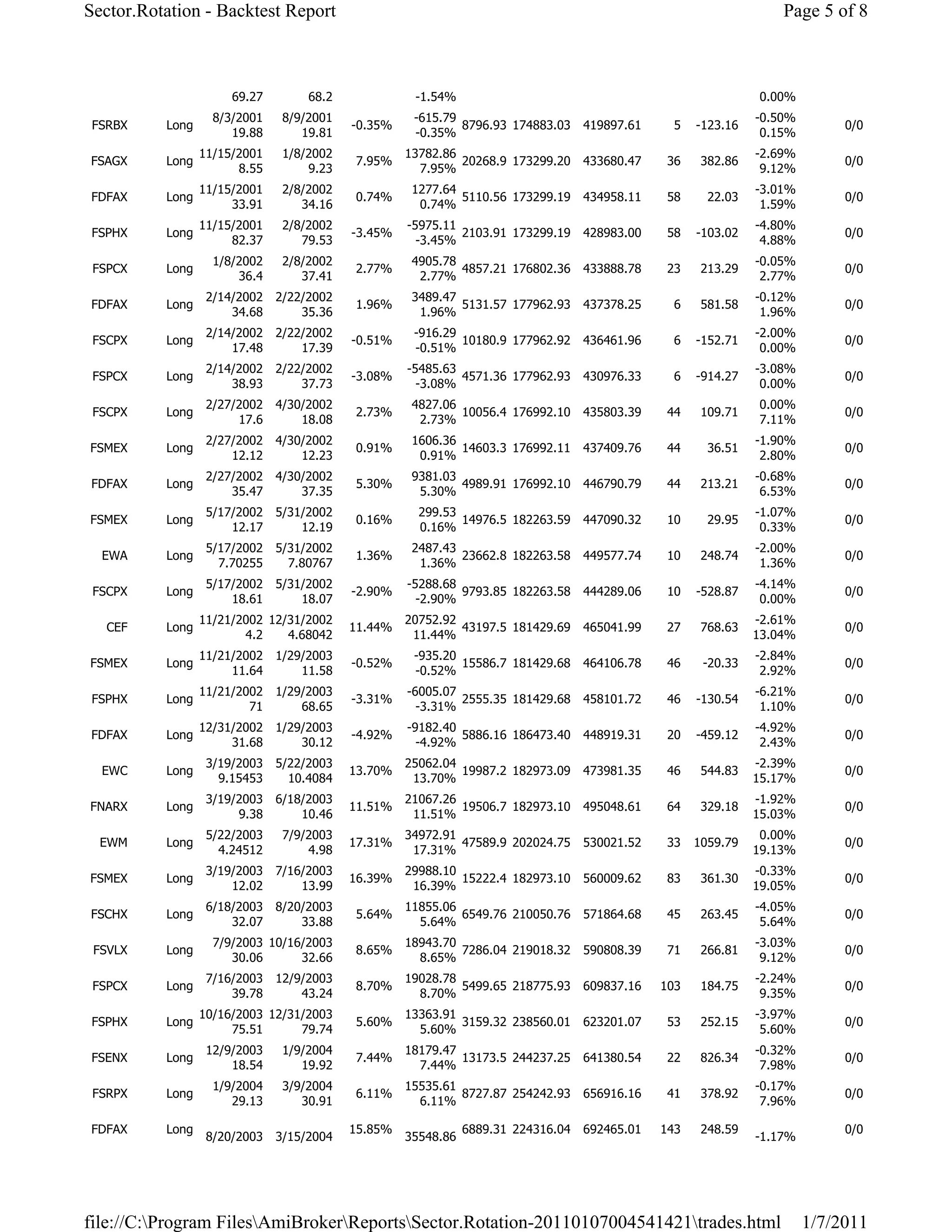

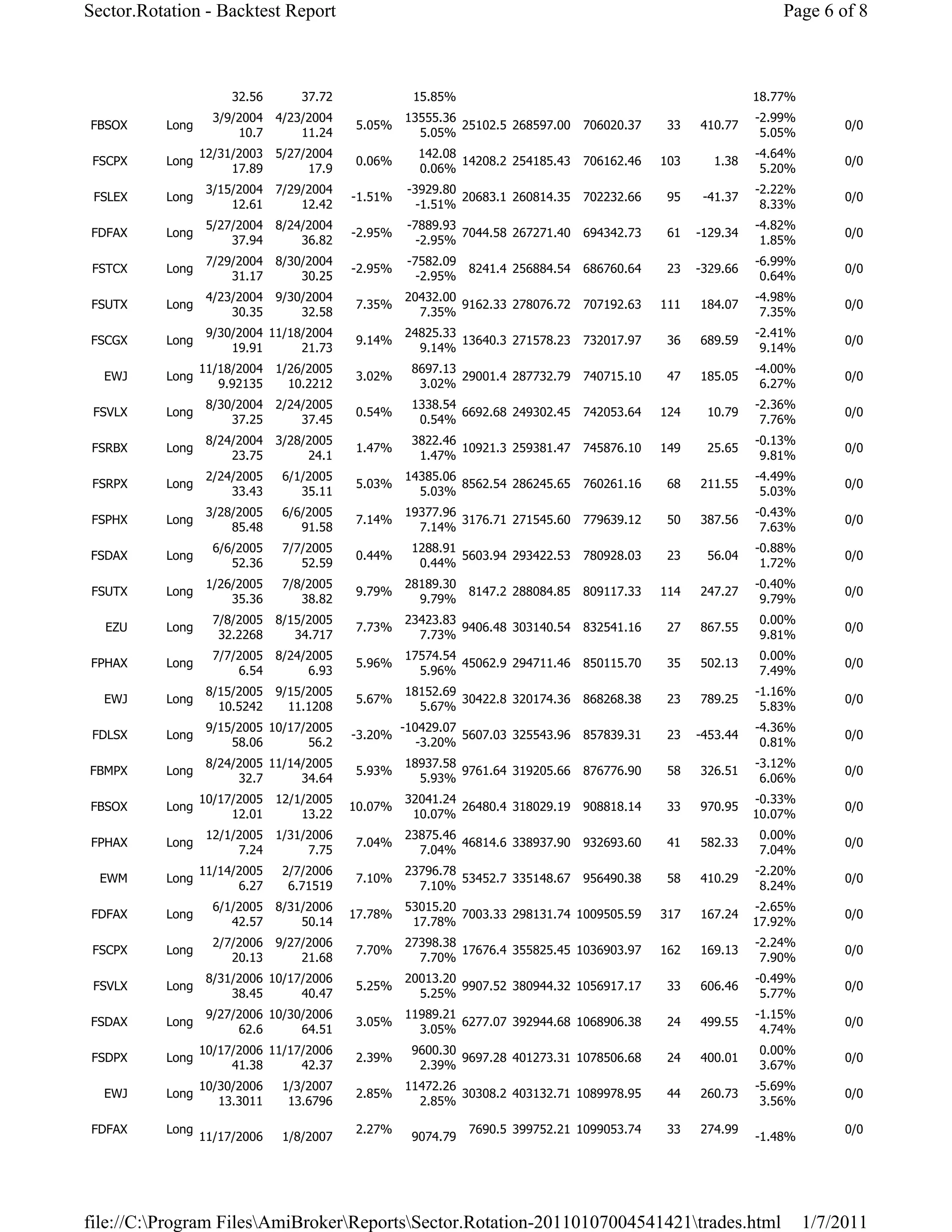

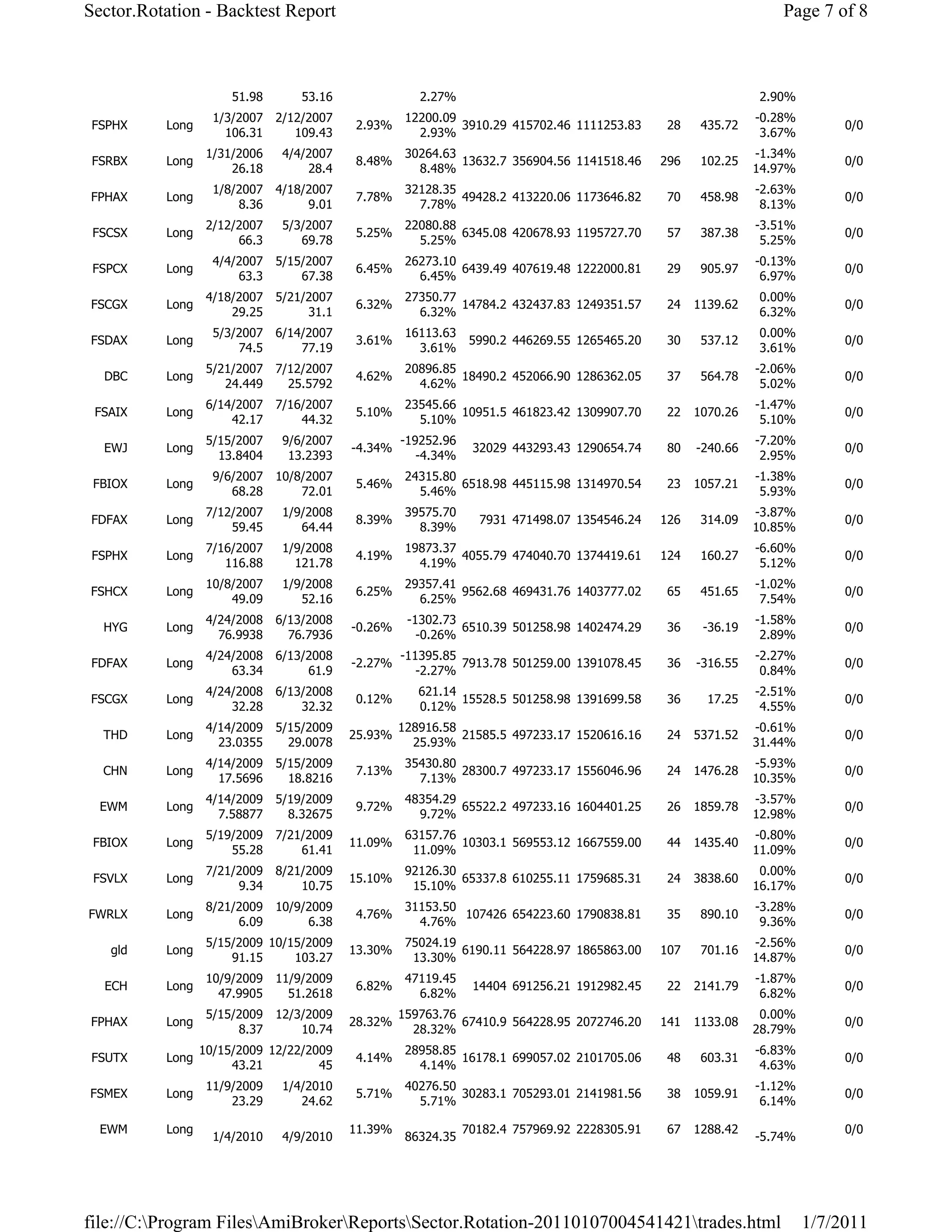

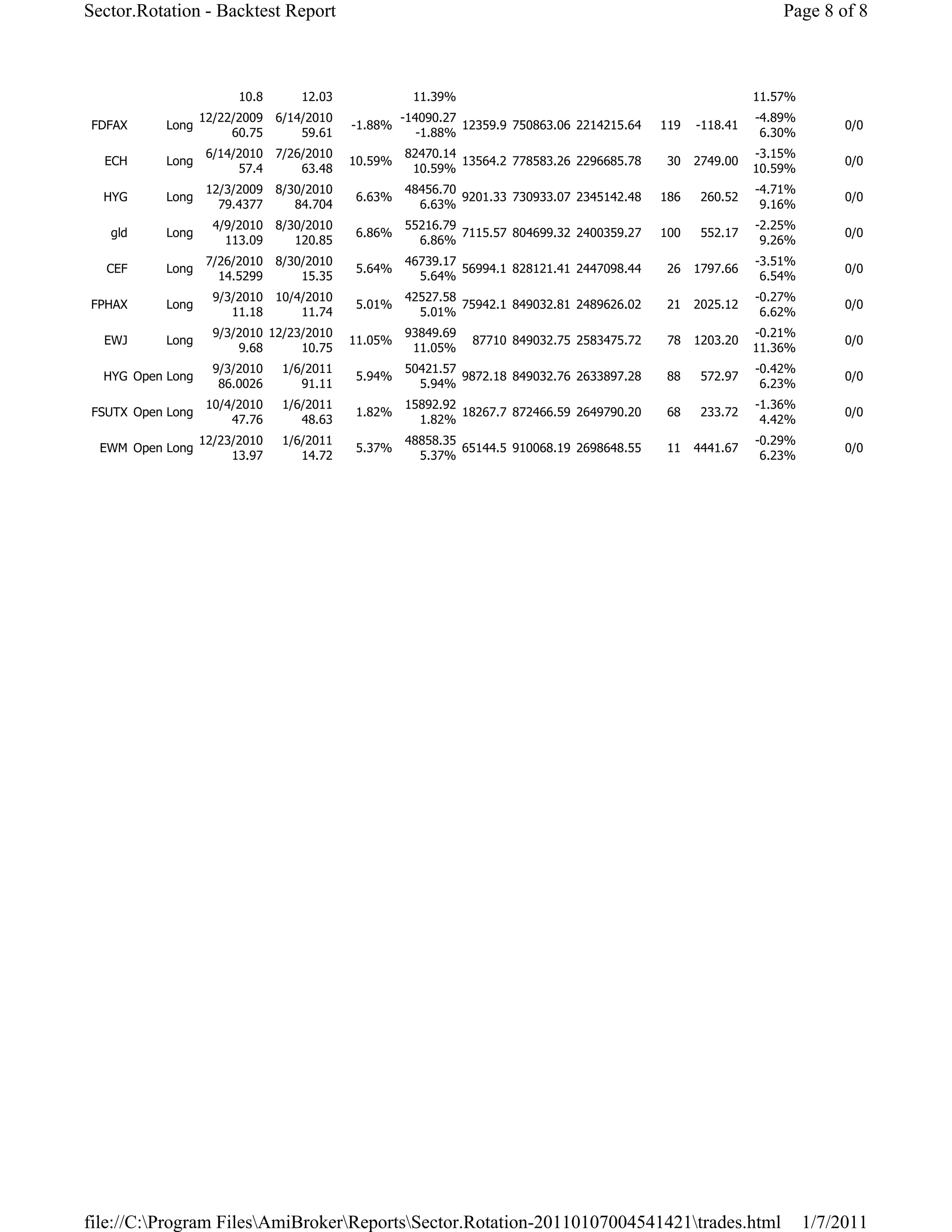

The document summarizes trades from a backtest of a sector rotation strategy between 1986 and 1989. It includes details on 210 total trades with 152 winners and 58 losers. The maximum drawdown was 14.2% and the strategy achieved an annual return of 13.9% over the backtest period with an overall profit of $2.7 million. Individual sector fund trades are listed with entry and exit dates, profit/loss amounts, and percentage returns.