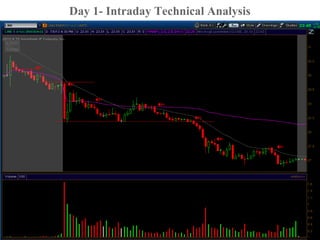

This document provides analysis and recommendations for trading the stock LINE over three days (July 2nd, 3rd, and 5th) based on news and technical indicators. On day 1, the stock gaps down significantly on news of an SEC investigation and is recommended to be shorted. On day 2, it opens near the previous day's low and is analyzed for further short opportunities. Day 3 is seen as a potential uptick rule reversal play, looking for one final push lower followed by consolidation above the VWAP for a reversal long entry. Detailed price levels and technical indicators are highlighted for entry and exit points each day.