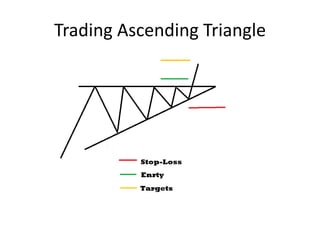

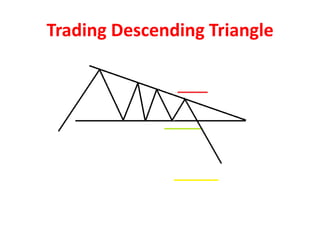

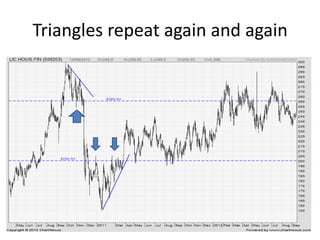

Triangles are patterns formed by converging trend lines meeting at a single point, showing indecision in the market. There are three main types: ascending, descending, and symmetrical triangles. Triangles can indicate continuation or reversal of the pre-existing trend. Volume is generally low inside the triangle and increases at the breakout. Traders watch for breakouts of the trend lines and aim to enter positions in the direction of the breakout. Stop losses are placed outside the pattern to limit risk. Patterns like triangles can provide insight into market behavior but may not always work as expected.