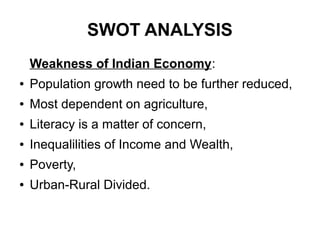

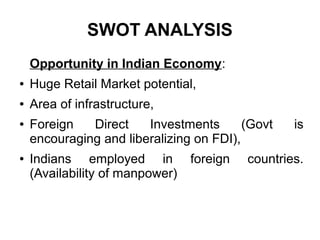

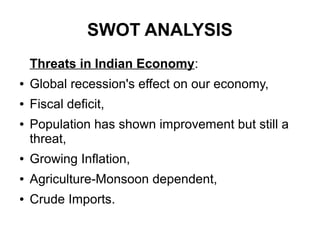

The document provides information on business cycles, inflation, price indices, and a SWOT analysis of the Indian economy. It defines business cycles as alternating periods of economic expansion and contraction. There are typically four phases in a business cycle: expansion, peak, contraction, and trough. Causes of business cycles include under/over consumption, innovations, and natural disasters. Inflation is defined as a persistent rise in general price levels. Price indices measure changes in prices between periods. The SWOT analysis identifies strengths like agriculture and skilled workforce, weaknesses like population growth and literacy, opportunities in infrastructure and FDI, and threats like global recession and growing inflation.