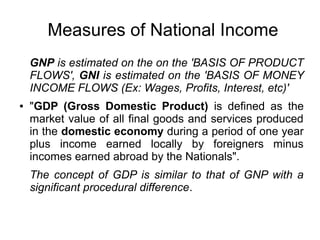

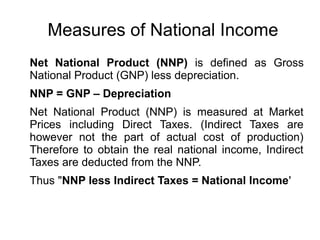

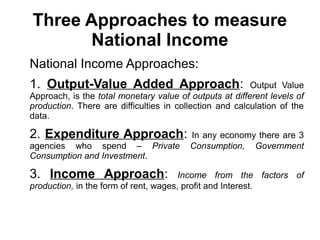

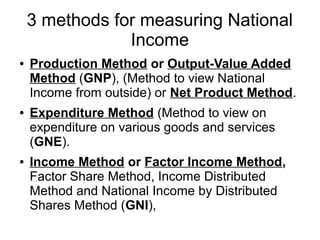

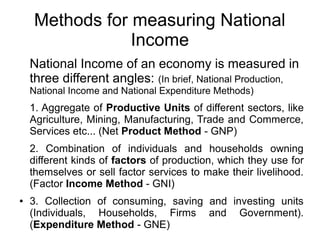

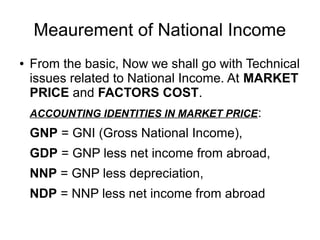

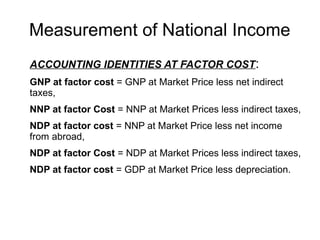

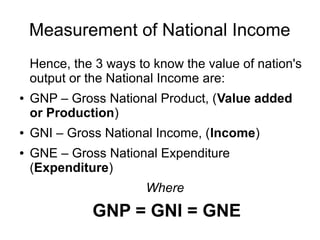

National income refers to the total value of all final goods and services produced within a country in a given period of time, usually one year. There are three main approaches to measuring national income: the production or output approach, the expenditure approach, and the income approach. The key measures of national income are Gross National Product (GNP), Gross Domestic Product (GDP), and Net National Product (NNP). GNP is the total market value of all final goods and services produced domestically and abroad by a country's citizens and companies in a year. GDP is similar but excludes income earned abroad. NNP is GNP minus depreciation.

![Measures of National Income

Measures of National Income:

[Gross National Product (GNP), Gross Domestic Product (GDP)

and Net National Product (NNP).]

"Gross National Product (GNP), is defined, as the

value of all final goods and services produced during a

specific period, usually a year, plus income earned

abroad by the nationals minus income earned locally

by the foreigners"

GNP is identical to the concept of GNI,

Thus GNP = GNI. The difference between the two is

only the procedural nature.](https://image.slidesharecdn.com/module5-1efm-nationalincome-160404160355/85/Module-5-1-efm-national-income-11-320.jpg)