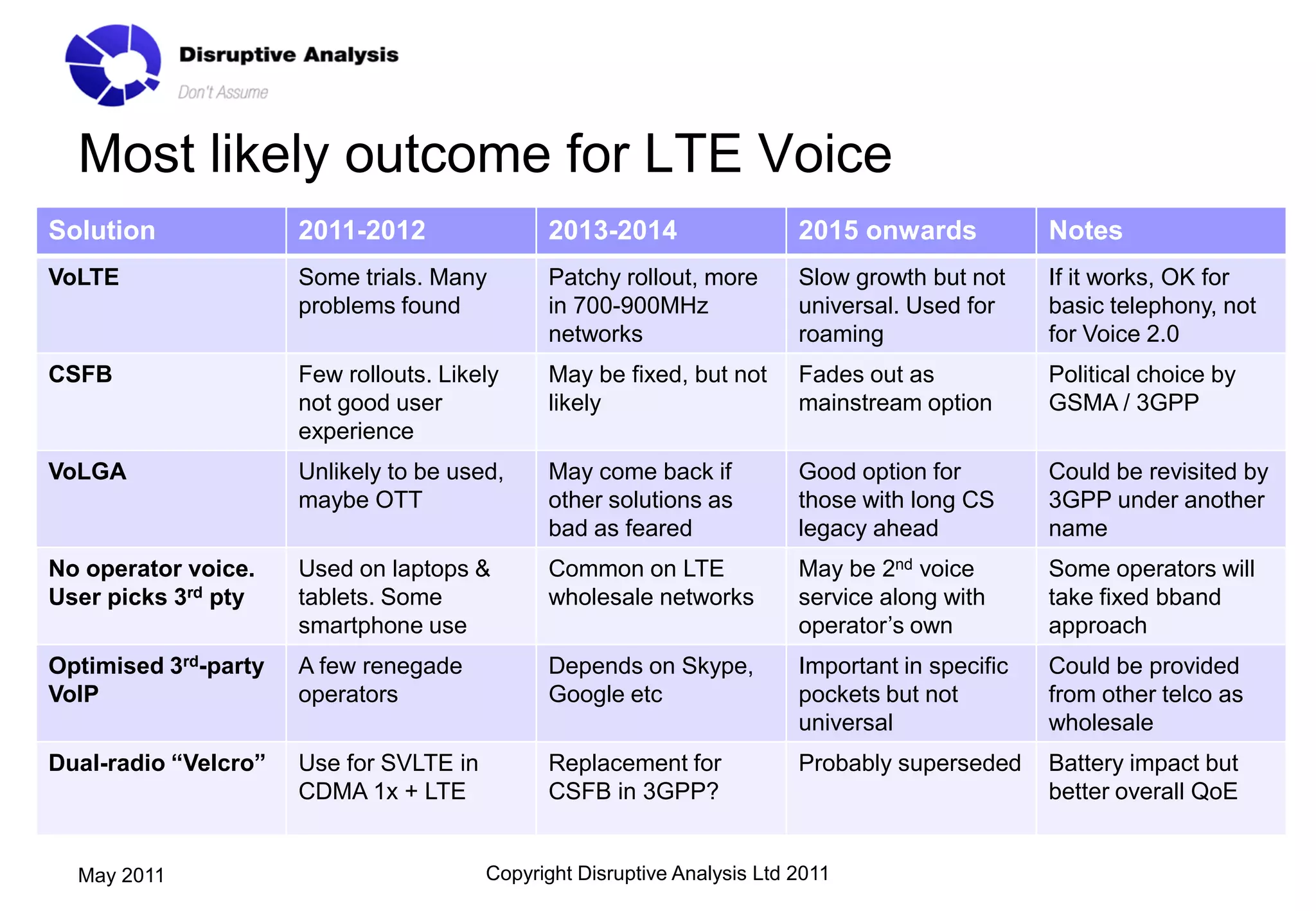

The document discusses the evolution of voice communication and telephony from 2000 to 2020, highlighting the shift towards LTE and cloud-based models while emphasizing the fragmentation of voice services into various applications. It outlines potential challenges for implementing VoLTE and the need for operators to adapt to new business models as traditional telephony faces competition from more natural communication methods. The author emphasizes participation and collaboration in shaping the future of voice technology and communications.

![Will future operators all support voice? How?

Full IMS

+ VoLTE

Partial “Velcro”

IMS / GSM or

NGN CSFB or

VoIP VoLGA

Integrated

voice &

data

operators

Cloud Data

voice only &

(non- BYO-

2020 “Straw Man”

access) VoIP

1bn LTE handsets

Partner

Comms services ARPU $20 / mo Skype /

[but 50% carried on 2G/3G/WiFi] Google

$120bn revenue etc + need for continuity at LTE / 3G

= equivalent to 2010 SMS market / 2G /WiFi boundary

May 2011 Copyright Disruptive Analysis Ltd 2011](https://image.slidesharecdn.com/disruptiveanalysis-ltesummitvoicepresmay2011-110523120621-phpapp01/75/Disruptive-Analysis-LTE-Summit-2011-voice-presentation-may-2011-9-2048.jpg)