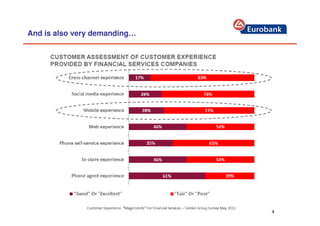

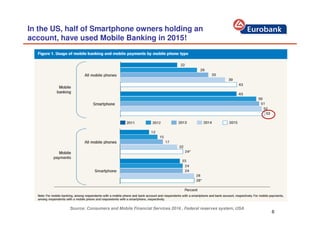

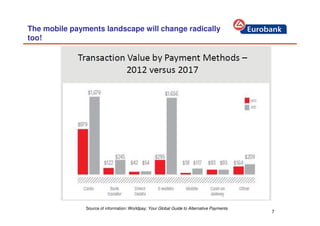

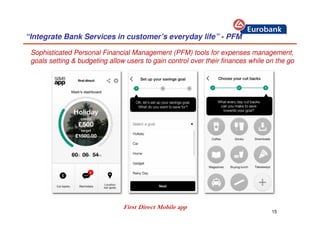

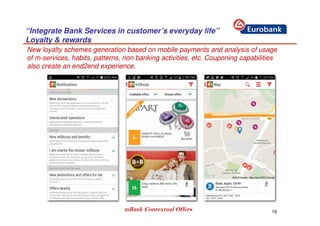

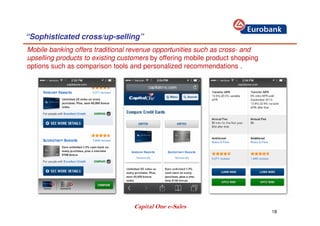

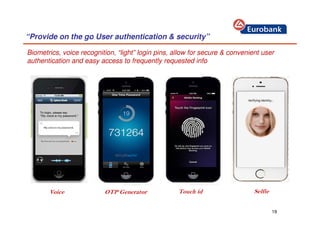

The document discusses key digital trends for business success and customer engagement in the banking sector, emphasizing the demand for convenient mobile services and the rise of fintech. It highlights the importance of mobile payments, personal financial management tools, and the integration of banking services into consumers' daily lives. Additionally, the document mentions the need for superior user experience through advanced authentication methods, gamification, and the utilization of various devices for banking services.