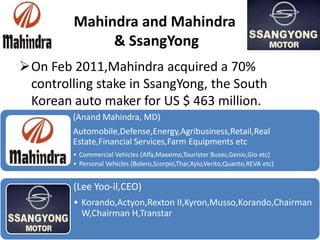

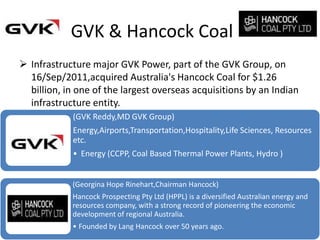

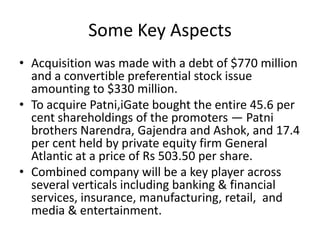

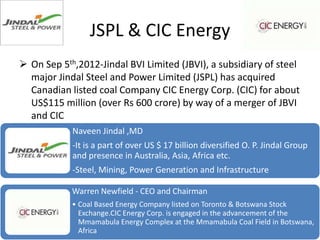

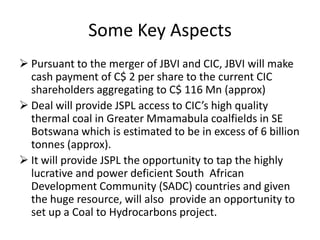

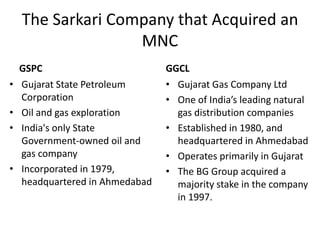

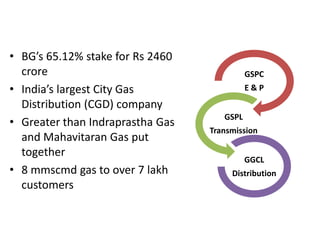

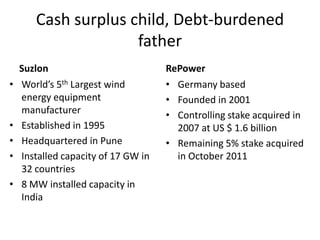

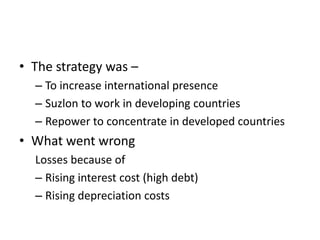

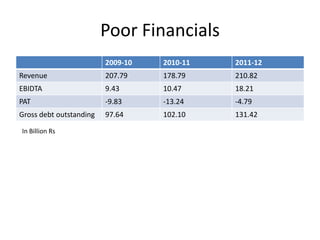

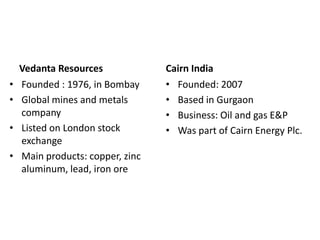

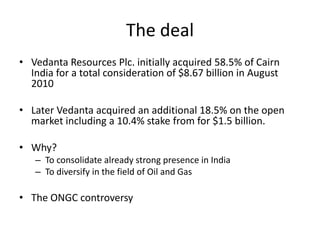

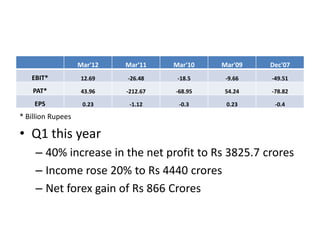

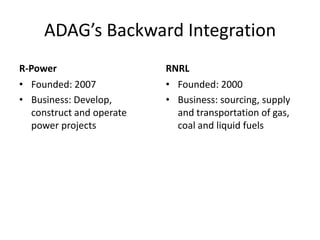

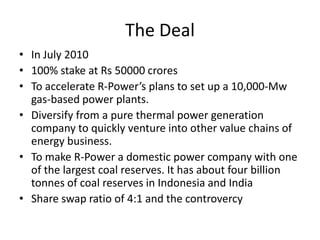

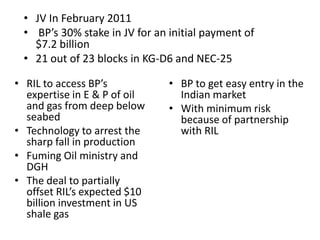

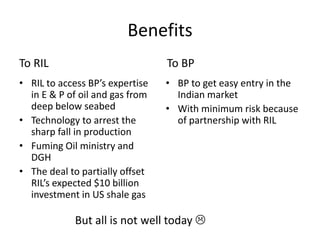

This document summarizes several major mergers and acquisitions involving Indian companies between 2011-2012. It discusses Mahindra acquiring a controlling stake in SsangYong Motors, GVK Group acquiring Hancock Coal in Australia, iGATE acquiring Patni Computers, Jindal Steel acquiring CIC Energy, Fortis acquiring Quality Healthcare businesses, Gujarat Gas acquiring majority stake in GGCL from BG Group, Suzlon acquiring Repower, Vedanta acquiring Cairn India, Reliance Power acquiring RNRL, and RIL forming a joint venture with BP. Key aspects of each deal such as purchase price, synergies, and business overview are provided.