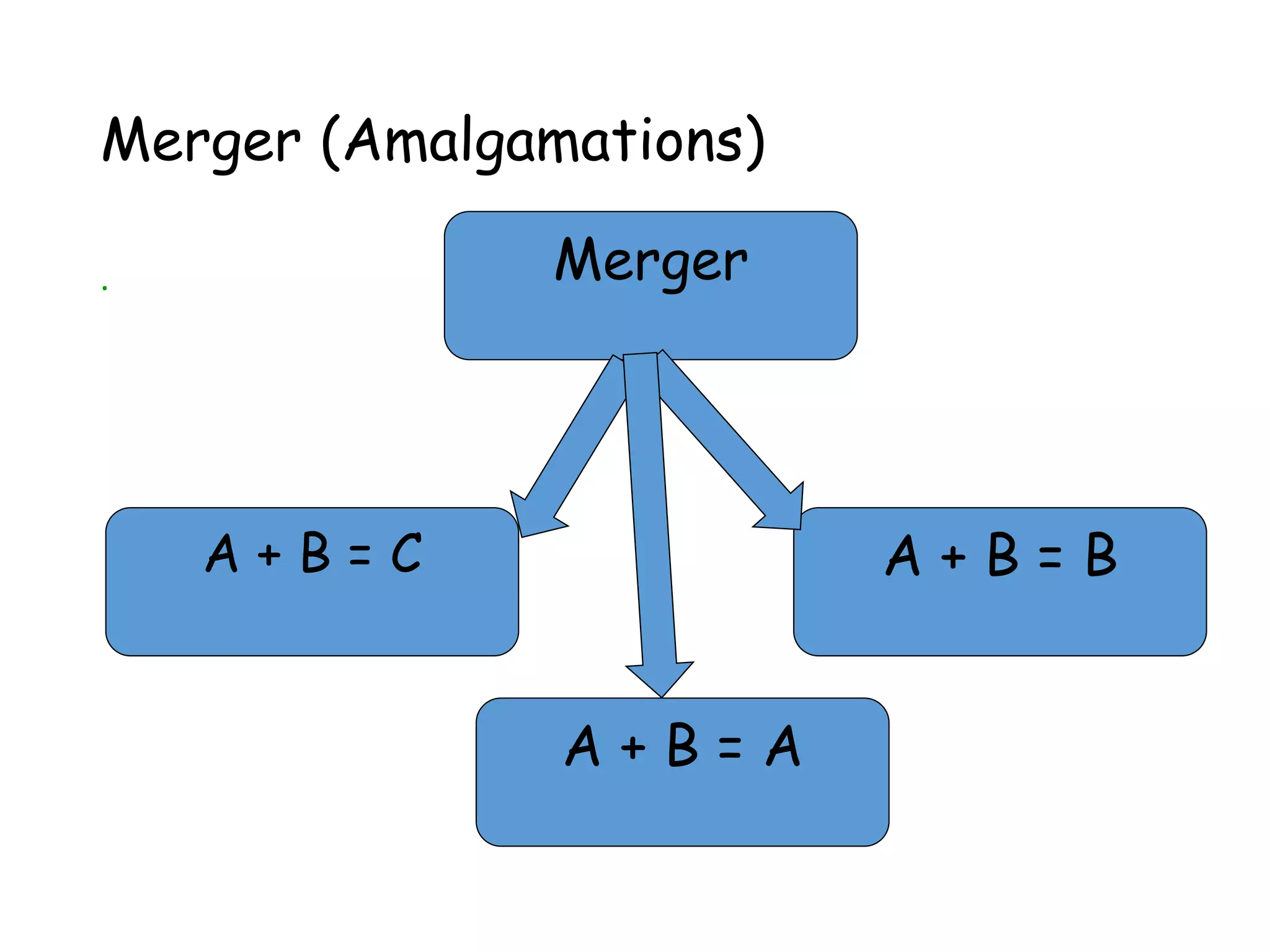

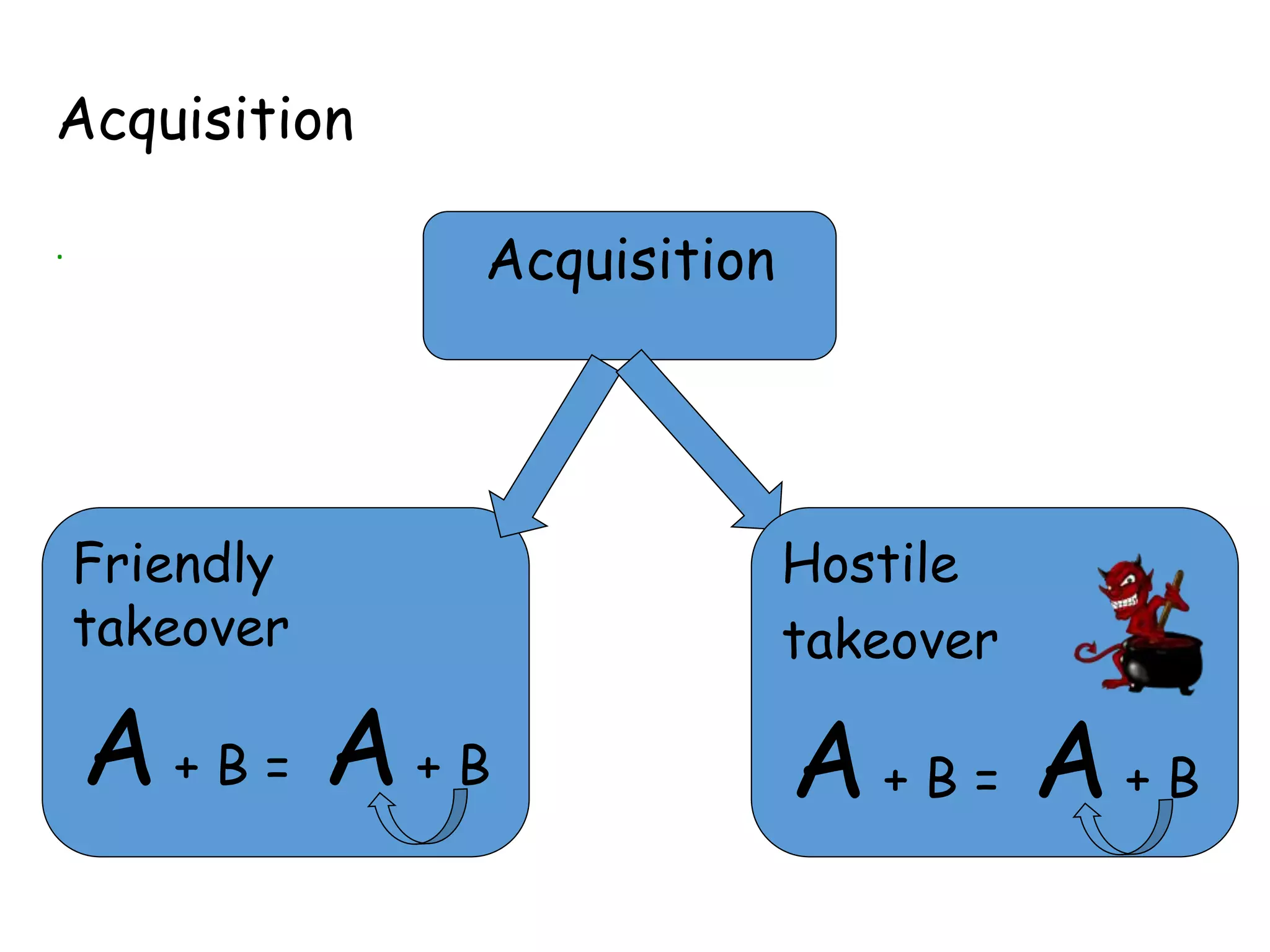

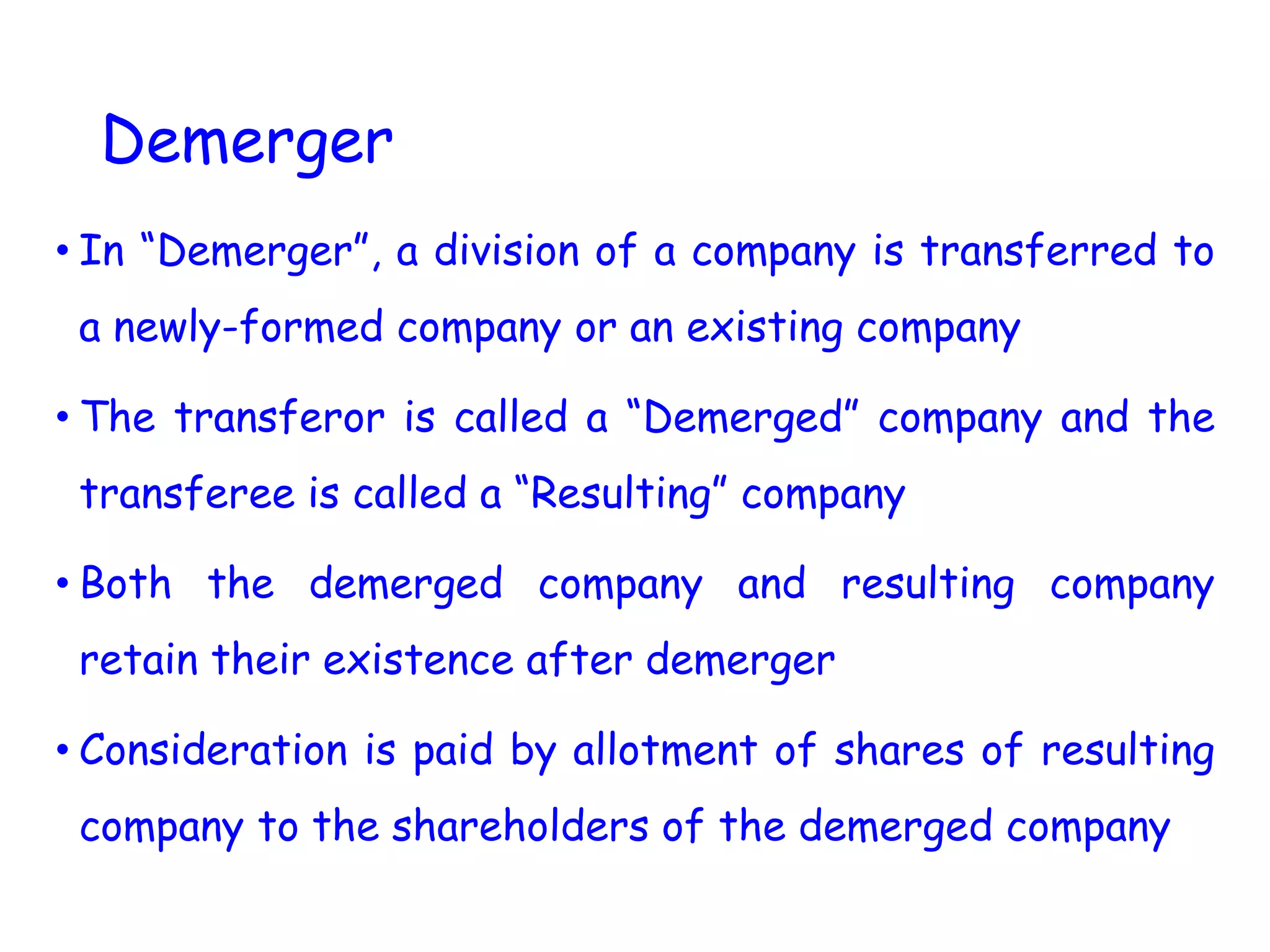

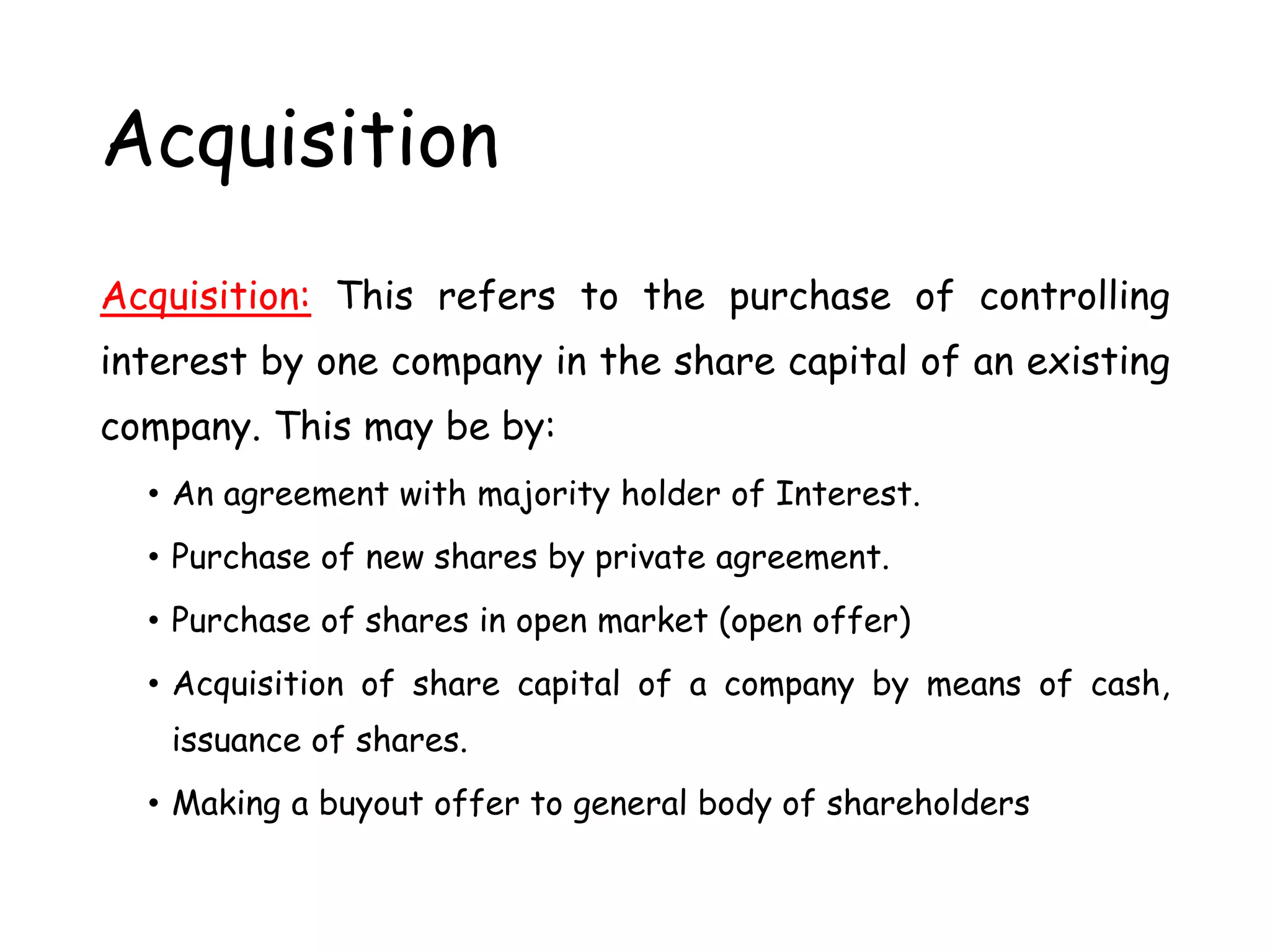

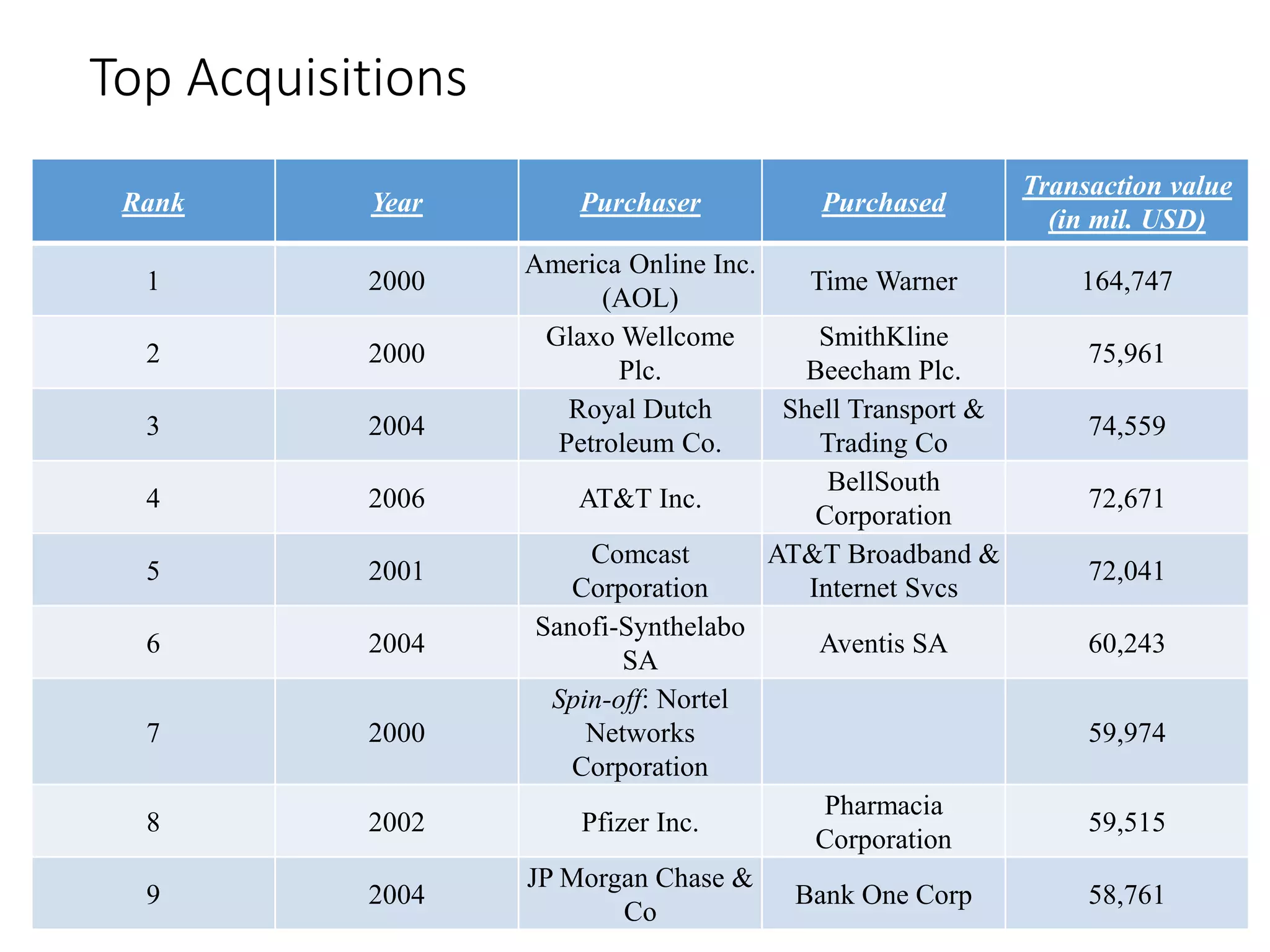

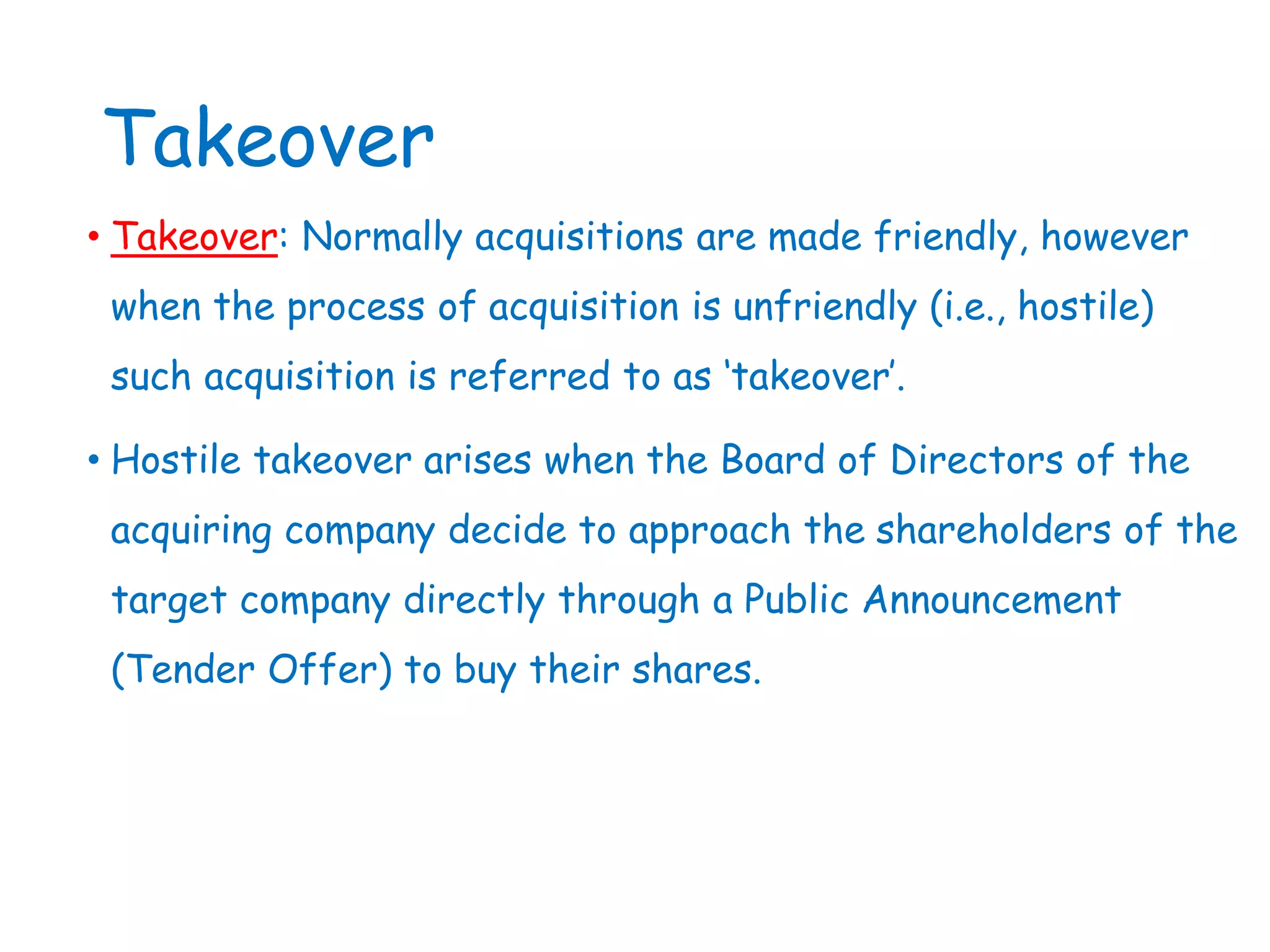

This document provides an overview of mergers and acquisitions (M&A) in India. It defines key terms like amalgamation, acquisition, and takeover. It notes that M&A deal value in India was US$62 billion in 2010 and US$54 billion in 2011. The main differences between an amalgamation and takeover are that in an amalgamation, the amalgamating company loses existence while in a takeover, both companies remain standing. The document discusses types of mergers like horizontal, vertical, conglomerate, and concentric. It provides examples of reasons for M&As like synergies, diversification, taxation benefits, and growth opportunities.